Unlocking Value: A Strategic Look at Deere & Co’s Dividend Potential

Here’s a straightforward approach I’ve designed, called the “Made for 2025” Dividend Plan, focusing on dividend stocks poised for significant growth.

When these dividends increase, stock prices often follow suit.

This reliable method performs well, regardless of economic changes or government policies, ultimately leading to promising price gains from stable payers.

Current Opportunity: Deere & Co’s Market Position

Let’s explore a relevant case: a recent decline in dividend grower Deere & Co (DE) comes amidst President-Elect Trump’s comments:

“They’ve announced a few days ago that they are going to move a lot of their manufacturing business to Mexico. I am just notifying John Deere right now that if you do that, we are putting a 200% tariff on everything that you want to sell into the United States.”

Clearly, Deere plans to keep its operations in the U.S. at least until 2028. Simultaneously, favorable conditions for grain prices should enhance its cyclical business, supporting both profits and stock value. When grain prices rise, few companies match Deere’s effectiveness in the agriculture sector, where they lead in manufacturing and distributing agricultural, construction, and forestry equipment.

Timing Your Purchase: Wheat Prices Matter

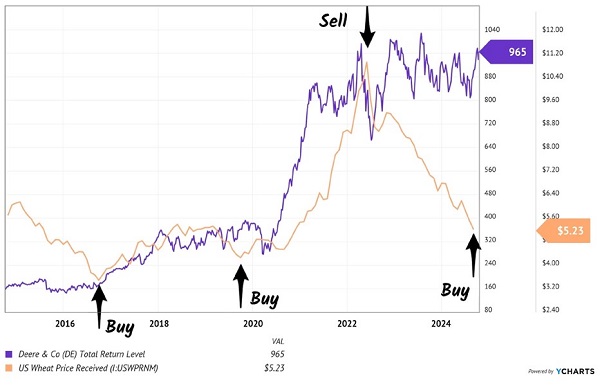

To invest in Deere, consider buying when grain prices, particularly wheat, are low. Historically, low wheat prices indicate a downturn in Deere’s profits, which often foreshadows an upturn in the market.

Notably, as contrarian investors, we want to buy DE when wheat prices are low, not when they are peaking.

Buy DE When Wheat is Low (and Sell When High)

Historical Performance and Shareholder Returns

Over the past two decades, grain prices have experienced significant volatility. However, Deere’s commitment to shareholder returns has consistently elevated its stock, reflecting a remarkable 2,000% increase in value.

The blue bar below illustrates the cash Deere has gathered over 20 years. The company has wisely utilized this cash for acquisitions, core business investments, and the establishment of a new financial services unit. Importantly, about 60% of this cash has benefitted shareholders directly through dividends and share buybacks:

The 2 Big Bars: Shareholder Cash

Focusing on the last decade, Deere has raised its dividend by 145%. This increase coincided with a previous wheat price surge, during which the company also repurchased 21% of its shares:

Divvie Up, Share Count Down

A Bright Future Amidst Challenges

This approach is favorable for shareholders. Fewer shares lessen the total dividend payout required, allowing Deere to increase dividends for investors. This creates a beneficial cycle that enhances investor returns.

Management remains proactive in dealing with low wheat prices by managing costs, generating cash, and preparing for recovery.

Commodity prices will rise again; it’s only a matter of timing. Current market conditions are nearing their lowest point.

Despite Deere’s recent stagnation since 2022, which left it perceived as “dead money,” the company’s management remains optimistic. Recently, they raised the dividend by 10.2%, signaling confidence in future growth.

Our Hidden Yields subscribers were positioned to benefit from this dividend increase, already seeing an 8% gain in our Deere holding in just two months—an impressive annualized return of 51%!

The stock is currently rated a Hold. We’re prepared to add to our position on any future pullbacks at HY. For anyone looking to invest, I recommend checking out additional “Made for 2025” Dividend Stocks.

Additional Resources:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.