Challenges Ahead for Luxury Home Furnishings Retailer RH

Company Overview of RH

RH (formerly Restoration Hardware) holds a Zacks Rank of #5 (Strong Sell) and is known for its high-end home furnishings. Based in California, RH showcases a variety of upscale products across 70 galleries, outlets, catalogs, and online platforms. Their offerings include luxury home décor, furniture, bathroom goods, and lighting. In 2015, RH expanded into the hospitality market by opening several RH-branded cafés, restaurants, and hotels. Currently, its primary market remains the U.S., with recent expansions into Europe and Canada.

Concerns Over Tariffs

The current market narrative in 2025 features the Trump Administration’s aggressive tariff strategies aimed at reshoring manufacturing, correcting trade imbalances, and negotiating enhanced trade agreements. As of 2024, approximately 72% of RH’s products are sourced from Asia, with 35% from Vietnam, 23% from China, and the rest from Indonesia and India.

Earlier this month, RH reported on its supply chain adjustments, explaining, “The company has been operating with 25% tariffs from China since the last Trump administration and has successfully resourced the majority of its China production to Vietnam at significantly better than pre-tariff landed China pricing. The company has also moved some production to its own factory in North Carolina.”

While these moves indicate strategic adaptation, investors remain uneasy. Reliance on Chinese manufacturing persists, and establishing production in Vietnam will necessitate significant time and investment. Additionally, uncertainties surround ongoing trade discussions with Indonesia and India as of this writing.

Pressure on Profit Margins

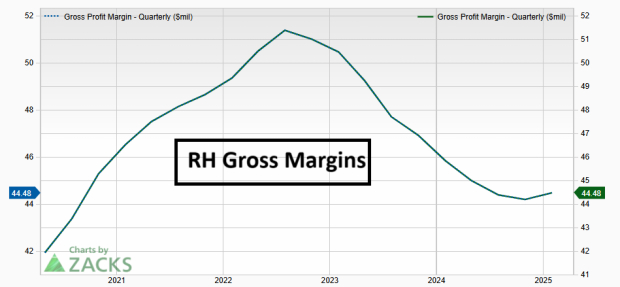

In addition to tariffs, RH faces other challenges affecting profit margins. Recent declines in consumer confidence have led to caution among their affluent customer base, causing them to slow spending while awaiting a more favorable economic outlook. Gross margins have dropped from over 50% to 44.8% since 2022.

Image Source: Zacks Investment Research

Increasing Spending and Rising Debt Concerns

The costs associated with maintaining luxury showrooms, along with high rent and the reconfiguration of its supply chain, led to excess spending exceeding $1 billion last year. Complicating matters, RH’s debt levels have surged, and significant expenses appear continuing with no resolution in sight.

History of Earnings Surprises

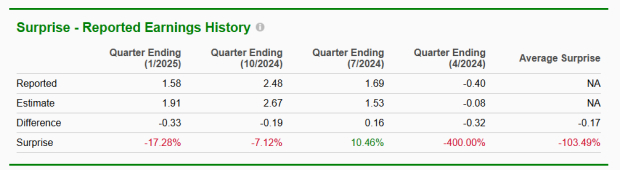

RH’s earnings have consistently missed Zacks Consensus Estimates, averaging a deviation of 103.49% over the past four quarters, raising concerns among investors.

Image Source: Zacks Investment Research

Bearish Trends and Market Risks

Following the latest earnings report, RH shares fell by over 40% with trading volumes soaring more than tenfold, indicating significant investor sell-off. This decline aligns with the formation of a bearish flag pattern in their stock chart.

Image Source: TradingView

Conclusion

RH, a premium home furnishing retailer, continues to struggle with several challenges, including tariff implications, rising debt, and reduced margins. These obstacles, coupled with a weak Zacks Rank and bearish market patterns, highlight the risks associated with the company’s outlook.

Zacks Identifies #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has skyrocketed more than +800% since we recommended it. NVIDIA remains a strong player, but our new leading chip stock has substantial growth potential.

With impressive earnings growth and a growing customer base, it is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor market is projected to expand from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

RH (RH) : Free Stock Analysis Report

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.