Understanding the Impact of Recessions on Investments

Humans are inherently cautious, especially when it comes to potential threats. Our ancestors survived by being constantly alert for dangers like tigers or bears. Though these threats are no longer a part of our everyday lives, our instinct to be wary still exists. Today, the fear of a recession is a significant concern for many investors.

Typically, recessions can harm investment portfolios, sometimes leading to significant losses. While economies and stock markets do eventually recover, some investors may take years or even decades to regain their footing.

The historical context of economic downturns in the U.S. is revealing. Prior to the Great Depression in 1929, many downturns were referred to as “panics.” Examples include the Panic of 1873, 1893, and 1907, which led to bank runs as depositors lost faith in their financial institutions’ ability to repay them. This turmoil ultimately resulted in the establishment of a national bank in 1913, now known as the Federal Reserve System.

While bank runs are rare today, we still see instances of panic selling driven by investor fears:

- Concerns about inflation.

- Worries about rising interest rates.

- Fears stemming from international conflicts and trade challenges.

- And above all, anxiety about the possibility of a recession.

Even whispers of an impending recession can stir panic among investors, creating an atmosphere of uncertainty that often leads to indecision. This can manifest in various responses, from conservative cash holdings to aggressive purchasing strategies.

As we find ourselves in the second quarter of 2022, sentiments around a possible recession have intensified. If you’re feeling more anxious and uncertain lately, you’re certainly not alone.

A recent survey from Bank of America indicates that investor worry about the global economy has reached heights not seen since the financial crisis of 2007-2008. Deutsche Bank is the first major institution to forecast that the U.S. will experience a “mild” recession later in 2022 extending into early 2023. Concurrently, Moody’s Analytics estimates a 33% chance of recession, while Goldman Sachs provides a similar estimate at 35%.

Jamie Dimon, CEO of JPMorgan Chase and a prominent figure in the banking world, informed shareholders in April 2022 that the global economy is likely to slow, stating, “it could easily get worse.” The advisors at InvestorPlace also concur that a recession remains a possibility. Heightened concerns over the war in Ukraine have amplified ongoing inflation, which is at a 40-year high. This evolving situation warrants careful monitoring by all investors.

These instincts can serve a beneficial purpose. If these concerns prompt us to approach investment decisions more judiciously and strengthen our portfolios, we can better withstand potential losses that might arise during recessionary periods.

Now is an opportune moment to reflect on your approach to portfolio management in the event of a recession. Even if a downturn does not occur, preparing strategies to mitigate significant losses will pay dividends in the long run.

Understanding Recessions

The most straightforward definition of a recession is two consecutive quarters of economic contraction. The National Bureau of Economic Research (NBER) officially determines when recessions occur, considering various economic indicators beyond mere contraction. Those interested can explore these details here.

It’s important to note that NBER uses retrospective data, meaning recessions are declared after the fact. By the time one is confirmed, the worst impacts on the economy and the stock market may already have occurred, with signs of recovery possibly underway.

That said, many economists and investors can sense when a recession is occurring based on observable changes in the economy, the news cycle, and individual financial situations.

Consumer behavior typically becomes more conservative. Spending decreases on non-essential items, corporate revenues decline, manufacturing slows, and unemployment rates rise as more people find themselves jobless.

