Griffon Corporation: A Strong Diversification Asset in Today’s Market

To manage risk and stabilize financial portfolios, “diversification” is crucial during economic downturns or periods of market uncertainty. Griffon Corporation’s GFF Stock presents a compelling option for investors.

Despite tariff concerns, Griffon is well-positioned to maintain and even grow its performance. This diversified holding company manufactures a variety of consumer products, including garage doors and health care items.

Griffon’s Zacks Diversified Operations Industry ranks in the top 10% among over 240 Zacks industries, with GFF earning a Zacks Rank #1 (Strong Buy) and being recognized as Bull of the Day.

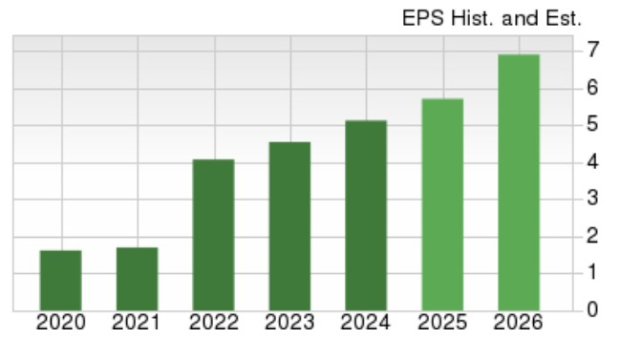

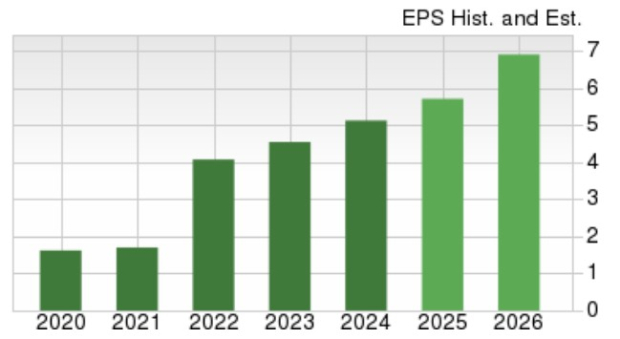

Griffon’s Impressive EPS Growth

Griffon’s diverse portfolio contributes to its resilience and strong profitability, with annual earnings projected to rise by 11% in fiscal year 2025. Projections indicate a further increase of 21% in FY26, reaching $6.90 per share. Notably, Griffon’s EPS estimates reflect a staggering 325% increase from earnings of $1.62 per share in 2020.

Image Source: Zacks Investment Research

While total sales are expected to decline by 1% this year, forecasts suggest a recovery with a 3% increase in FY26, totaling $2.67 billion. EPS estimates for FY25 and FY26 have also risen by 3% and 7%, respectively, in the past 60 days.

Image Source: Zacks Investment Research

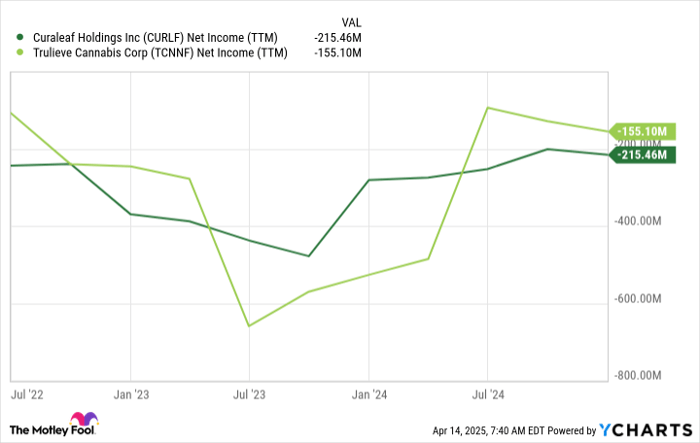

GFF Stock Performance & Valuation

Year to date, Griffon Stock has declined by 2%. However, over the last three years, it has surged by more than 270%, significantly outperforming broader market indexes.

Image Source: Zacks Investment Research

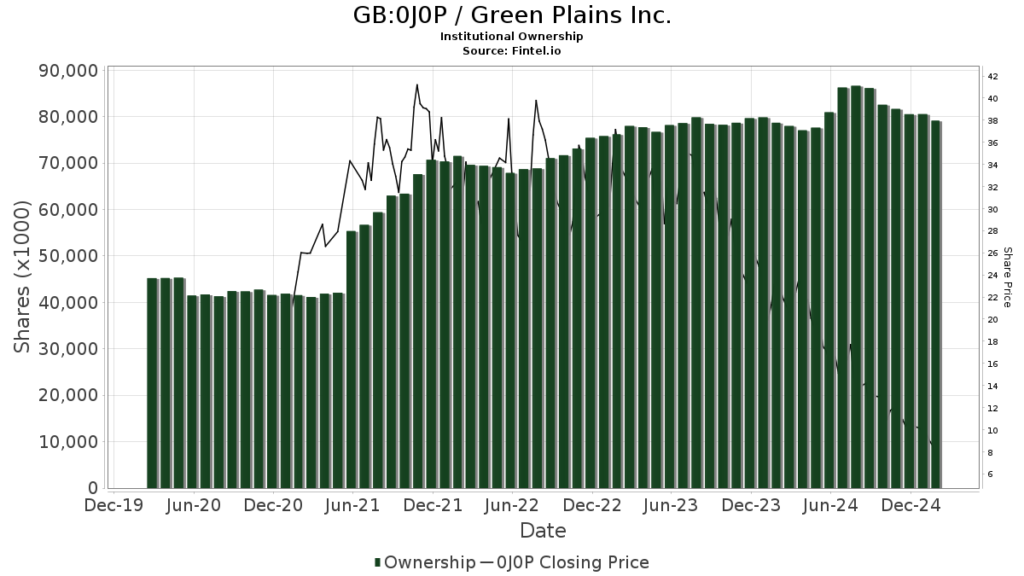

With rising EPS estimates indicating potential short-term gains, it’s worth noting that GFF trades at an attractive 12.3X forward earnings. This represents a significant discount compared to the S&P 500’s 20.4X and below the industry average of 15.7X forward earnings, with competitors like 3M MMM and Honeywell International HON.

Image Source: Zacks Investment Research

Griffon’s Dividend Growth

Additionally, GFF offers an annual dividend yield of 1.02%. The company has raised its dividend seven times over the last five years. With a 13% payout ratio, there is substantial potential for future increases.

Image Source: Zacks Investment Research

Conclusion

In light of the ongoing trade tensions between the U.S. and other nations, diversification is increasingly vital for investors. Griffon Corporation presents a solid diversification opportunity, boasting a strong buy rating and an overall “A” in the VGM Zacks Style Scores, signifying favorable value, growth, and momentum.

7 Best Stocks for the Next 30 Days

Analysts have identified 7 elite stocks from a selection of 220 Zacks Rank #1 Strong Buys, expected to show early price pops.

Since 1988, this list has outperformed the market more than twice, with an average annual gain of +23.9%. These selected 7 stocks deserve immediate attention.

see them here >>

For timely recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days.

Griffon Corporation (GFF) : Free Stock Analysis report

Honeywell International Inc. (HON) : Free Stock Analysis report

3M Company (MMM) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.