Shares of SoundHound AI (NASDAQ: SOUN) fell after the company released its third-quarter earnings, even though it reported impressive revenue growth. Notably, the stock is still up roughly 200% for the year as of today.

Given the solid revenue performance, let’s examine the latest results to determine whether now is a good time to invest in SoundHound.

Impressive Revenue Growth

Although the stock price decreased, SoundHound’s Q3 results were strong. The company experienced an 89% year-over-year increase in revenue, reaching $25.1 million. Adjusted earnings per share (EPS) recorded a loss of $0.04, which is an improvement compared to the $0.06 loss from the previous year. These results surpassed the analyst consensus that anticipated $23 million in revenue and a loss of $0.07, according to Factset.

SoundHound also noted that its total subscriptions and bookings backlog—excluding its acquisition of Amelia—was double compared to last year. Including Amelia, this figure is projected to exceed $1 billion, with an average contract duration of approximately six years.

In the automotive sector, the company reported double-digit growth in automotive units along with unit price increases. Previously, SoundHound had emphasized a significant deal with a major customer, but now, it is relying more on software-as-a-service (SaaS) revenue due to its expanded capabilities. Additionally, it secured a partnership with a new electric vehicle manufacturer from the Middle East.

Within the restaurant sector, SoundHound has established connections with seven of the top 20 quick-service operators. It continues to enhance its services related to drive-thrus, phone orders, and employee assistance. Recently, it also entered into a significant partnership with another major global pizza chain.

The acquisition of Amelia has allowed the company to diversify its services further, winning or renewing contracts in telecommunications, healthcare, insurance, retail, and banking. Deals were also renewed with a branch of the U.S. military and a top international payment card services provider.

Revising Revenue Outlook

SoundHound has raised its revenue forecasts for both 2024 and 2025. For 2024, the company now expects revenue between $82 million and $85 million, an increase from its previous estimate of over $80 million. Analysts had predicted $82.6 million.

Looking ahead to 2025, the guidance was raised from an initial expectation of more than $150 million to a range of $155 million to $170 million, while the analyst consensus was set at $152.1 million.

Image source: Getty Images.

Should Investors Consider This Dip?

Overall, SoundHound delivered a solid quarter and presented optimistic guidance. However, given the stock’s earlier gains this year, some investors may have expected even stronger projections.

The company has maintained a cautious approach in its forecasts, still working on integrating Amelia into its main operations. There may also be plans to offload some low-margin segments. The acquisition of Amelia is pivotal since it addresses technology gaps and allows for expansion in multiple sectors.

Both the automotive and restaurant industries promisingly offer growth prospects. SoundHound’s larger vision aims to establish an AI voice ecosystem across various industries, allowing businesses to manage complex, industry-specific interactions effectively. The rollout of its Polaris foundation model, built on billions of actual conversations, signals progress. Moving forward, incorporating insights from Amelia is likely to enhance the AI models further.

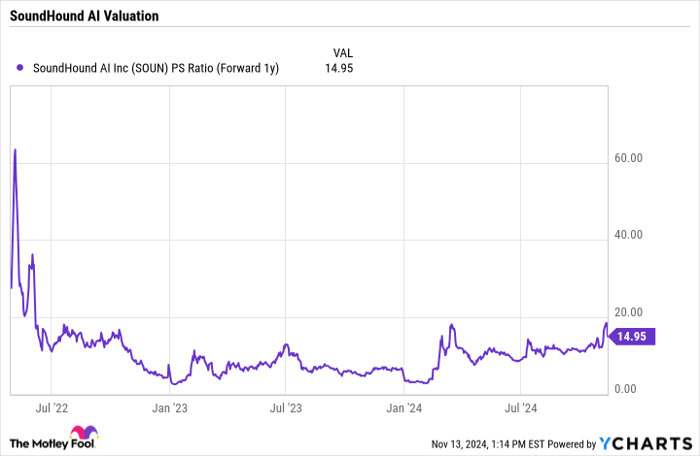

From a valuation standpoint, SoundHound trades at a price-to-sales (P/S) ratio of 15 times 2025 analyst estimates, which could be perceived as high.

SOUN PS Ratio (Forward 1y) data by YCharts

SoundHound is still in its early stages with significant potential ahead. If it can establish itself as a leader in AI voice solutions across industries, it may unlock substantial opportunities for growth. Although the current valuation does not appear cheap, it aligns with the company’s impressive growth trajectory.

Given its early stage and potential, SoundHound is viewed as a solid yet speculative growth opportunity. Investors might consider a small position during this market pullback.

Opportunity Awaits for Strategic Investors

Have you ever felt like you missed your chance to invest in successful stocks? If so, pay attention now.

Our team of expert analysts often issues a “Double Down” stock recommendation for companies they predict are poised for significant growth. If you’re concerned about missing the opportunity, this may be the perfect moment to invest before it’s too late. Here are some success stories:

- Amazon: A $1,000 investment when we doubled down in 2010 would now be worth $22,819!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $42,611!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $444,355!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and another chance may not arise soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends FactSet Research Systems. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.