Twilio’s Remarkable Resurgence: A Promising Investment Opportunity

Twilio (TWLO) has turned the corner after facing tough times, positioning itself as a notable mid-cap tech stock in today’s market. Once celebrated for its high growth, Twilio saw a significant decline when tech valuations dropped in 2022. However, stronger growth predictions and a fair valuation have once again caught the eye of investors.

Currently holding a Zacks Rank #1 (Strong Buy), Twilio blends solid fundamentals with an encouraging technical trading pattern, hinting at a potential for continued growth. This upward momentum, backed by promising growth forecasts and an appealing valuation, could lead to substantial gains as the company enhances its recovery.

Twilio’s suite of powerful APIs for cloud communications empowers businesses to integrate messaging, voice, and video into their applications, fostering better customer engagement on a large scale. By streamlining digital connections between companies and consumers, Twilio positions itself as a vital player in the ongoing digital business transformation, an area likely to see growing demand in the future.

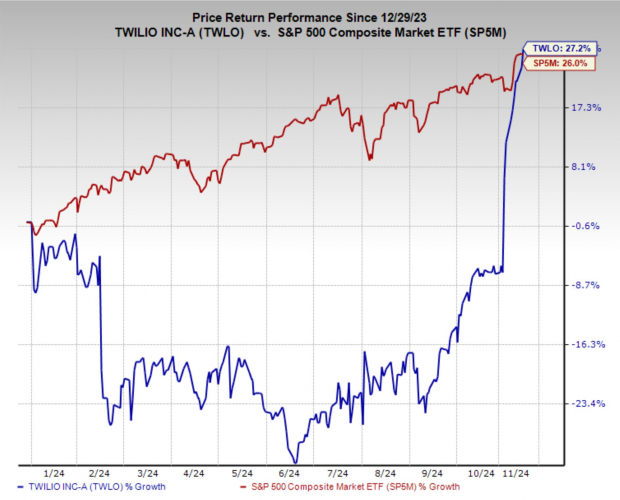

Image Source: Zacks Investment Research

Rising Earnings Estimates Propel Stock Value

Since early 2023, Twilio has seen a robust upward trend in its earnings revisions. Although this improvement wasn’t reflected in the stock’s performance until recently, it has now caught the attention of investors. Twilio’s sharply rising earnings estimates are pushing the stock up.

In the last month, estimates for the current quarter have skyrocketed by 16.3%, while projections for fiscal year 2025 have increased by 10.5%. These growing estimates showcase confidence in Twilio’s growth potential and profitability, spurred by high demand for its communication solutions as companies embrace digital transformation.

Image Source: Zacks Investment Research

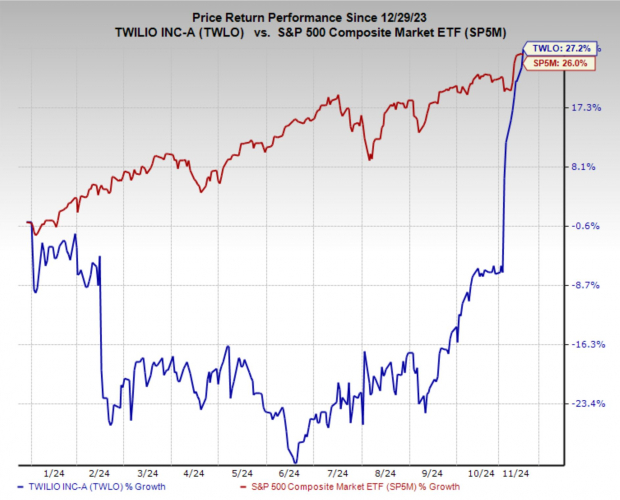

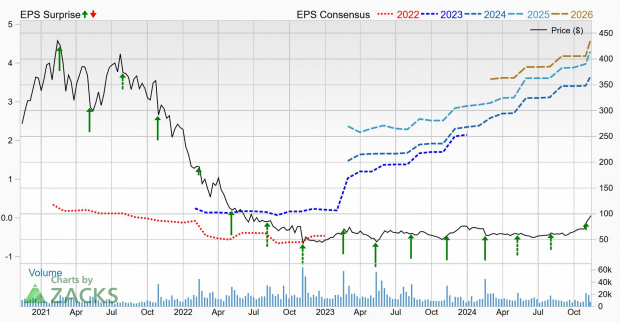

Key Technical Breakthrough for TWLO Stock

Twilio’s stock lingered near historic lows for about two years, but a significant technical breakout has shifted the narrative recently. Investors are now paying renewed attention.

The share price has surged beyond the $80 resistance mark, climbing nearly $20 higher since then. This momentum indicates there may still be room for further growth, supported by Twilio’s strong valuation and optimistic growth predictions.

Image Source: TradingView

Despite a stagnant stock price over the last two years, Twilio’s sales and earnings have shown consistent growth. This resilience has brought its valuation to a more reasonable level of 26.5x forward earnings.

Consider Twilio’s impressive growth trajectory: earnings are projected to increase at an annual rate of 41.8% over the next three to five years. Currently, Twilio holds a PEG ratio of just 0.63, indicating a substantial discount compared to its growth potential. This balance of moderate valuation and strong growth makes Twilio an attractive choice for long-term investors.

Is Investing in TWLO Stock Worth It?

Twilio’s recent resurgence has it positioned strongly in the tech sector, revealing not only solid growth potential but also an enticing valuation. Following a challenging phase, the company’s strong fundamentals and positive earnings revisions have attracted new investor interest. With a Zacks Rank #1 (Strong Buy) and appealing PEG ratio, Twilio’s stock seems both valuable and growth-oriented.

Additionally, the recent technical breakout along with rising earnings projections imply that Twilio could maintain its upward momentum. Nonetheless, as with any investment, prospective buyers should closely track price movements and the broader market environment. For those seeking to invest in a company involved in digital transformation, Twilio provides a compelling growth opportunity.

Discover 5 Hot Stocks to Capitalize on Infrastructure Spending

Trillions of federal dollars are set aside for the maintenance and enhancement of America’s infrastructure. This funding will not only improve roads and bridges but also significantly invest in AI data centers, renewable energy sources, and beyond.

Within this context, you will uncover 5 surprising stocks positioned to gain the most as this spending spree unfolds.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Want the latest investment recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Twilio Inc. (TWLO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.