Re-Evaluating SPYD’s Flawed Dividend Yield

Not too long ago, I warned against the siren allure of the SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD). The ETF’s recent semi-annual reconstitution only serves to reaffirm my skepticism. The ETF’s fundamentals have further deteriorated, with a decline in expected dividend yield and a rise in the forward price-earnings ratio. It’s akin to applying fresh paint to a dilapidated building – a futile attempt to mask the underlying decay. Unsurprisingly, I reaffirm my “sell” rating on SPYD and delve into an in-depth comparison with three superior alternatives.

SPYD Strategy and Latest Reconstitution Update

Tracking the S&P 500 High Dividend Index, the SPYD selects the 80 highest-yielding dividend securities in the S&P 500 Index in equal weight. The latest reconstitution saw the addition of several REITs among the nine substitutions, indicating a business-as-usual approach. However, this strategy seems to perpetuate the ETF’s inherent flaw of perpetually holding poor-performing dividend stocks in the S&P 500 Index. The recent additions, trading on average 5.58% below their 200-day moving average prices, starkly contrast with the relatively well-performing stocks they replaced.

The negative performance underscores the missteps in SPYD’s composition, culminating in a lack of profitability or dividend quality screens. The absence of such guardrails has left investors vulnerable to significant value erosion, as evidenced by the decline in stock prices and dividend cuts.

Evaluating SPYD’s Fundamentals and Performance

When digging into the dividend grades, a pattern emerges. Companies with low grades were indeed not on solid financial footing, leading to subsequent dividend slashes. Therefore, the relevance of dividend safety grades becomes evident, offering investors a defensive stance against value erosion. A comparison with other ETFs highlights SPYD’s shortcomings in dividend consistency and growth, crucial factors for long-term investments.

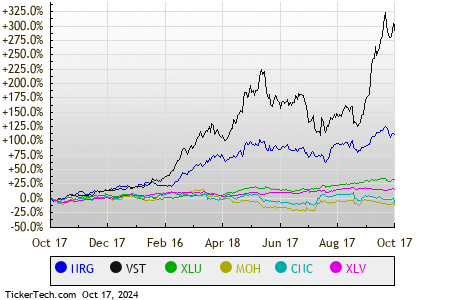

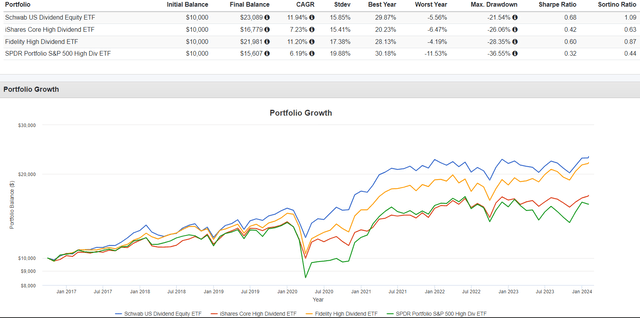

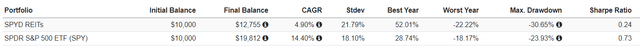

Performance Comparison

Compared to other ETFs, SPYD’s performance is lackluster at best. Since its inception, SPYD has lagged significantly behind its counterparts, with marked drawdowns and failure to recover from losses. The absence of safety guardrails in its high-dividend strategy has proven to be a fundamental flaw, resulting in a minimal capital gain prospect on top of a near 5% dividend yield at best.

