PPG Industries Faces Hurdles as Market Weighs on Performance

PPG Industries is a leading global supplier of paints, coatings, chemicals, and specialty materials. The company provides sealants and industrial coatings utilized across diverse fields, including packaging, marine equipment, and automotive parts.

Based in Pittsburgh, PPG specializes in manufacturing adhesives and metal pretreatments for a range of products such as appliances, construction equipment, and consumer electronics. Additionally, PPG develops advanced technologies for pavement marking used by government and commercial sectors.

Current Challenges Impacting PPG

PPG is encountering several obstacles, particularly a decline in demand for its products in the United States and Europe. Factors such as the Russia-Ukraine conflict and declining consumer confidence are contributing to this decreased demand in Europe. Sales and volumes are suffering due to weakened industrial production and lower automotive build rates, which directly affect PPG’s Industrial Coatings segment.

Moreover, PPG’s high debt level raises concerns. By the end of last year, its long-term debt reached approximately $5.8 billion, a situation that limits the company’s financial flexibility.

A Look at Performance Rankings

PPG Industries holds a Zacks Rank of #5 (Strong Sell) and is part of the Zacks Chemical – Specialty industry group, which is currently ranked in the bottom 19% out of about 250 ranked industries. This group is expected to underperform the market over the next 3 to 6 months, continuing a trend from the previous year.

Stocks that are part of weaker industries often present intriguing short-sale opportunities, as their overall poor performance can hinder individual stocks from staging rallies. Over the past year, PPG shares have lagged the general market, presenting a potentially appealing short opportunity as the new year approaches.

Recent Earnings Shortfalls and Outlook

PPG has struggled with earnings expectations recently, missing forecasts in two of the last three quarters. Last month, the company disclosed fourth-quarter earnings of $1.61 per share, falling short of the Zacks Consensus Estimate by -2.42%. Furthermore, revenues were reported at $3.73 billion, a drop of 14.3% year-over-year, and also underwhelmed analysts’ projections.

The provider of paints and coatings has a negative trailing four-quarter earnings surprise of -0.64%. This consistent underperformance in meeting estimates indicates potential challenges ahead for PPG.

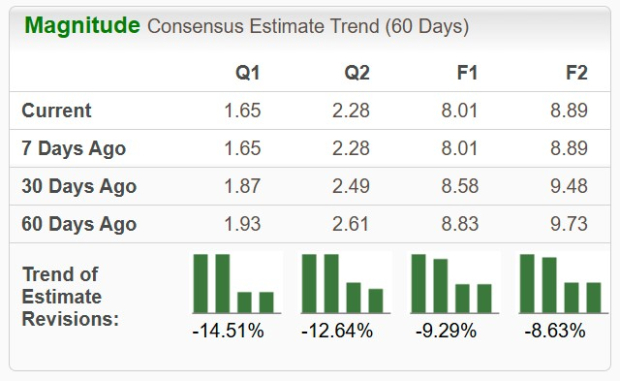

Recently, analysts have drastically lowered earnings estimates, with a -14.51% cut in the past 60 days for the upcoming quarter. The current Zacks Consensus EPS Estimate for Q1 stands at $1.65/share, signaling a negative year-over-year growth of -11.3%.

Image Source: Zacks Investment Research

Such declining earnings forecasts are concerning and tend to signal bearish trends valuable for investors to consider.

Technical Analysis

As displayed below, PPG stock is currently trending downwards. The stock has experienced a sequence of lower lows and is significantly underperforming major indices. Additionally, the shares are trading below both the 50-day (blue line) and 200-day (red line) moving averages, which is typically viewed as favorable for bearish investors.

Image Source: StockCharts

PPG’s stock has also experienced a “death cross,” where the 50-day moving average falls below the 200-day moving average. A significant upward movement in the stock price, along with improved earnings estimate revisions, would be necessary before considering long positions. Notably, the stock has decreased nearly 18% over the past year.

Concluding Thoughts

The current fundamental and technical landscape suggests that PPG stock may not be on the path to new highs anytime soon. Its inclusion in one of the weakest-performing industry groups only compounds existing problems. Frequent earnings misses and declining future estimates likely restrict any potential rallies, further entrenching the stock’s downtrend.

PPG carries a poor ‘F’ rating in the Zacks Momentum Style Score category, implying its shares may continue to decline based on unfavorable trends in pricing and earnings.

Investors may want to avoid PPG for the time being or consider including it in a short or hedging strategy. It may be wise for bulls to stay clear of PPG until they see significant positive changes.

Take Advantage of Zacks’ Exclusive Offers

We’re serious.

In an unprecedented move, we offered an opportunity for members to gain 30-day access to all our picks for just $1. They faced no obligation to spend any more.

Many have seized this chance, while others hesitated, suspecting strings attached. In reality, we aim to introduce you to our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which have closed 256 positions with substantial gains in 2024.

Want the latest recommendations from Zacks Investment Research? Download our free report on the 7 Best Stocks for the Next 30 Days.

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.