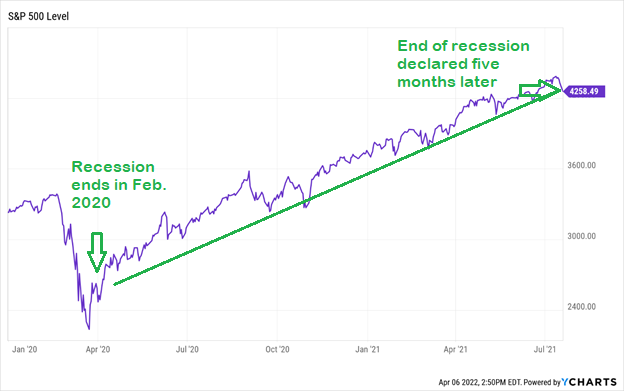

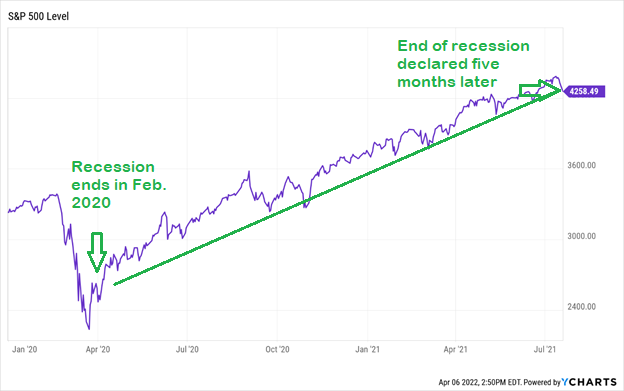

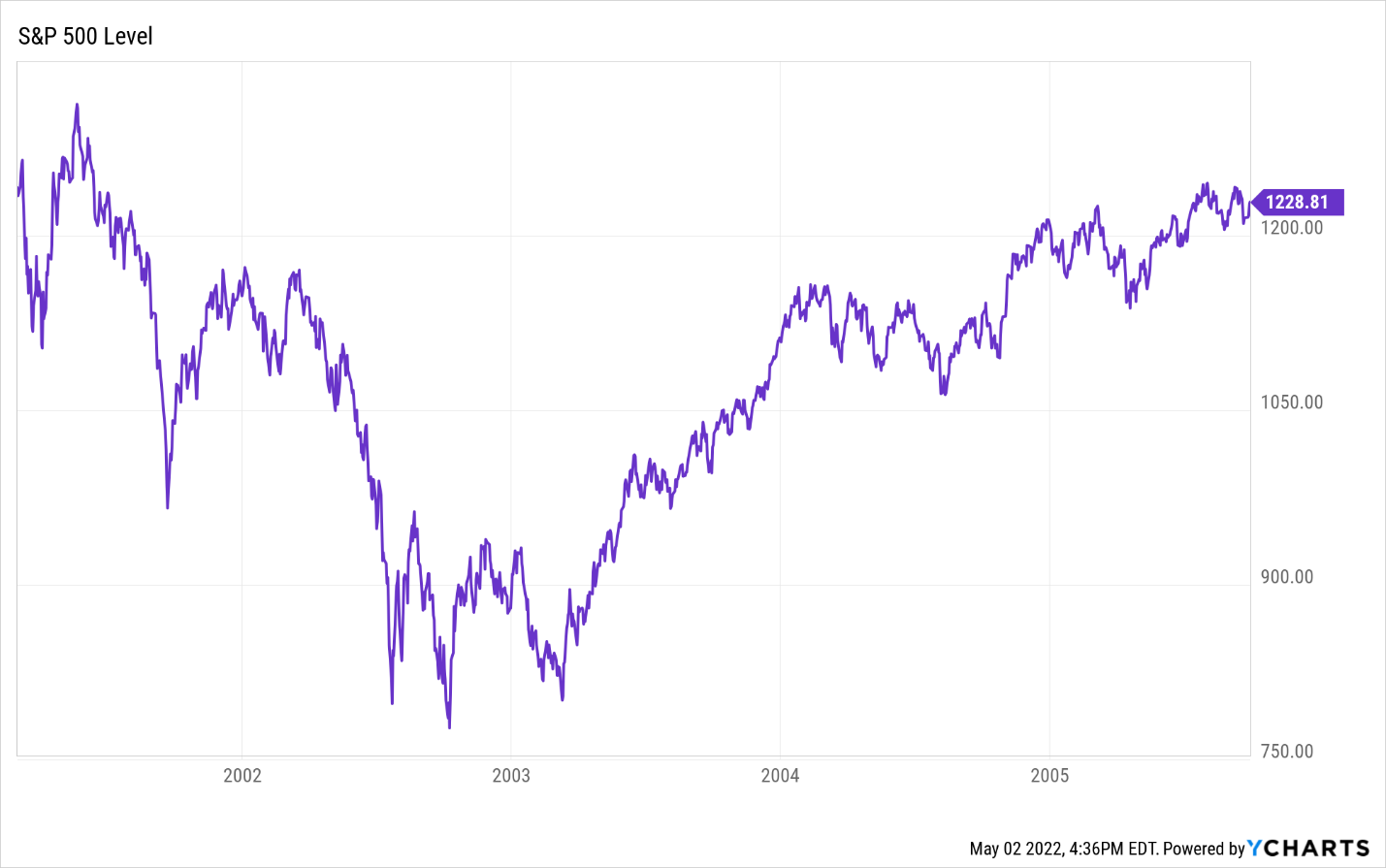

Historically, recessions have varied in duration, lasting anywhere from a lengthy 65 months in 1873 to a mere two months in recent history. The 2020 recession, triggered by the COVID-19 pandemic, is notably the shortest, officially running from February 2020 to April 2020. NBER made this announcement in July 2021, over a year after the fact. Investors who waited for confirmation before re-entering the stock market missed significant gains; this is evident in the subsequent rally captured in the S&P 500 chart below.

Over the past 80 years, since the conclusion of World War II, recessions have averaged about 11.1 months in length. This means both short and prolonged recessions are exceptions rather than the norm. Investors who ignore recession signals do so at their own peril.

Interestingly, stocks can rise even during recessions. Historically, the market looks ahead, and as evidenced in 2020, stocks may start to climb even while a recession is taking place. This underscores the importance of staying informed and ready to act.

Analyzing Stock Performance During U.S. Recessions Since 1945

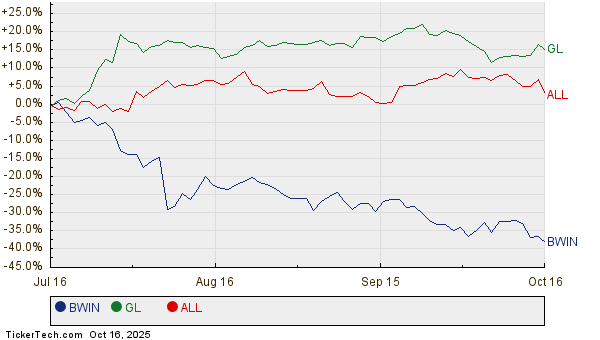

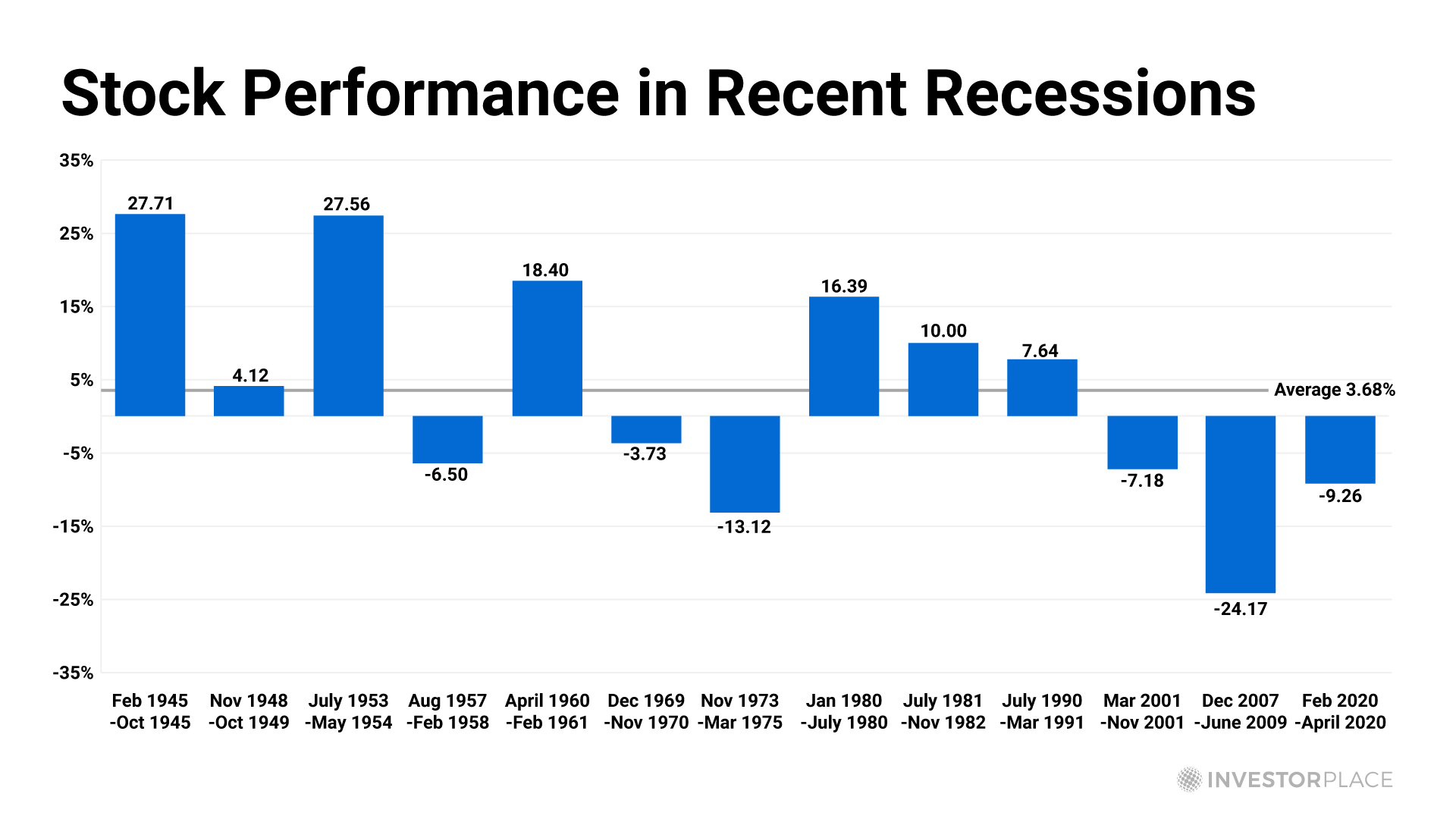

Recent data from Hartford Funds indicates a complex relationship between stocks and recessions. Over the past 78 years, stocks gained during seven out of 13 U.S. recessions post-1945, suggesting that not all recessions trigger significant market downturns.

Source: InvestorPlace

On average, the performance during these 13 recessions shows a positive return of +3.7%. Notably, in the seven recessions where stocks performed well, they saw an average gain of 16%. Conversely, during the six recessions marked by stock declines, the average loss was about 10.7%.

It becomes evident that recessions, while often financially challenging, do not always lead to disastrous stock performance. Nevertheless, the costs—both in time and value—can be high for investors.

