Polaris Inc. Faces Tough Times Ahead Amid Declining Sales Forecasts

Polaris Inc. PII is navigating a challenging retail environment, which is expected to persist throughout 2024 and into 2025.

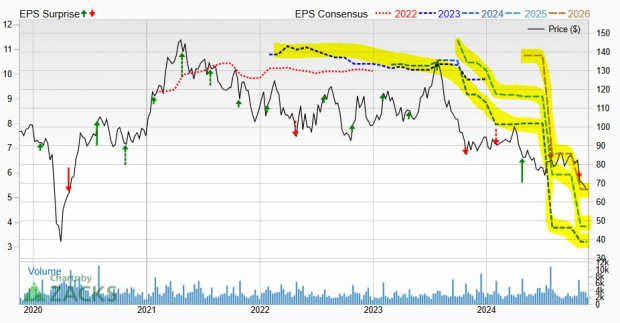

In late October, Polaris fell short of earnings expectations for Q3, leading to a significant drop in its earnings per share (EPS) outlook over the past year.

Overview of Polaris Stock

Polaris stands out as a leader in the off-road vehicle sector, extending its influence in both street and watercraft markets. Its offerings include all-terrain vehicles such as side-by-sides and ATVs, along with Indian Motorcycle and Slingshot products designed for highways.

Additionally, the company manufactures snowmobiles and boats, including well-regarded Bennington pontoon boats. Polaris caters to a wide range of customers, from private individuals to commercial entities and government clients.

Image Source: Zacks Investment Research

The past 15 years saw Polaris achieve substantial revenue growth, with a notable boom in 2021 and 2022 when consumer spending surged. The company recorded an additional 4% revenue growth in 2023, following impressive rates of 16% and 18% in 2022 and 2021 respectively.

However, Polaris is projected to see a steep 21% decline in sales for 2024, dipping below its 2021 figure to roughly $7.11 billion. Analysts predict a staggering 65% drop in adjusted earnings year over year for 2024, with its full-year 2024 consensus estimate decreasing by 65% along with a 63% cut for 2025.

Polaris missed Q3 EPS expectations by 16% and issued disappointing forecasts. The downward revisions to earnings have contributed to a Zacks Rank of #5 (Strong Sell) for PII. CEO Mike Speetzen remarked, “As consumer confidence and retail demand remain challenging, we have focused on managing dealer inventory and improving operational efficiency.”

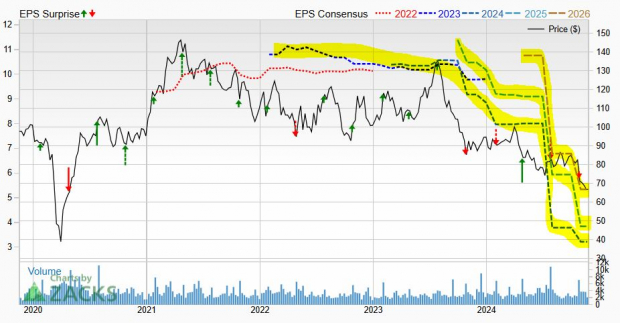

Image Source: Zacks Investment Research

“Having a robust dealer network is essential for our long-term success. We have adjusted our current production and shipment plans to aim for a 15-20% decrease in dealer inventory by year-end, and I am encouraged by our progress. A challenging retail environment is expected through the rest of 2024 and into next year,” Speetzen added.

Should Investors Steer Clear of Polaris Stock?

Over the past decade, Polaris stock has decreased by 60%, while its Auto-Tires-Trucks sector has increased by 45%. This year, PII shares have fallen 28% and are trading well below their 200-week moving average.

While there may be potential for a rebound, investors might find it prudent to wait for clearer signs of a turnaround at Polaris before making any purchases.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Polaris Inc. (PII): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.