Big Tech’s Surge in Capital Spending: Nvidia Poised for Growth

Major technology companies are increasing their investments in artificial intelligence infrastructure, resulting in a significant rise in capital expenditures.

According to Bloomberg Intelligence, Amazon, Microsoft, Alphabet, Meta Platforms, Apple, and Oracle collectively spent $110.2 billion in capital expenditures (capex) in 2023, a jump from $104.2 billion in 2022. This year, their projected spending is expected to reach around $165.2 billion, marking an approximate 50% increase from last year.

Looking ahead, these tech giants are anticipated to spend nearly $200 billion in capex by 2025, driven by the growing demand for AI applications. Bloomberg notes that much of this investment will focus on enhancing data centers with graphics processing units (GPUs) and other related infrastructure.

In this landscape, GPU manufacturer Nvidia (NASDAQ: NVDA) stands to benefit significantly from the elevated capital spending among these major players.

Nvidia Captures Major Capital Spending from Big Tech

The technology leaders mentioned above are heavily investing in AI-related data centers, and Nvidia has emerged as a key beneficiary. The demand for Nvidia’s GPUs has surged due to their effectiveness in training large language models (LLMs) and for inference applications.

Nvidia’s data center revenue skyrocketed 217% in fiscal 2024, ending at $47.5 billion. In the first half of the current fiscal year, the company already reported $49 billion in data center revenue, with $42 billion attributed to sales of AI GPUs. At this growth rate, Nvidia’s GPU revenue from data centers could reach $84 billion this year.

This trend suggests that Nvidia could capture more than half of the capex from the major tech firms mentioned earlier. However, it’s important to note that Nvidia’s data center GPU revenue also includes sales to other companies and governments, not just the big tech players.

Demand for Nvidia’s next-generation Blackwell graphics cards has been so high that they are reportedly sold out for the next 12 months. Nvidia highlighted that major organizations such as Amazon Web Services, Dell Technologies, Google, Meta, Microsoft, OpenAI, Oracle, Tesla, and xAI are expected to adopt Blackwell, indicating a strong likelihood that Nvidia’s growth from big tech’s capex will continue next year.

Bank of America analyst Vivek Arya stated in a CNBC interview that Nvidia maintains a remarkable 80% to 85% share of the AI chip market. This places the company in a prime position to benefit from the projected $200 billion in capital expenditures from these tech firms. Additionally, investment bank Mizuho estimates the AI GPU market could reach $400 billion annually within five years, suggesting Nvidia’s growth trajectory is set to persist.

Given this context, analysts expect Nvidia’s revenue to grow at an impressive rate of 57% annually over the next five years, leading many to believe that investing in Nvidia now is a wise choice considering its current valuation.

Current Stock Valuation of Nvidia Appears Attractive

While Nvidia’s trailing price-to-earnings (P/E) ratio of 65 may seem high, its forward earnings multiple of 36 indicates substantial expected earnings growth. When comparing this figure to the Nasdaq-100 index, which has a forward earnings multiple of nearly 30, Nvidia’s valuation appears more justified.

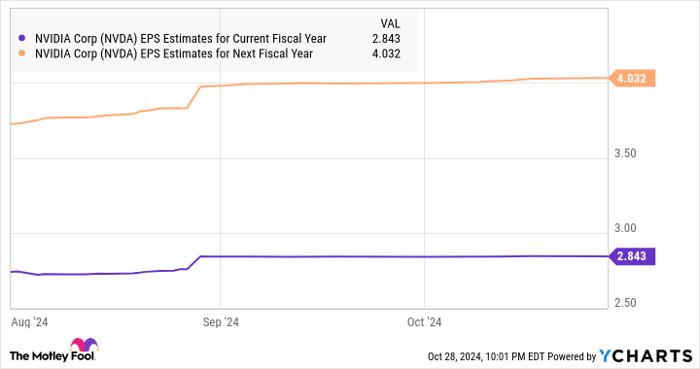

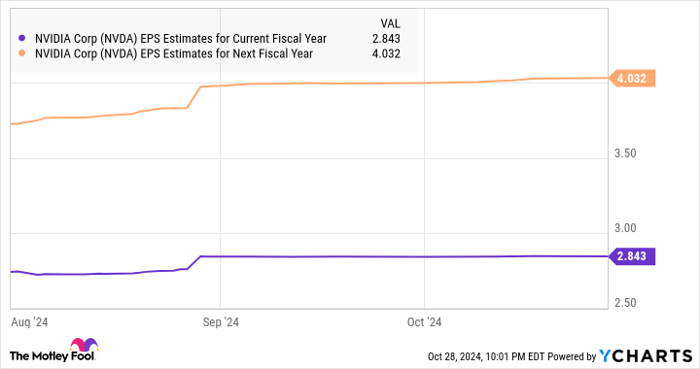

In fiscal 2024, Nvidia reported earnings of $1.19 per share. The following chart illustrates robust growth in its earnings expected for the current and following fiscal years.

NVDA EPS Estimates for Current Fiscal Year data by YCharts.

Nvidia’s price-to-earnings growth (PEG) ratio is approximately 1.1, indicating that the stock may be fairly valued. This ratio assesses a company’s expected earnings growth potential, and a PEG of around 1 suggests accurate pricing for that growth. Furthermore, Nvidia’s PEG ratio is lower than the S&P 500 Information Technology sector’s average PEG of 1.39 as of June, making it a more attractive option.

For those considering investment in AI stocks, Nvidia presents a compelling case, especially with the potential for continued strong performance ahead, following a remarkable 184% gain in 2024.

Is Now the Right Time to Invest in Nvidia?

Before you decide to purchase shares of Nvidia, consider this:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to invest in right now—and Nvidia is not on that list. The stocks that were selected may offer significant returns in the coming years.

Thinking back to when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to approximately $912,352 today!*

Stock Advisor guides investors in building a successful portfolio, with regular updates and two new stock picks each month. Since 2002, it has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.