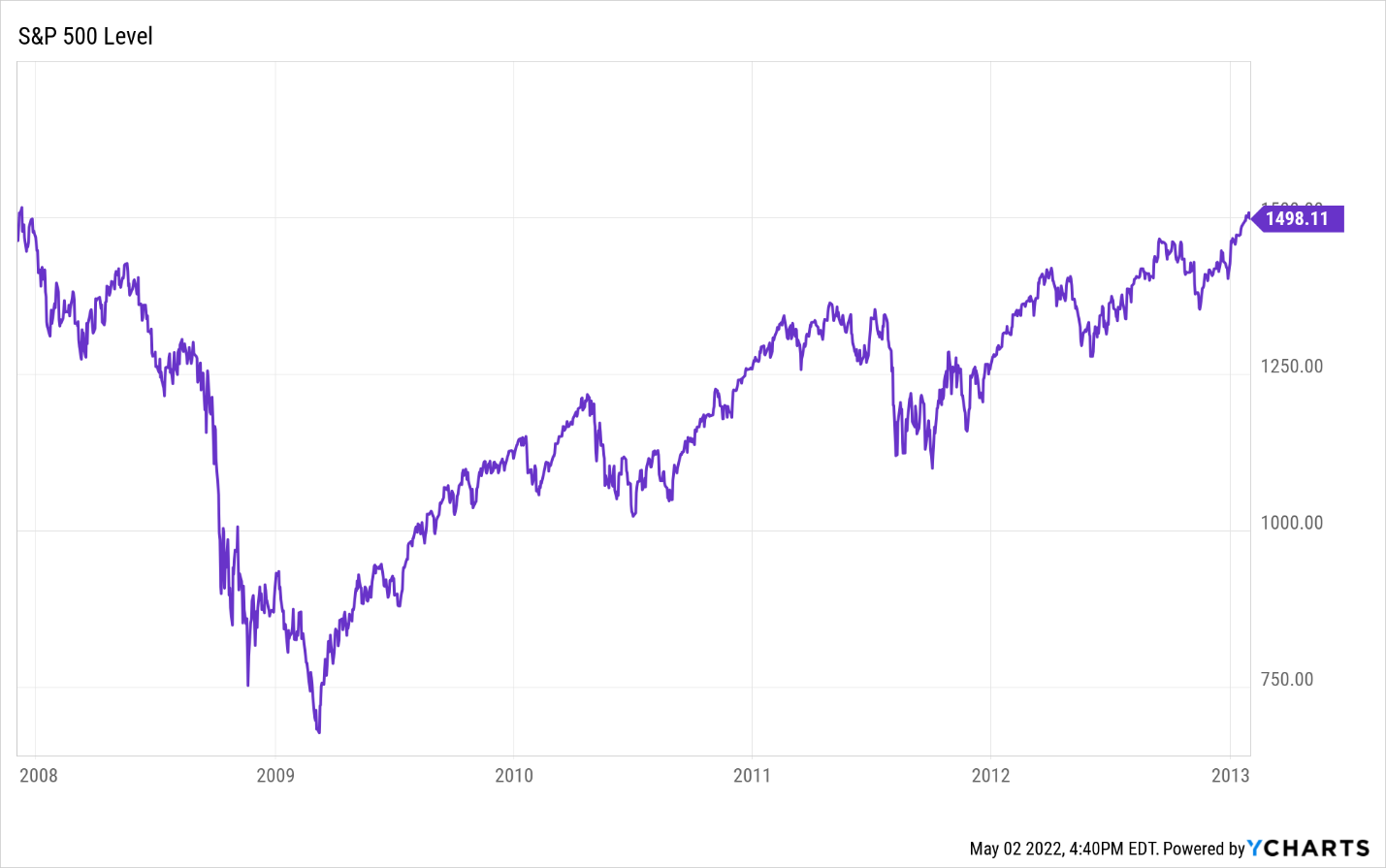

Examining the most recent recession reveals an interesting trend; stocks exhibited a rapid recovery to new highs. This contrasts sharply with the period of the previous recession from December 2007 to June 2009, known as the “Great Recession.” Triggered by the subprime mortgage crisis and financial instability, this recession caused stocks to take considerably longer to recover. Following the downturn, the S&P 500 saw a significant rally beginning from the lows in March 2009, but it took nearly four years before it regained its pre-recession levels.

A similar recovery pattern can be observed during the 2001 recession, which coincided with the bursting of the dot-com bubble. As the recession ended in late 2001, the S&P 500 initially rallied, only to fall again in 2002 and not fully recover until the fall of 2005.

Understanding Recession Indicators: The Yield Curve Explained

The Nasdaq Composite faced significant challenges, taking 15 years to surpass the all-time highs from 2000 prior to the recession. In this report, we will discuss five strategies for investing in a recession. However, it’s important to note that recessions are only identified after they have occurred.

Understanding Key Recession Indicators

Before the National Bureau of Economic Research (NBER) can officially declare a recession, several indicators can suggest its possibility. One of the most reliable indicators that investors monitor is the yield curve.

As of mid-2022, investor anxiety is palpable. The bond market has sent numerous warning signals, including a brief inversion of the Treasury yield curve for the first time since 2019, which occurred at the end of March and early April.

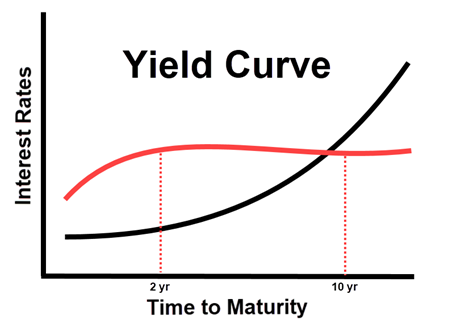

The yield curve illustrates the relationship between short-term and long-term interest rates, as reflected in bond yields. Typically, long-term bonds provide higher yields than short-term bonds, reflecting the greater risk investors face by tying their funds for an extended period.

A typical yield curve is shown in the accompanying chart, provided by John Jagerson and Wade Hansen to their Strategic Trader readers in early April. In this chart, the black line represents the long-term 10-year yield, while the red line indicates the short-term 2-year yield.

Source: InvestorPlace

The yield curve is considered “flat” when the difference between short-term and long-term interest rates narrows and “inverted” when short-term rates exceed long-term rates. An inverted yield curve is alarming because it typically indicates reduced bank profits and is often a sign of an impending recession.

Among all yield curves, the spread between the 10-year and the 2-year Treasury bond yields is particularly significant. Historically, a negative spread has accurately predicted every recession over the past 50 years.

This trend was evident at the conclusion of the first quarter in 2022. As the year began, the 2-year and 10-year yields began to converge, culminating in a moment where the 2-year yield (indicated by the purple line) briefly surpassed the 10-year yield (illustrated by the orange line).

As investors keep a close watch on these trends, understanding the nuances of the yield curve can provide valuable insights into economic conditions and potential investment strategies in challenging times.

