A Steady Investment Amid Market Volatility: Why Palomar Holdings is Worth Watching

Investing in today’s market, with its focus on AI and high-growth tech companies, can feel overwhelming. However, finding a reliable business with consistent growth can be refreshing. Palomar Holdings (PLMR) stands out as a specialty insurance provider operating in a sector often unnoticed by those chasing the latest trends.

Though insurance may lack the excitement of tech industries, it features a robust business model. With strong unit economics, predictable cash flows, and a product that remains essential across market cycles, well-managed insurers can generate long-term wealth.

Palomar Holdings shines due to its top Zacks Rank, remarkable growth predictions, reasonable valuation, and notable price momentum. These factors make it an attractive stock to consider in the current investing climate.

Image Source: Zacks Investment Research

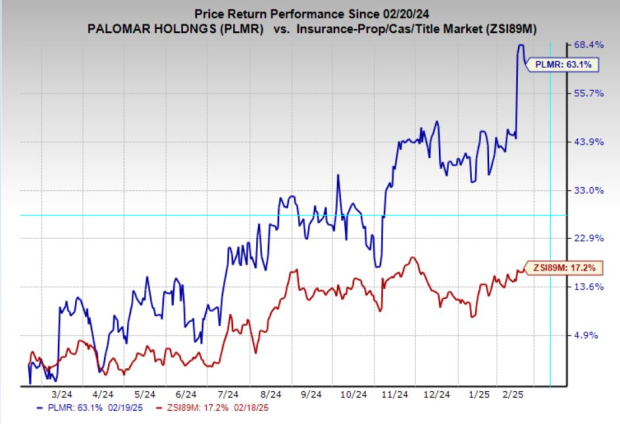

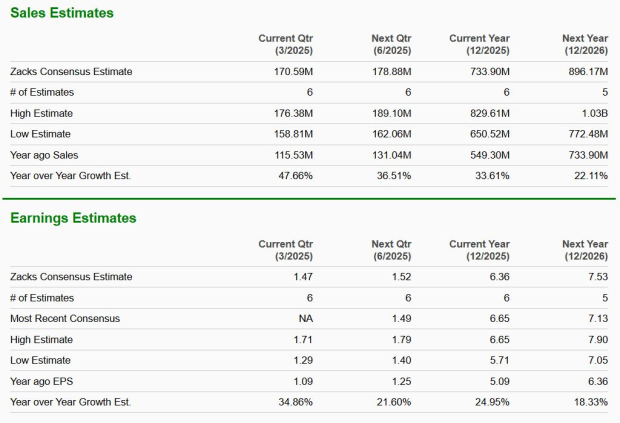

Strong Growth in Sales and Earnings

Palomar Holdings showcases impressive business metrics that reflect its growth potential. The company is anticipated to achieve 33.6% revenue growth this year, with an additional 22.1% increase expected next year. Furthermore, earnings are projected to rise by 25% this year and 18.3% next, demonstrating operational efficiency and careful underwriting.

In addition to its robust sales and earnings projections, Palomar is experiencing growing profitability, with current net margins at 21.1% and on the rise.

Moreover, analysts have been raising earnings estimates consistently over the past year, reflecting confidence in Palomar’s prospects. Recently, estimates have been amended upward across various timeframes, solidifying Palomar’s esteemed Zacks Rank #1 (Strong Buy) rating. This upward trend indicates ongoing momentum and a positive outlook for investors.

Image Source: Zacks Investment Research

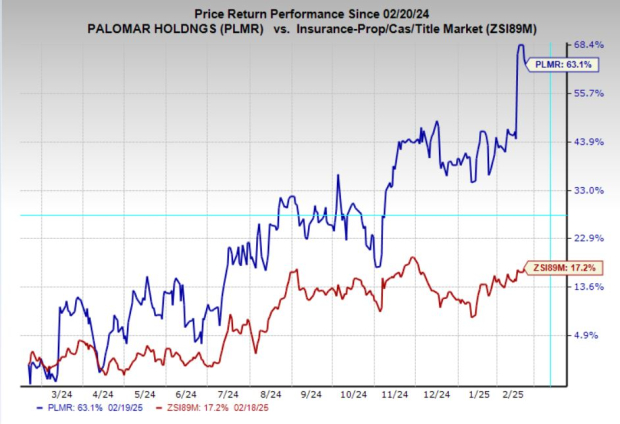

Positive Stock Performance

PLMR stock reflects strong momentum. After an impressive surge following its latest quarterly earnings report, the stock has been consolidating and forming a bullish pattern. As the company continues to deliver strong results, increased investor interest suggests potential for even higher stock prices in the near future.

Image Source: TradingView

Valuation Analysis of Palomar Holdings

Currently, Palomar is trading at 22.9x forward earnings, below the industry average of 29.8x. The company’s faster growth compared to industry norms adds to the attractiveness of its stock, especially as it outperforms the sector and overall industry.

Image Source: Zacks Investment Research

Is Palomar Holdings a Good Investment?

With its impressive growth trajectory, solid business fundamentals, and attractive valuation, Palomar Holdings presents a strong investment opportunity. Amidst the volatility in other sectors, PLMR is positioned well for continued success, making it appealing for investors seeking stability and potential for long-term wealth growth.

5 Stocks Set to Double

These stocks were specifically chosen by a Zacks expert as their top pick to gain +100% or more in 2024. While not every selection guarantees success, past recommendations have yielded significant returns: +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of the stocks featured in this report are currently off Wall Street’s radar, presenting an excellent opportunity to invest early.

Today, See These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, you can download a free report on the 7 Best Stocks for the Next 30 Days.

Palomar Holdings, Inc. (PLMR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.