Here’s what you need to know for today’s market situation.

Market Insights: A Lack of Sellers Boosts Stocks

Market Dynamics and Seller Activity

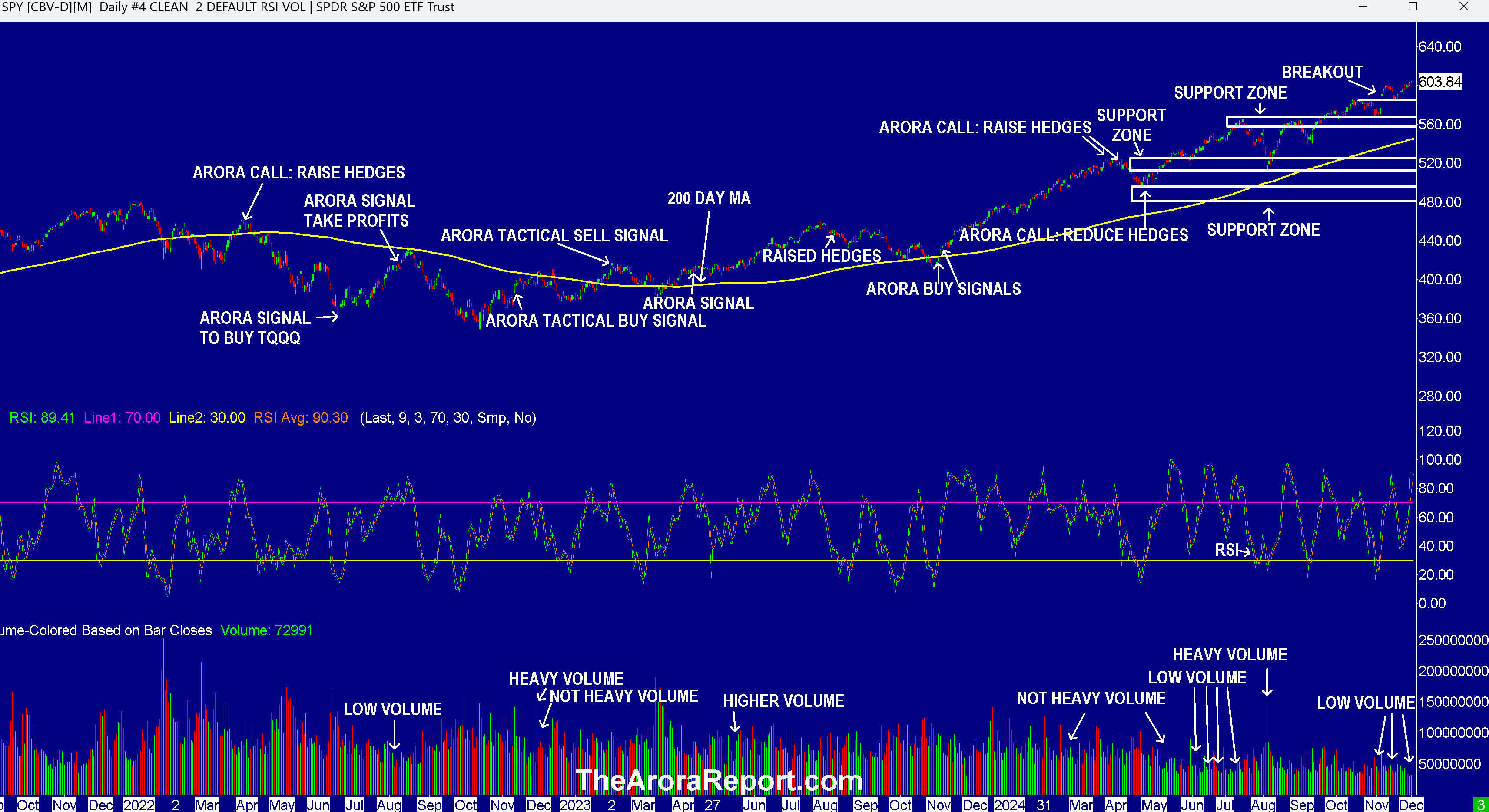

Please click here for a chart of SPDR S&P 500 ETF Trust SPY, the benchmark for the S&P 500 (SPX).