Understanding Inverted Yield Curves and Recession Indicators

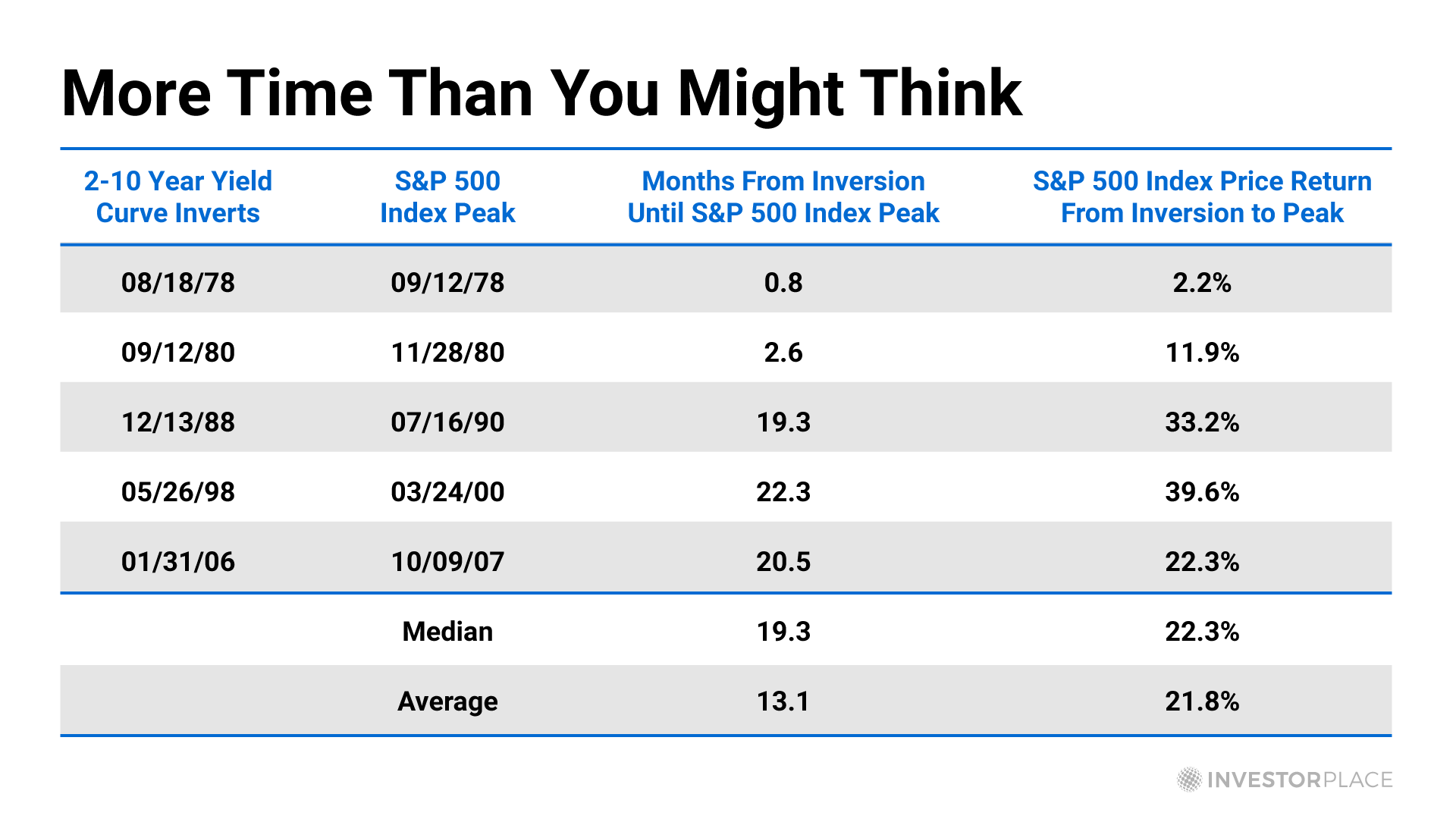

Timing is crucial as inverted yields do not traditionally indicate an immediate recession. Historically, they often signal opportunities in the market instead.

Luke Lango, Chief Investment Strategist at InvestorPlace, shared insights with his subscribers:

Inversions of the 10-2 yield curve have not marked stock market peaks. Rather, they have occurred before stock market booms.

For instance, in 1988, the 10-2 spread went negative, leading to a 33% rally in stocks over the subsequent 20 months. Similarly, a 10-2 inversion a decade later triggered a 40% increase in stocks over 22 months. In 2006, following another inversion, stocks surged by 22% in 20 months.

Source: InvestorPlace

This data suggests yield curve inversions do forecast recessions, but the signs come early. In the interim, stock markets often experience significant gains.

Exploring Other Recession Indicators

While the yield curve garners much attention, it is not the sole indicator suggesting a potential recession.

Stagflation is another critical concept to consider. It occurs during times of high inflation coupled with stagnant economic growth and low unemployment, which describes the current situation. The Federal Reserve faces the challenge of raising interest rates to combat inflation. However, higher rates can hinder businesses’ borrowing ability, potentially reducing hiring and employee retention.

Achieving a “soft landing,” where the economy stabilizes without significant downturn, is ideal. Nevertheless, investors often adopt a cautious approach until the economic trajectory becomes clearer.

Consumer confidence serves as another vital measurement for economists assessing recession risks. With consumer spending accounting for approximately 70% of the U.S. economy, any decline in confidence could trigger reduced spending, leading to economic slowdown.

Multiple factors impact consumer confidence, including employment levels and real income, which adjusts personal income for inflation. Although employment remains high, wage growth has struggled against inflation since early 2021.

Indicators such as wholesale and retail sales reflect demand for goods, as do manufacturing statistics. For a less conventional indicator, one could examine men’s underwear sales. Former Fed Chairman Alan Greenspan famously noted that underwear is the last article of clothing men buy; thus, falling sales might suggest consumers are becoming more frugal.

With a clearer understanding of recession indicators, let’s explore potential investment opportunities that may arise during these economic downturns…

The first principle to grasp about investing…

Investment Strategies During Recessions: What to Consider

Recessions, despite their severity, consistently conclude. Historical data confirms that economic downturns have a defined lifespan. However, investors often grapple with determining their duration and the potential financial toll they may impose.

Cash as a Safety Net

Though cash isn’t the most thrilling investment option, its significance becomes particularly clear during recessions. It serves as a protective cushion for your portfolio, reducing overall volatility and risk. While its value doesn’t grow like equities, having $1,000 in cash today remains $1,000 tomorrow, regardless of market fluctuations (though inflation may impact purchasing power).

Additionally, cash acts as “dry powder,” ready to capitalize on investment opportunities that arise during market downturns. Many quality stocks become available at discounted prices amidst economic struggles. However, it’s crucial not to let the fear of recession lead to excessive cash holdings or a complete exit from the market. Such panic can cause investors to incur larger losses than necessary.

It’s vital to differentiate between cash for investments and personal finances. Always maintain some liquid cash for emergencies, such as job loss or unexpected home repairs. For practical financial planning, avoid tying up cash needed in the immediate future in stocks due to their unpredictability.

Choosing Recession-Resilient Stocks

Several sectors historically perform better during recessions. These industries manage to sustain or even increase demand when the economy contracts:

- Healthcare/Pharmaceuticals: The necessity for healthcare and medicines continues regardless of economic conditions. Companies like Johnson & Johnson (JNJ), Pfizer Inc. (PFE), Abbvie Inc. (ABBV), and Amgen Inc. (AMGN) remain stable. Firms such as Abbott Laboratories (ABT) and Medtronic PLC (MDT) along with software providers like Cerner Corp. (CERN) also demonstrate resilience.

- Utilities: Essential services like water, electricity, and gas maintain steady demand, making utility stocks a safer investment during downturns. Companies such as Nextera Energy Inc. (NEE) and Dominion Energy Inc. (D) often provide solid dividends, appealing to investors near market lows.

