Zebra Technologies Sees Stock Surge as Automation Demand Grows

Zebra Technologies Corporation ZBRA has experienced a remarkable 75% rise in share prices over the past year, showcasing a significant recovery from the pandemic’s highs and lows.

In late October, ZBRA reported better-than-expected results for the quarter, attributing the success to “continued momentum in demand” across its diverse customer base, which includes sectors like manufacturing, energy, and logistics. With a robust U.S. economy driving data center growth, infrastructure investments, and reshoring, Zebra Technologies is positioned for continued expansion.

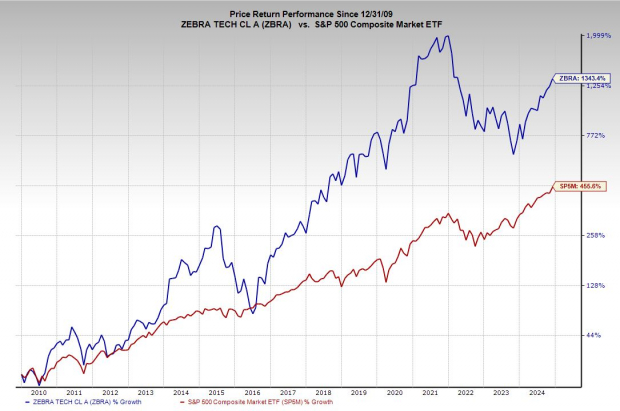

Over the last decade, ZBRA has outperformed the S&P 500, posting double its gains while surpassing the Industrial Products sector. However, it currently trades about 30% below its all-time highs, despite a broader market that is flourishing.

ZBRA: A Hidden Gem Tapping into Major Industry Trends

Zebra Technologies enhances productivity for frontline workers by providing a range of advanced tools. The company produces handheld computers, wearables, tablets, scanners, and interactive kiosks, supplemented by numerous software solutions tailored to modern needs.

The company’s products are indispensable in today’s technology-driven landscape, with applications extending across healthcare, manufacturing, utilities, and retail.

Image Source: Zacks Investment Research

Given the increasing reliance on tech, Zebra Technologies is crucial for businesses looking to implement digital solutions across various sectors—from distribution centers to telecommunications.

In the third quarter, Zebra Technologies achieved a 31% revenue growth, with U.S. sales surging by 47%. Notably, North American sales rose 22%, primarily due to mobile computing and printing products.

Internationally, the company saw strong performance in Southeast Asia and India, alongside stabilization in the Chinese market.

Gross margins improved by over 4%, reaching 48.8%, as the company refined its operations, including the consolidation of its North American distribution centers into one facility near Chicago.

Adjusted earnings skyrocketed by 301% compared to the last quarter, marking a significant turnaround for the company.

Promising Growth Ahead for ZBRA

Zebra Technologies provided optimistic guidance for the future. “We increased our full-year outlook for profitable growth in response to our recent performance and ongoing demand,” stated CEO Bill Burns during the Q3 earnings briefing.

“We remain well-equipped to strengthen our leadership in the industry with our innovative technologies that enhance our clients’ supply chain processes.”

Image Source: Zacks Investment Research

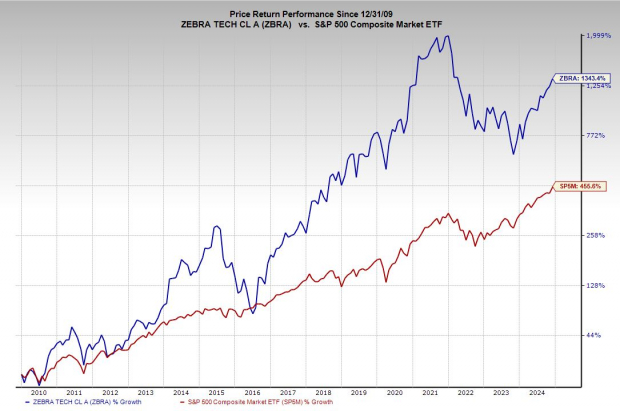

Looking ahead, ZBRA aims to grow revenues by 8% in 2024, estimating an increase from $4.58 billion in FY23 to $5.25 billion by FY25. Adjusted earnings are anticipated to rise by 43% next year and by another 14% in FY25, climbing from $9.82 to $15.97 per share.

Earnings estimates for Q4 have jumped by 17% since the last release, with projections for FY24 and FY25 up by 10% and 5% respectively.

These positive revisions have led to a Zacks Rank #1 (Strong Buy) for Zebra Technologies, indicating a strong recovery trend already underway.

Examining ZBRA’s Performance Metrics

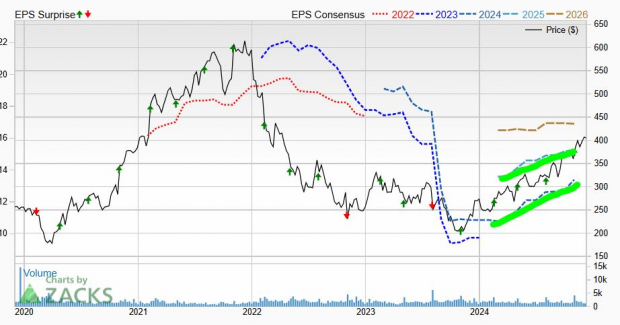

Over the past 25 years, ZBRA stock has surged approximately 1,500%, greatly eclipsing the 360% gain in the Industrial Products sector and a 370% rise in the S&P 500. In the past decade, shares have increased by 450%, far outpacing the sector and doubling the benchmark performance.

Despite this strong growth, ZBRA is currently down 33% from its peak in December 2021, while the S&P 500 has risen nearly 30% during the same period.

Image Source: Zacks Investment Research

Fortunately, ZBRA is on track for a comeback, with shares experiencing a significant 75% increase in the past year, recently hitting a 52-week high.

Zebra Technologies remains a key player in the automation sector, demonstrating resilience and an ability to adapt to changing market conditions.

Zebra Technologies Sees Recovery: Is It Time to Buy After a 33% Dip?

Technical Indicators Show Positive Signs for ZBRA

Zebra Technologies has recently climbed back above its 200-week moving average, as well as the 21-and 50-month averages. The stock’s Relative Strength Index (RSI) levels indicate it is not overheating, which might appeal to cautious investors. Currently, Zebra Technologies trades near its five-year median valuation at 27.6 times forward 12-month earnings.

Potential for Long-Term Growth Despite Market Challenges

With Wall Street optimistic about Zebra Technologies’ strong earnings and revenue growth, the stock could maintain its upward momentum. Investors are increasingly seeking robust stocks that offer significant near-term potential, particularly as the overall market shows signs of being overextended.

Moreover, Zebra Technologies stands to gain from key megatrends in both the U.S. and global economies. The company provides a wide range of products and software, all of which are becoming essential as industries evolve.

Explore Promising Opportunities in Nuclear Energy

The demand for electricity is surging, prompting a shift from fossil fuels like oil and natural gas. Nuclear energy presents a viable alternative as nations look to sustainable solutions.

Recently, leaders from the U.S. and 21 other nations committed to tripling global nuclear energy capacity. This ambitious goal could yield substantial profits for companies in the nuclear sector, particularly for early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, investigates leading companies and technologies in this field, featuring three standout stocks poised for significant growth. Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Additionally, if you’re looking for investment insights, Zacks Investment Research offers a free report titled 5 Stocks Set to Double. Click here to get your free report.

Zebra Technologies Corporation (ZBRA): Free Stock Analysis Report

For additional insights, read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.