Key observations from the chart include:

- After a slight pullback, stock prices have risen again.

- The breakout line has served as a support in this upward trend.

- The rally is taking place with low trading volume, suggesting a scarcity of sellers. This makes it easier for the market to rise.

- According to The Arora Report analysis, several factors contribute to the lack of sellers:

- Some are choosing to defer profits until 2025 to delay tax payments.

- Investor sentiment is notably strong.

- Retail investors seem to be complacent.

- Professional traders are waiting for year-end movements from underperforming money managers.

- The Relative Strength Index (RSI) indicates an overbought market.

- China is responding to recent U.S. semiconductor sanctions by banning the export of materials like gallium, germanium, and antimony. Restrictions on graphite exports to the U.S. are also in place. These elements are crucial for producing certain semiconductors, night vision technology, and satellite components. Notably, Mp Materials Corp MP has seen its stock rise approximately 13% in premarket trading due to these developments.

- Investors are awaiting the JOLTS job openings report, which will be released at 10 AM ET and could influence market movements.

- All eyes are on the jobs report due on Friday at 8:30 AM ET, which is expected to significantly guide the Federal Reserve’s next moves according to The Arora Report analysis.

Money Flow Among the Magnificent Seven

Early trading shows positive money flows in major stocks including Amazon.com, Inc. AMZN, NVIDIA Corp NVDA, Meta Platforms Inc META, and Apple Inc AAPL.

Money flows are neutral for Alphabet Inc Class C GOOG.

Conversely, early trading shows negative money flows for Microsoft Corp MSFT and Tesla Inc TSLA.

Both SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust Series 1 QQQ show positive money flows.

Understanding Money Flows

Tracking money flows in SPY and QQQ can provide investors a significant advantage. Understanding when smart money is entering the market for stocks, gold, and oil further refines that edge. For instance, the most popular ETF for gold is SPDR Gold Trust GLD, while iShares Silver Trust SLV is favored for silver. The United States Oil ETF USO is the go-to for oil.

Bitcoin Activity

Bitcoin BTC/USD is currently trading within a limited range, staying under $95,000.

Strategies for Investors

Investors should focus on future opportunities rather than past performance. The Arora Report’s proprietary protection band is a highly regarded tool that synthesizes data, indicators, news, and analysis into actionable insights.

Maintaining long-term positions is advisable, with adjustments made based on individual risk tolerance. Consider a protection band using cash or short-term Treasury bills, alongside tactical trades for protection against market shifts. This method allows investors to safeguard their assets while still seeking growth.

Investors can shape their protection bands by combining cash with hedges. Older or conservative investors might opt for a higher protection band, while younger or more aggressive investors could choose a lower level. Those choosing not to hedge should hold a total cash level greater than that stated, but less than cash plus hedges.

A 0% protection band signals a highly bullish stance, suggesting full investment. In contrast, a 100% protection band indicates a defensive position, advocating for caution with cash reserves and hedges.

Being well-capitalized is essential for seizing new investment opportunities. When recalibrating hedge quantities, it’s wise to adjust stop-loss levels for stock positions and consider wider stops for high beta stocks, which typically fluctuate more than the broader market.

Reassessing Traditional Portfolios

Current conditions do not favor long-duration bond allocations when risk-reward is adjusted for inflation.

Those adhering to the traditional 60/40 stock-bond strategy should focus on high-quality bonds with five-year durations or less. Investors open to a more tactical approach may benefit from using bond ETFs as temporary positions, rather than as long-term commitments.

The Arora Report has a reputation for accurate predictions, including the early recognition of the AI rally, the new stock market bull market of 2023, and the 2008 financial crisis. Sign up for the free Generate Wealth Newsletter for ongoing insights.

Market News and Data brought to you by Benzinga APIs