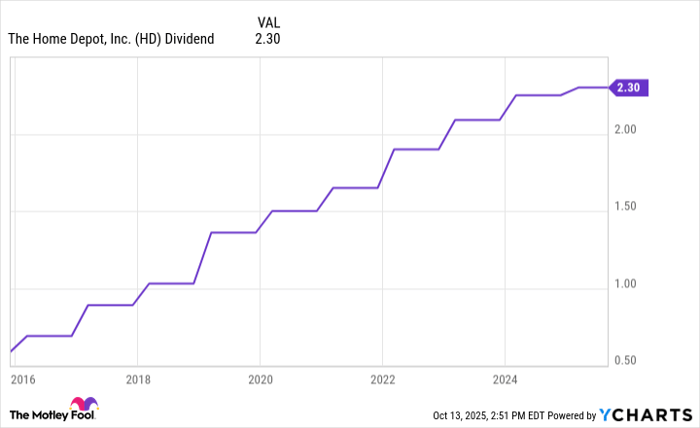

- Home and Auto Maintenance: Economic pressure leads consumers to postpone major purchases but not the upkeep of their current assets. Consequently, retailers such as Home Depot Inc. (HD) and Lowe’s Companies Inc. (LOW) may see increased sales.

- Consumer Staples: Basic needs like food and cleaning supplies typically maintain demand even when discretionary spending declines. Notable firms include Procter & Gamble Co. (PG), Coca-Cola Co. (KO), and Pepsico Inc. (PEP).

- Discount Stores: When budgets tighten, consumers gravitate toward discounts on everyday items. Stores such as Walmart Inc. (WMT) and Target Corp. (TGT) benefit from this shift.

Understanding these strategies and sectors can help investors navigate through challenging economic landscapes and potentially enhance their portfolios during recessions.

Understanding the Role of Dividend Stocks in Tumultuous Markets

- Notable dividend stocks include Costco Wholesale Corp. (COST) and Dollar General Corp. (DG).

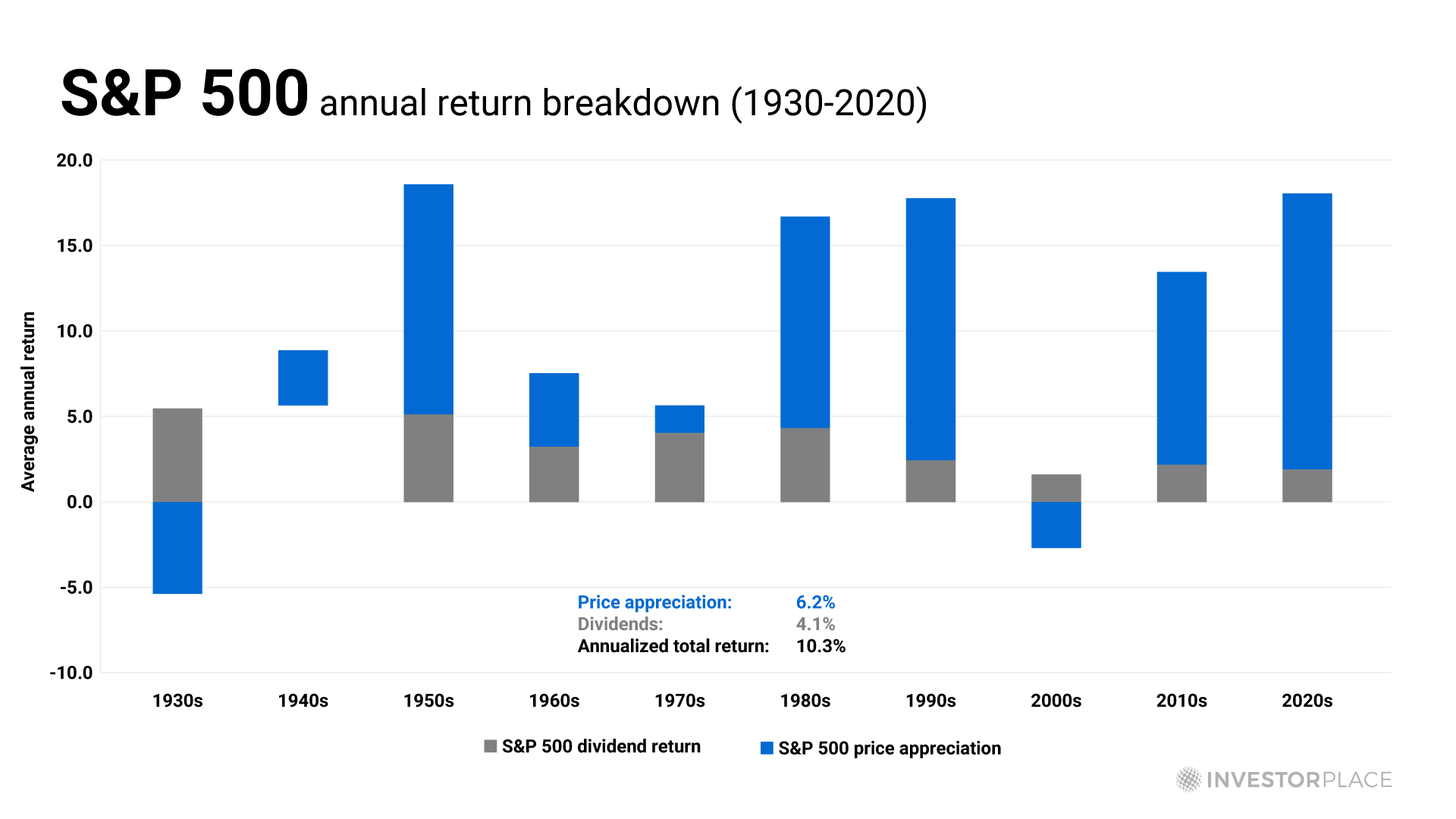

During periods of economic uncertainty, many investors shift their focus toward dividend-paying stocks. Historical data suggests that allocating a portion of your portfolio to dividend stocks can be beneficial regardless of market conditions.

According to S&P Global, dividends have contributed to 32% of the S&P 500’s total returns since 1926. Fidelity statistics indicate that from 1930 to 2020, dividends accounted for nearly 40% of overall returns.

Source: Fidelity

This data underscores the significant role dividends play in overall market returns, contributing to roughly one-third of total stock market gains over nearly a century.

Stocks with reliable dividends typically demonstrate lower volatility. The income generated by these dividends can help cushion against declines in share prices. Investors often view dividend stocks as safer options during uncertain economic periods.

However, dividends are not guaranteed. Companies can reduce or eliminate dividends as necessary, making it crucial to evaluate firms with a robust dividend history and strong cash flow to reduce the likelihood of cuts.

Strategy #3: Long-Term Buying Opportunities

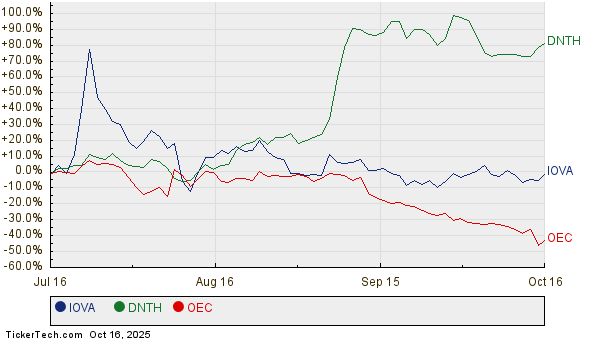

Stock prices often decline during recessions as the health of their underlying businesses deteriorates. This relationship is understandable, yet excessive fear can lead to price drops that do not reflect a company’s fundamentals.

Investing rooted in emotion, particularly “panic selling,” can cause significant financial losses. When investors sell hurriedly, they often forgo optimal pricing, much like a distressed seller in any market. Meanwhile, opportunistic buyers can benefit from discounted prices.

Typically, stock movements correlate with a company’s earnings and revenue trajectory. Nevertheless, during periods of instability, such as economic downturns or geopolitical concerns, this correlation may falter. Companies that continue to grow their earnings and revenue may trade at lower prices than their underlying value justifies. Savvy investors might seize the chance to acquire shares at bargain prices.

