Progressive Corp’s Strong Performance and Analyst Upgrades Fuel Growth

The Progressive Corp (PGR), currently holding a Zacks Rank #1 (Strong Buy), is a prominent independent agency writer for private passenger auto insurance. Since 1998, it has led the market in motorcycle product offerings.

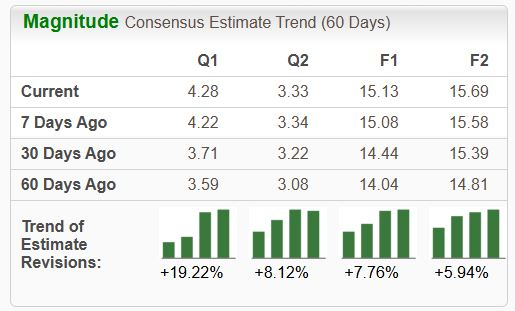

Analysts have revised their expectations upwards, propelling PGR into this highly sought-after ranking. Such optimism underscores the company’s growth potential.

Image Source: Zacks Investment Research

Besides positive earnings estimate revisions, Progressive Corp stands out in the Zacks Insurance – Property & Casualty sector, currently positioned in the top 14% of all Zacks industries. Let’s delve deeper into the company’s recent performance.

Remarkable Growth in PGR Shares

PGR shares have displayed impressive growth in 2025, rising nearly 20% and significantly outperforming the S&P 500 index. Robust quarterly results have contributed to this upward trajectory, with the company surpassing consensus EPS and revenue expectations for six consecutive quarters.

Image Source: Zacks Investment Research

Notably, net premiums earned—the core revenue generator—have seen strong growth, increasing 20% year-over-year in the latest quarter. This momentum plays a crucial role in the company’s impressive earnings reports.

Below is a chart illustrating PGR’s net premiums earned on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, PGR shares offer a modest annual yield of 0.1%. While this yield may seem low, the overall share performance compensates for it effectively.

Bottom Line

Investors can implement a robust strategy to identify potential winning stocks by leveraging the Zacks Rank, a powerful market analysis tool. Stocks that achieve the coveted Zacks Rank #1 (Strong Buy) are expected to outperform the market compared to other rankings.

With a Zacks Rank of #1, Progressive Corp. (PGR) presents a compelling investment opportunity for market participants.

Explore 7 Top Stocks for the Coming Month

Just released: Analysts have identified 7 elite stocks from a current pool of 220 Zacks Rank #1 (Strong Buy) stocks, projecting them as “Most Likely for Early Price Pops.”

Since its inception in 1988, this list has outperformed the market by more than double, averaging gains of +24.3% annually. Hence, it’s advisable to pay close attention to these selected stocks.

For the latest investment recommendations from Zacks Investment Research, you can download the report: 7 Best Stocks for the Next 30 Days. Click here for your free report.

The Progressive Corporation (PGR): Access your free Stock Analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.