Assessing Sub-Industry Fundamentals

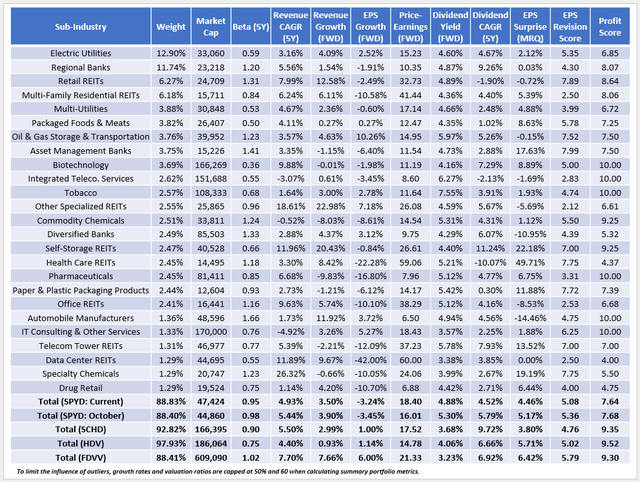

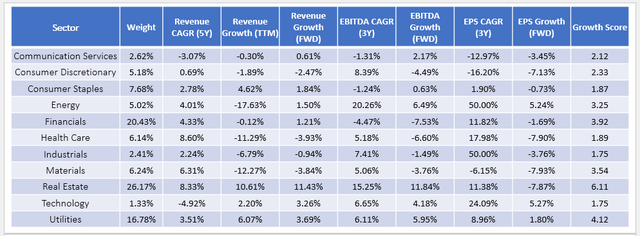

Delving into SPYD’s fundamentals by sub-industry only serves to reinforce the ETF’s declining trajectory. With estimated negative earnings growth and a high forward earning ratio, SPYD falls short against its peers, further compounding its vulnerabilities.

Challenging Assumptions: A Critical Analysis of SPYD High-Dividend ETF

Maintaining an investment portfolio relies heavily on diversification and risk assessment. One would expect that an equal-weighted ETF such as SPYD would offer improved diversification. However, upon closer examination, this account might not hold true. The top 25 sub-industries of SPYD make up a staggering 88.83% of the fund, leading to uncertainty regarding its diversification status in comparison to SCHD or FDVV.

Volatility and Risk

High-dividend ETFs may not necessarily be less volatile than the market itself. SPYD’s five-year beta of 0.95, coupled with a substantial allocation to Electric Utilities and significant exposure to volatile Regional Banks and REITs, raises concerns. Notably, the REITs within SPYD exhibit an increased level of volatility, with an annualized standard deviation nearly four points higher than the S&P 500 ETF over the last five years. Investors in SPYD should be conscious of the elevated risk associated with this investment, particularly in turbulent economic conditions.

Growth and Valuation Concerns

The combination of growth and valuation for SPYD has deteriorated over the last few months. A surge in forward price-earnings, from 16.01x to 18.40x, with no simultaneous improvement in estimated earnings growth raises red flags. Additionally, SPYD’s estimated earnings growth remains negative, accentuating the subdued growth prospects. Even when excluding REITs, the estimated earnings growth of SPYD stands at -1.76%, with a drastic decline evident across most sectors over the last five years.

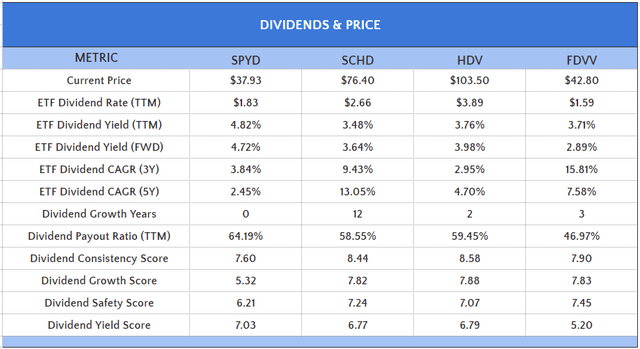

Dividend Yield and Performance

Notably, the constituents of SPYD yield 4.88%, reduced from 5.30% in October, and exhibit a challenging 4.52% five-year dividend growth rate. Furthermore, SPYD’s poor dividend safety score and relatively weak profit score, in comparison to SCHD, HDV, and FDVV, suggest potential vulnerabilities. The trade-off for increased diversification often leads to lower quality, exemplified by SPYD’s performance in bear markets and its current vulnerability.

Investment Recommendation

Despite the recent reconstitution of SPYD, which involved adding and removing certain stocks, concerns persist. The strategy of SPYD, rotating into the worst-performing S&P 500 Index stocks every six months, appears flawed. Its weaker dividend safety score, profit score, and estimated earnings growth compared to SCHD, HDV, and FDVV do not bode well. Coupled with its unattractive 18.40x forward earnings valuation, this ETF presents considerable risks. While the allure of SPYD’s 4.81% estimated dividend yield may be tempting, investors should exercise caution due to the fund’s low-quality nature. In light of this analysis, reiterating a “sell” rating for SPYD is advisable. This calls for a more in-depth discussion, and I eagerly anticipate engaging with the readers further in the comments section below. Thank you for investing your time in this analysis.