Investor Luke Lango has conducted insightful research on these trends, particularly the phenomenon of “divergence” that arises during such tensions:

In my early years as an investor, I remember reading numerous books, attending various lectures, and consulting with hedge fund managers to discover which investment style suited me best. My goal was to identify the approach that would yield the highest returns.

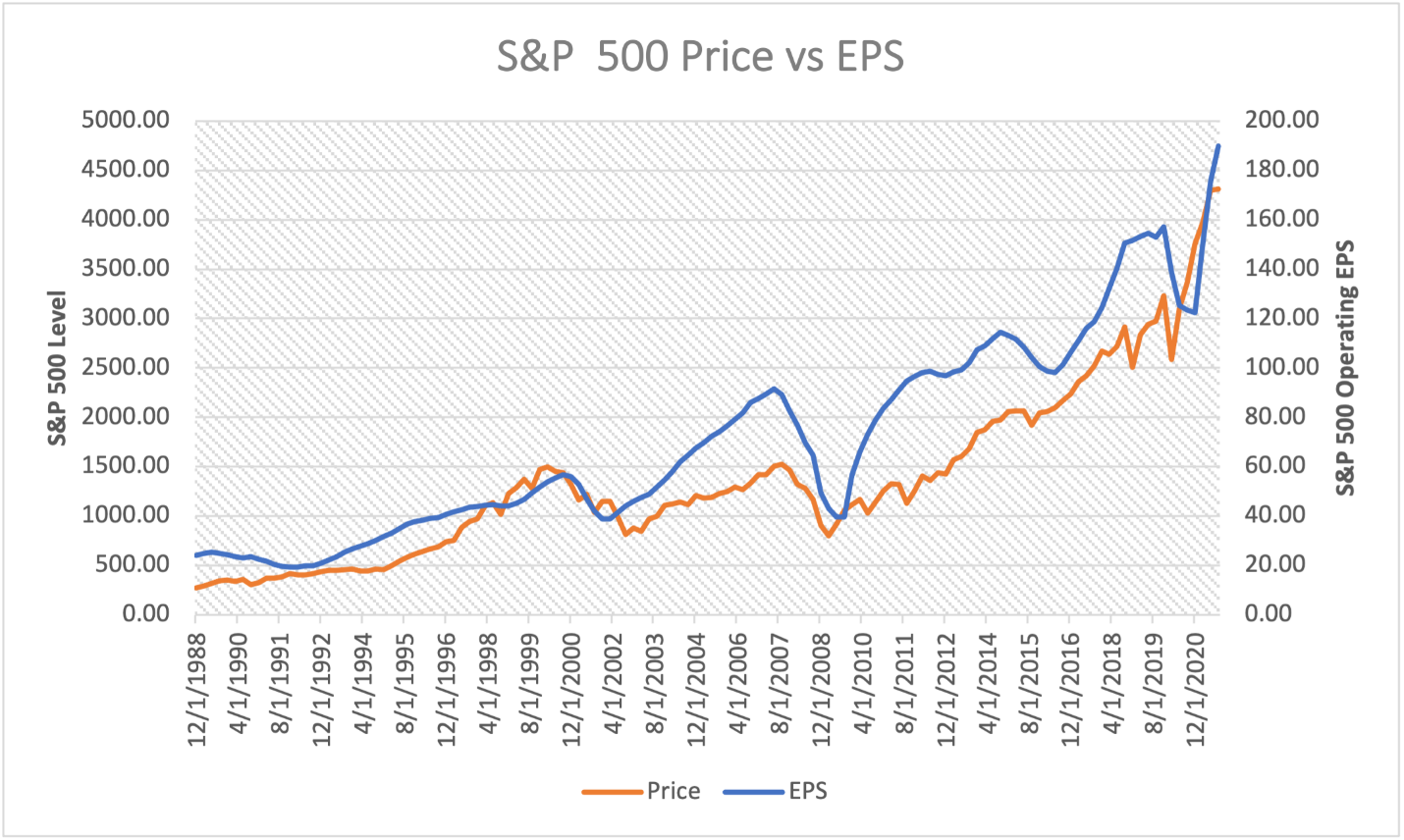

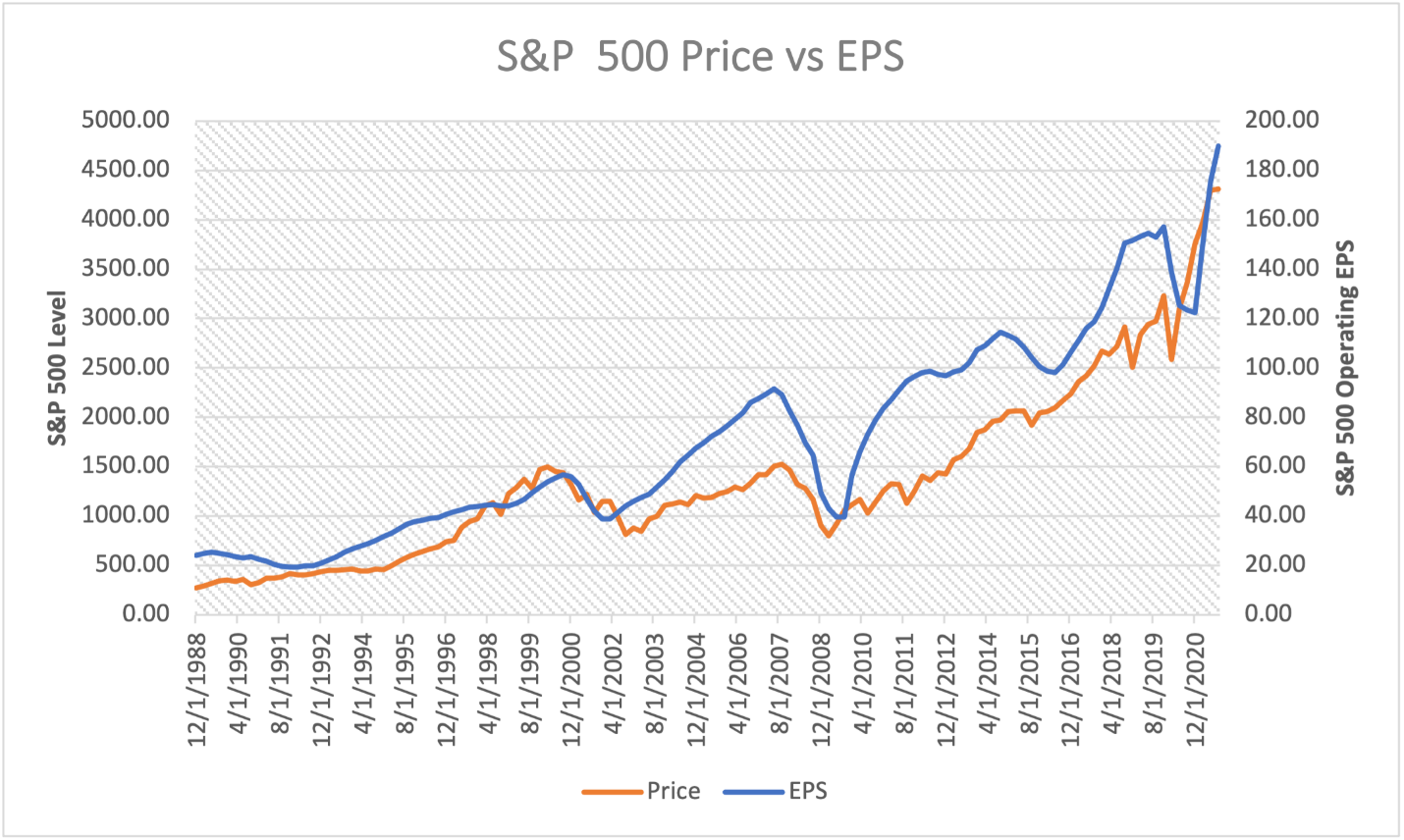

This journey led me to revisit a pivotal chart, illustrating the earnings per share of the S&P 500 versus its price from 1988 to 2022.

