Bally’s Stock Faces Tough Times Amid Weak Earnings and Increased Scrutiny

Bally’s Corporation, carrying a Zacks Rank #5 (Strong Sell), is facing declining earnings estimate revisions that signal caution for investors.

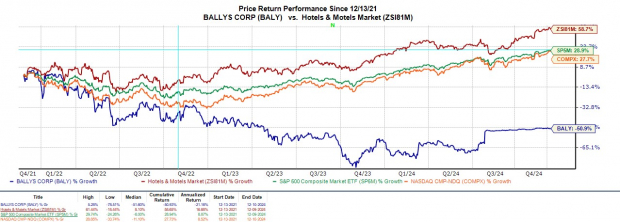

Despite rising over +20% in 2024, it may be wise for investors to cash in on gains as Bally’s struggles to return to profitability. The stock remains down 50% over the past three years, and the recent poor performance in Q3 has reignited concerns about downside risks.

Image Source: Zacks Investment Research

Weak Q3 Performance Driven by High Operating Costs

Bally’s reported a Q3 net loss of $247.86 million, translating to -$1.99 per share. This fell significantly short of analyst expectations, which had predicted an adjusted loss of -$0.25 per share and represented a decline from EPS of -$1.15 in the same period last year. Operating expenses surged by 20% compared to the previous year.

On the revenue side, Q3 sales totaled $629.97 million, down from $632.48 million a year ago, while also missing the estimated $650.63 million by about 3%. Notably, Bally’s has missed earnings expectations in three out of its last four quarterly reports and has not met sales estimates for six consecutive quarters.

Image Source: Zacks Investment Research

Regulatory Scrutiny and Industry Challenges

Bally’s faces tough competition as the Zacks Hotels and Motels Industry currently ranks in the bottom 23% of 250 Zacks industries. Moreover, the company is under SEC investigation regarding its accounting practices, further complicating its situation.

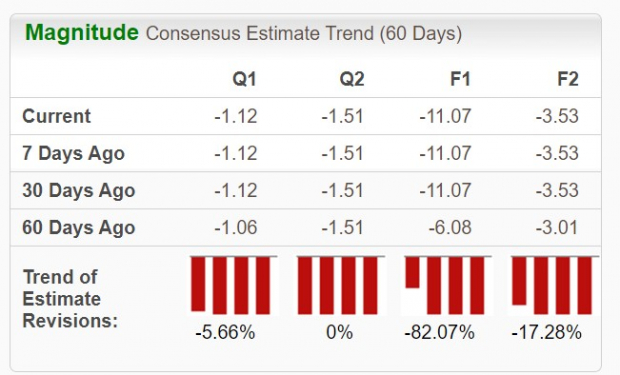

Declining Earnings Per Share (EPS) Estimates

In light of the disappointing earnings report, EPS projections for fiscal 2024 have dropped from an anticipated loss of -$6.08 to -$11.07 per share in just 60 days. Additionally, FY25 EPS estimates have shifted to a projected loss of -$3.53 from -$3.01 two months prior.

Image Source: Zacks Investment Research

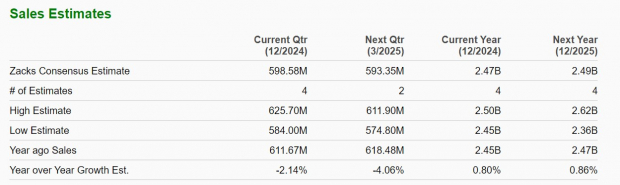

Future Sales Growth Looks Weak

Looking ahead, Bally’s anticipates less than 1% sales growth for FY24 and FY25, with total revenue expected to remain around $2.4 billion. This stagnant outlook may dampen investor confidence regarding the company’s earning potential.

Image Source: Zacks Investment Research

Conclusion

Given the ongoing SEC investigations and declining EPS forecasts, investors might want to reconsider holding Bally’s stock. The trend issues surrounding profitability suggest a challenging road ahead for the company.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Bally’s Corporation (BALY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.