STMicroelectronics Faces Significant Stock Decline Amid Industry Shifts

STMicroelectronics STM shares have declined 51.2% year-to-date (YTD), significantly trailing the Zacks Semiconductor-General industry, which has risen 132.2%, as well as the Zacks Computer & Technology sector at 27.4%.

In stark contrast, competitors like NVIDIA NVDA, Amtech Systems ASYS, and Texas Instruments TXN have seen share increases of 186.6%, 36.9%, and 16.1%, respectively, during the same period.

The drop in STM’s performance is linked to a drop in customer backlogs and orders during the third quarter. The company highlights a noticeable shift in customer preferences—moving from fully battery electric vehicles to hybrids and from premium models to economy options. Additionally, car manufacturers have been cutting production to better control inventory.

The softness in Power & Discrete and Microcontrollers has been largely driven by ongoing weaknesses in the Industrial market, which have adversely impacted revenue growth. In the first nine months of 2024, STM reported revenues of $9.95 billion, a decline of 23.5% compared to the same period in 2023.

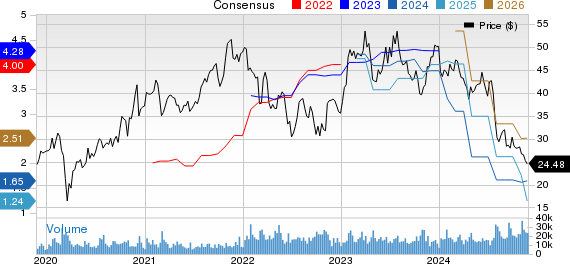

STMicroelectronics N.V. Price and Consensus

STMicroelectronics N.V. price-consensus-chart | STMicroelectronics N.V. Quote

STM Projects Weak Q4 and FY24 Results

For Q4 2024, STM anticipates revenues around $3.32 billion, signaling a year-over-year drop of 22.4%. The Zacks Consensus Estimate aligns with this projection, forecasting a similar decline of 22.5%.

The company expects gross margins to be approximately 38%, negatively impacted by an estimated 400 basis points primarily due to product mix, selling prices, and higher unused capacity costs. The earnings consensus has been adjusted to 35 cents per share, reflecting an 18.6% decrease over the past month and a year-over-year fall of 69.3%.

Looking at the full year of 2024, STM reports expected revenues of $13.27 billion, representing a 23.2% year-over-year decline. This decrease is mainly attributed to lower revenues in Automotive, with a slight offset from improved sales in Personal Electronics. Consensus earnings for the year are projected to be $1.65 per share, down by a penny in the past 60 days, indicating a decline of 63%.

Gross margins are estimated at about 39.4% affected by around 290 basis points due to unused capacity costs.

Consequently, STMicroelectronics anticipates a slow recovery in the Industrial sector and less-than-expected growth in Automotive revenues in the latter half of the year compared to the first half.

New Product Launches May Boost STM’s Future

Despite current challenges, recent product introductions and strategic partnerships could support a recovery for STM stock.

One key collaboration is with Qualcomm Technologies, working together on next-generation industrial and consumer IoT solutions enhanced by edge AI. Qualcomm’s innovative wireless technologies will be integrated with STM’s leading microcontroller ecosystem as part of this agreement.

STM’s latest EVLDRIVE101-HPD motor-drive design, which includes a 3-phase gate driver, STM32G0 microcontroller, and a compact 750W power stage, is ideal for drones, robots, and industrial equipment such as pumps.

Additionally, the company recently launched ultra-low-power STM32 MCUs that can halve energy consumption, benefiting the Industrial sector by minimizing battery changes and waste, with designs capable of utilizing energy-harvesting systems like solar cells.

The introduction of the ST Edge AI Suite—an extensive set of software tools for embedded AI applications—marks a significant advancement for the company.

Advancements in Automotive Technology May Lift STM

STM’s development of Automotive microcontrollers for next-gen vehicles is noteworthy. These software-defined cars will leverage Ethernet as the main communication method, increasing memory, and performance capabilities to boost functionality with no downtime.

Another highlight is the launch of the ASM330LHBG1 automotive accelerometer and gyroscope module, offering a cost-effective solution for compliance with functional safety standards.

Investment Outlook for STM Stock

Currently, STM shares appear undervalued, holding a Value Score of A.

Notably, the stock boasts a forward 12-month Price/Sales ratio of 1.76X, in comparison to the industry’s average of 16.10X.

STM has a Zacks Rank #3 (Hold), suggesting that while current shareholders should maintain their position, potential investors might want to wait for a more favorable buying opportunity. Find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our experts have identified five stocks that have the highest probability of gaining +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian spotlights one stock poised for the most significant rise.

This top choice is a leading financial firm, already serving over 50 million customers with diverse, innovative solutions that are primed for substantial growth. While not every pick will yield positive results, this one could exceed past Zacks’ Stocks Set to Double, like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners-Up

Looking for the latest insights from Zacks Investment Research? Download 5 Stocks Set to Double today. Click here for this free report.

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Amtech Systems, Inc. (ASYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.