Understanding Market Dynamics: Earnings vs. Stock Prices Over Time

Source: InvestorPlace

The chart above shows a near-perfect alignment between the blue line representing earnings per share (EPS) and the orange line representing stock prices, with a strong mathematical correlation of 0.93. This illustrates a critical relationship in financial markets.

After examining this data, it becomes clear: earnings are a primary driver of stock prices. Other factors—such as Federal Reserve actions, inflation, geopolitical tensions, and economic downturns—pale in comparison. Historical trends from the past 30 years reveal that this correlation between earnings and stock prices generally remains consistent.

However, there are moments when earnings and revenues diverge from stock prices. Notably, during periods of macroeconomic uncertainty, such as the early part of 2022, fear takes over, leading investors to sell regardless of fundamental financial health.

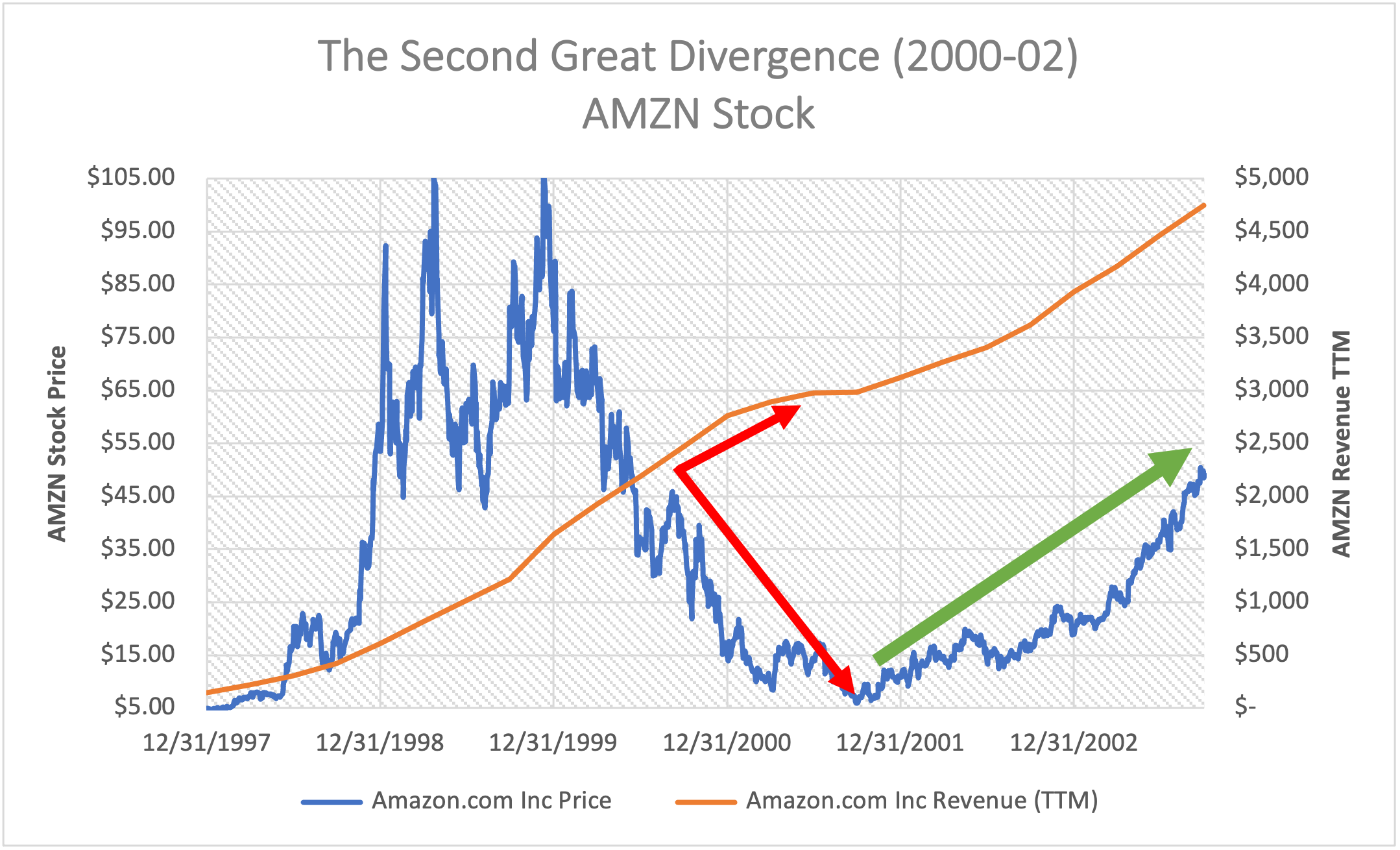

Luke identified a significant divergence during the 2001 dot-com bubble collapse, when the economy slid into recession. His research indicates that this was an optimal time to buy internet stocks. He specifically highlighted Amazon’s performance:

From December 1999 to September 2001, Amazon’s stock plummeted by an astonishing 92% despite revenues climbing by 82%. This marked an unprecedented market divergence.

The aftermath was remarkable; within one year, Amazon’s stock soared by 166%, and within two years, it surged 707%. Over two decades later, the stock has risen 52,860%.

Stock price and revenue between 1997 and 2004.” width=”2158″ height=”1310″ srcset=”https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022.png 2158w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-300×182.png 300w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-1024×622.png 1024w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-768×466.png 768w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-1536×932.png 1536w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-2048×1243.png 2048w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-200×121.png 200w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-400×243.png 400w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-116×70.png 116w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-100×61.png 100w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-82×50.png 82w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-78×47.png 78w” sizes=”(max-width: 2158px) 100vw, 2158px”>

Stock price and revenue between 1997 and 2004.” width=”2158″ height=”1310″ srcset=”https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022.png 2158w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-300×182.png 300w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-1024×622.png 1024w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-768×466.png 768w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-1536×932.png 1536w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-2048×1243.png 2048w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-200×121.png 200w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-400×243.png 400w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-116×70.png 116w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-100×61.png 100w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-82×50.png 82w, https://investorplace.com/wp-content/uploads/2022/05/second_divergence_amazon_052022-78×47.png 78w” sizes=”(max-width: 2158px) 100vw, 2158px”>

Source: InvestorPlace

Investors need to approach undervalued stocks with a long-term perspective, particularly amidst potential recession fears. Understanding when the market shifts back to focusing on fundamentals can be challenging.

Nonetheless, quality companies that are aligned with growth trends may have the potential to outperform as market fears subside.

Strategy #4: Hedging and Shorting

For those interested in actively managing portfolios during challenging economic periods, consider both hedging as a way to mitigate risks and shorting stocks to gain from market downturns.

Eric Fry, a macro expert and former hedge fund manager, suggests that successful hedging strategies can yield returns regardless of market direction. This approach allows investors to safeguard against losses while potentially profiting from adverse market movements.

