Stocks Recover: Wall Street Ends Losing Streaks in Promising Start to 2025

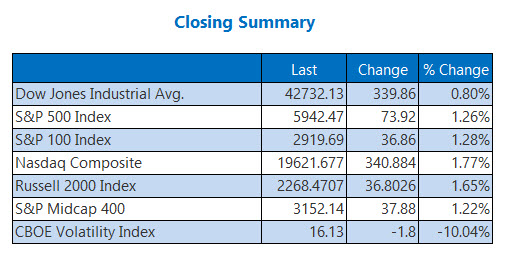

Today, stocks marked their first victory of 2025 by ending various losing streaks. The Dow Jones Industrial Average rose by 339 points, breaking a four-day decline. Meanwhile, both the S&P 500 and Nasdaq saw increases of over 1%, snapping their five-day drops. Tech stocks fueled the recovery, highlighted by Nvidia (NVDA) achieving its best daily gain since November 19. Despite a strong finish on Friday, all three major indexes recorded weekly losses.

Read on for further insights into today’s market:

- 3 stock picks for 2025 that can enhance your portfolio.

- An analyst shows strong support for Chewy stock.

- Additionally, insights on TPR’s chart momentum, US Steel’s Nippon merger fallout, and a primer on the VIX for 2025.

Key Updates to Note

- Hydrogen tax credits are now more accessible for nuclear energy firms. (Reuters)

- The U.S. Surgeon General issues a serious warning about alcohol and cancer. (CNBC)

- Tapestry stock shows potential for growth.

- US Steel shares have dropped following the Nippon merger being put on hold.

- A VIX primer reveals insights you may not have realized you needed.

No significant earnings reports were released today.

Commodity Markets Show Weekly Strength

Oil prices rose in part due to expectations for more economic stimulus in China. The price of West Texas Intermediate (WTI) crude for February delivery increased by 83 cents, or 1.1%, to close at $73.96 per barrel. Over the week, crude oil posted a gain of 4.8%.

Conversely, gold prices softened as the U.S. dollar strengthened. For January delivery, gold fell by 0.5%, settling around $2,655.90 per ounce. Despite this drop, gold still managed to increase by 1.1% for the week.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.