https://www.youtube.com/watch?v=G6Uv2gI4NWo[/embed>

Oxford Industries Faces Setback with Significant Earnings Miss

Oxford Industries (OXM) is currently rated Zacks Rank #5 (Strong Sell). The company specializes in premium and upscale apparel and offers products under recognized brands like Tommy Bahama, Lilly Pulitzer, and Johnny Was.

Although the stock dropped after last week’s earnings report, it has rebounded by 15%. Despite this rally, analysts have lowered their estimates following the report, indicating caution among investors.

Company Overview

Founded in 1942 and based in Atlanta, GA, Oxford employs approximately 6,000 staff and boasts a market cap of $1.4 billion.

The company sells its products through various channels, including retail stores, online sites, and wholesale to specialty shops and departments, providing a diversified income base.

Oxford holds Zacks Style Scores of “B” for Value and “F” for Momentum.

Q4 Earnings Summary

On December 11th, Oxford reported a disappointing Q4 EPS miss of 200%. The company registered a loss of $(0.11) per share, a stark contrast to earnings of $1.01 per share during the same period last year. Additionally, quarterly sales totaled $308.02 million, falling short of the $316.83 million expected by analysts, reflecting a year-over-year decline of 5.70%.

Oxford Industries Signals Uncertain Future with Revised Financial Outlook

Downward Revision of Sales and Earnings Expected

Oxford Industries, Inc. revised its fiscal 2024 guidance downward, now expecting total sales to fall between $1.50 billion and $1.52 billion. This is a decrease from the $1.57 billion achieved in fiscal 2023. Adjusted earnings per share (EPS) for the fiscal year are projected to be between $6.50 and $6.70, significantly lower than last year’s adjusted EPS of $10.15.

Increased Expenditures for Growth

The company plans to raise its capital expenditures to around $150 million in fiscal 2024. This increase is largely attributed to investments in a new distribution center, expansion of retail locations, and enhancements in technology. Key areas of focus include e-commerce, AI-driven automation, and omnichannel capabilities.

Estimates Cut Following Earnings Report

Analysts have lowered their estimates for Oxford following the recent earnings report. For the current quarter, estimates have dropped by 10%, moving from $1.63 to $1.46.

Looking ahead, the next quarter saw a slight decrease in estimates, while long-term projections are also being revised down. Currently, full-year estimates for this year have shifted from $7.16 to $6.90, a 4% decline. Next year’s estimates are down 5%, from $7.98 to $7.61.

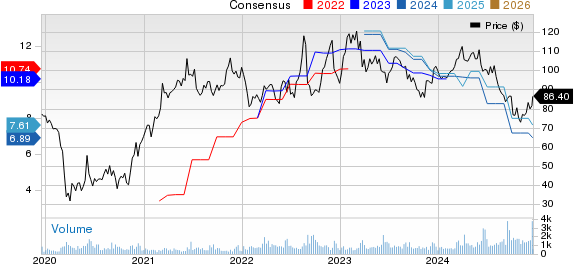

Oxford Industries, Inc. Price and Consensus

Oxford Industries, Inc. price-consensus-chart | Oxford Industries, Inc. Quote

After reporting weak Q3 results and providing disappointing guidance, shares of Oxford Industries have fallen. UBS has revised its price target from $81 to $80.

Market Response and Technical Insights

Initially, the stock drop was expected, yet it is currently trading above the levels seen before the EPS report. This could suggest that investors had anticipated a more disappointing quarter, especially as the stock has fallen more than 20% since July.

Despite a temporary rebound, challenges remain for bulls in the stock. Resistance levels sit around $93 based on the 200-day moving average, while the Fibonacci retracement level rests at $95. To break through these barriers, the stock will need either stronger market support or a positive shift in fundamental performance.

If bulls lose traction, a drop below the $78 level could signal a break of the 50-day moving average, raising the possibility of testing the year’s low at $71.50 once again.

Conclusion

Oxford Industries faces a more challenging financial landscape as it adjusts its forecasts and navigates market pressures. Investors will be watching closely to see how these factors will influence stock performance in the months ahead.

Oxford Industries Struggles Despite Recent Stock Rally

Challenges Ahead for Oxford Industries

Oxford Industries faces tough challenges despite a brief recovery in its stock. The company has lowered its guidance, and analysts are predicting weaker results in the future. These signs indicate that the recent rally might not be sustainable because of ongoing fundamental issues.

Technical Hurdles in Sight

Although the stock has gained some ground, breaking through critical resistance levels above $90 may be tough without better performance or wider market support.

Ralph Lauren: A Strong Alternative

For investors looking in this sector, Ralph Lauren (RL) may be a better choice. The stock carries a Zacks Rank #2 (Buy) and is now trading close to 2024 highs.

The Future of Energy: Nuclear Power

The need for electricity is surging while countries strive to cut down on fossil fuel reliance. Nuclear energy presents itself as an ideal alternative.

Recently, leaders from the U.S. and 21 other nations pledged to triple the world’s nuclear energy capacity. This ambitious move could lead to significant profits for stocks associated with nuclear energy—offering investors a chance to capitalize on this trend early.

Our pressing report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights the key players and technologies behind this progress, showcasing three standout stocks that stand to gain significantly.

Download the report, Atomic Opportunity: Nuclear Energy’s Comeback, for free today.

Looking for top investment ideas? You can also download the report, 5 Stocks Set to Double, at no cost.

Oxford Industries, Inc. (OXM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.