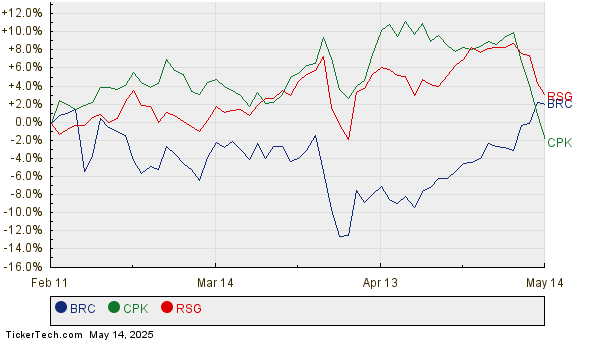

Understanding Market-Neutral Strategies in Hedge Fund Investing

Over recent years, a variety of hedge fund strategies have come to the forefront. While many continue to focus on short selling and buying stocks, others explore innovative combinations of bonds, currencies, futures, private equity investments, and derivatives.

Despite the diversity in tactics, the primary goal of most hedge funds is to create a “market-neutral” portfolio capable of generating positive results, irrespective of stock market fluctuations.

The concept of “market-neutral” strategies can be likened to fat-free ice cream; they provide the benefits of investing while mitigating significant risks.

A basic market-neutral trade comprises two components: one side betting on price increases and the other anticipating declines.

However, a perfectly market-neutral trade yields no profit or loss—only a breakeven scenario where gains on one side offset losses on the other. The true objective is not to remain neutral.

Market-neutral trades aim to profit when the combined performance of both trades results in a net benefit. It’s important to note that not every component of a market-neutral trade needs to be profitable for the overall trade to succeed.

Shorting a Stock stands as the most straightforward method to bet on potential declines. It’s crucial to recognize, however, that shorting can be riskier and more complex than simply purchasing shares. Engaging in short selling requires a margin account to borrow shares from your broker, which entails paying interest and returning borrowed shares.

Here’s how it works: If you identify a Stock that you believe will decline, you can “borrow” shares from your broker and sell them in the marketplace. Your aim is to repurchase those shares at a lower price, return them to the broker, and pocket the difference as profit.

In essence, you still follow the basic principle of buying low and selling high, just in reverse. For instance, if you borrow shares of XYZ Stock and sell them for $20 each, then insightfully buy them back when the price drops to $15, you gain $5 per share as profit—less any associated fees or interest.

The inherent risk lies in the possibility that the Stock could rise instead. In such cases, losses can escalate rapidly. The maximum profit achievable from shorting is capped at 100% if the Stock price eventually falls to $0. However, the potential losses from a rising stock price could theoretically be unlimited.

When this occurs, short sellers often “cover” by purchasing shares back at a loss. You might also receive a “margin call” from your broker, compelling you to return the borrowed shares.

Alternatively, you can hedge your portfolio without directly shorting a Stock. One method is investing in stocks that tend to perform well during recessions or market downturns. Additionally, consider inverse exchange-traded funds (ETFs) as a hedge strategy. These funds are designed to move opposite to the market, such as the ProShares Short S&P 500 ETF (SH), which would rise when the S&P 500 declines.

To conclude, here’s a thought from Eric on the concept of hedging:

Investors shouldn’t feel pressured to take huge risks every time they invest. Sometimes, it’s more prudent to aim for smaller, consistent gains. In tough periods, strategic short sales or portfolio hedges can yield results when conventional investments falter.

Short sales can generate profits from declining stock prices, serving as a potential hedge for regular portfolios. However, while they carry risks, so do traditional stock investments during a bear market.

For those curious about navigating the intricate world of hedging that can profit directly from falling Stock prices, don’t miss the final story in this month’s edition.

On the other hand, if advanced hedging strategies aren’t appealing, that’s alright too. Many investors prefer not to speculate against companies, or to deal with the potential losses associated with an increasing stock price.

There are other safer hedging approaches, such as investing in gold stocks, oil stocks, or inverse funds like the ProShares Short 20+ Year Treasury ETF (TBF).

While these indirect hedges do not automatically increase when the market falls, recent weeks have shown they can produce significant gains during times of market volatility.

Strategy #5: Build a Crisis-Proof Portfolio in Advance

Experience from the last three decades illustrates the necessity for investors to “harden” their finances and investment strategies.

We’ve covered various crises, from the historic pandemic to the Great Recession of 2007-’08 and the 2000 tech bubble burst. In today’s world, cybersecurity threats, financial fraud, and geopolitical conflicts add to market volatility.

Market drops occur with alarming frequency, driven by recessions, wars, and pandemics, among other factors. Hence, constructing and sustaining a resilient financial framework is among the wisest strategies for wealth protection.

InvestorPlace, one of the largest investment research firms globally, selects and recommends numerous stocks and investments annually. However, robust investment ideas lack value if they don’t integrate into a well-rounded portfolio that generates returns during boons while safeguarding assets in downturns.

In fact, asset allocation may be more critical than stock picking for successful wealth creation.

Asset allocation records how much of your wealth you distribute across various asset classes—stocks, bonds, cash, commodities, precious metals, and real estate. A diversified asset mix can limit exposure to significant declines in any single investment.

Crafting a Resilient Investment Strategy for Your Future

There’s no “one size fits all” asset allocation strategy that suits everyone.

When deciding on the right “mix” of investments, consider factors such as your age, risk tolerance, and financial goals, potentially with the assistance of a financial advisor. For instance, a 50-year-old paying college tuition for three children will approach asset allocation differently than a 32-year-old without family responsibilities.

Nevertheless, most investors share common goals. We generally seek a diversified portfolio that generates income passively. We strive to purchase high-quality assets at bargain prices and minimize the negative impacts of any economic downturn.

Achieving these goals requires diversification across various asset classes, including private businesses, stocks, bonds, real estate, cash, precious metals, and insurance.

Key Considerations for Asset Allocation

As you determine your ideal asset allocation, keep the following factors in mind:

For younger investors comfortable with stock market volatility, an exposure ranging from 50%-75% in stocks may be appropriate. A young person investing a significant portion of their wealth in stocks with a long-term perspective can see substantial gains, but they should be prepared for market fluctuations.

Conversely, older investors or those averse to risk might consider allocating as much as 75%-85% of their wealth to cash and bonds. As investment horizons shorten closer to retirement, the focus typically shifts from growth to wealth preservation, necessitating a conservative approach.

Regardless of your chosen allocation, avoid overconcentration in a single asset or class as it could expose your portfolio to unforeseen market crashes. A well-rounded strategy enhances your wealth’s resistance to crises and inflation.

Stay Grounded in Proven Investment Principles

Preparing your portfolio for a recession involves embracing strategies tailored to current market conditions. However, it also necessitates adherence to enduring principles that have stood the test of economic trials, including recessions and bear markets.

Maintain an emergency cash fund and consider your living expenses. Diversifying your portfolio across multiple asset classes can help minimize the risk of significant losses; never rely too heavily on any particular asset or investment within an asset class.

Incorporating dividends into your investments can provide both income and stability. When investing in stocks, prioritize a long-term perspective as short-term fluctuations can be unpredictable.

Emotionless investing is crucial. The market is known for panic sell-offs, and it can be tempting to react impulsively when you see stock prices decline. Selling out of fear is typically unwise, particularly if the long-term outlook for your investments remains unchanged.

Above all, remember that both recessions and bear markets are temporary. They can be challenging and stressful, but the market and economy will eventually recover. The inherent bias of capitalism favors growth, influencing the market’s long-term trajectory upwards.

Build a strategic portfolio.

Avoid catastrophic losses.

Practice patience.

If you can adhere to these principles, you will be well-equipped to navigate a recession and other adverse market conditions, while continuing on your journey toward wealth and financial independence.