Bank of America: Navigating Market Trends Amid Interest Rate Cuts

As the U.S. presidential election heats up and the Federal Reserve prepares to cut interest rates, investors are closely watching stock market reactions. In this context, Bank of America (BAC) is capturing attention.

Strong Trading Revenues Bolster Performance

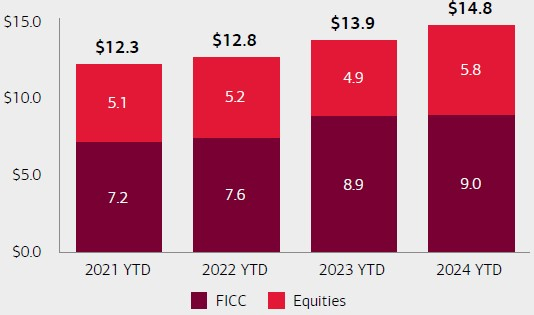

Historically, equity markets have thrived during election years. The upcoming presidential polls are expected to cause increased volatility, likely benefiting BAC’s trading income. Since 2022, the bank has shown consistent growth in sales and trading revenues.

Bank of America’s trading business is on track for a strong year. In the first three quarters of 2024, sales and trading revenues (excluding DVA) increased by 7% year-over-year, reaching $14.8 billion. This growth was largely driven by robust equity trading activities, a trend expected to persist in the current quarter.

Total Sales and Trading Revenue (excl. net DVA)

Image Source: Bank of America Corp.

Impact of Interest Rate Cuts on Bank of America

The anticipated interest rate cut from the U.S. central bank at the Nov. 6-7 FOMC meeting is expected to be advantageous for Bank of America, which has faced challenges from soaring interest rates. During the pandemic, the bank acquired large amounts of long-term Treasuries and mortgage bonds at low rates. However, since the Fed began raising rates in early 2022, the bank has been dealing with significant paper losses, affecting its net interest income (NII).

Though NII hit a low point in the second quarter of 2024, it rebounded in the third quarter. Management forecasts that this metric will rise in the fourth quarter, expecting two additional rate cuts and moderate hikes in loans and deposits.

Net Interest Income

Image Source: Bank of America Corp.

BAC anticipates NII growth into next year, despite some expected fluctuations due to the Fed’s lowering rates. Meanwhile, its competitor, JPMorgan (JPM), may see a decrease in NII for 2025 as a result of these cuts.

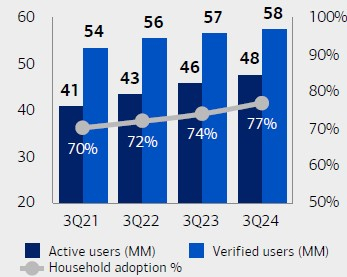

Expansion and Digital Innovations at BAC

Bank of America is aggressively expanding its branch network across the U.S. as part of a broader strategy to strengthen customer relationships and enter new markets. The bank plans to open over 165 financial centers by the end of 2026, with nearly 40 slated to open this year.

This expansion strategy follows the bank’s plans announced in June 2023 to establish a presence in nine new markets, including Omaha, Boise, and Milwaukee.

The bank’s investment in new centers and its move into new areas reflect a broader trend in the industry towards optimizing branch networks. This approach aims to enhance customer relationships and unlock fresh business opportunities. In a competitive banking landscape, effectively combining digital solutions with in-person services provides Bank of America with a strategic advantage.

BAC’s consumer mobile banking app is already benefiting over 47 million active users, while about 23 million people use Zelle, a popular money transfer service.

Digital Adoption

Image Source: Bank of America Corp.

Almost 87% of BAC’s global banking clients are digitally active, and the company’s CashPro platform uses AI to enhance service efficiency. Bank of America plans to continue investing heavily in technology to attract and retain clients and increase cross-selling opportunities.

Strong Balance Sheet and Shareholder Rewards

Bank of America holds a robust liquidity position. As of September 30, 2024, its average global liquidity sources amounted to $947 billion. The bank also enjoys investment-grade long-term credit ratings of A1, A-, and AA- from Moody’s, S&P Global Ratings, and Fitch Ratings, respectively, facilitating easy access to debt markets.

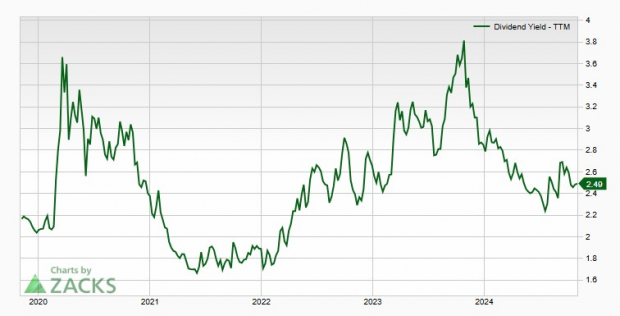

Returning value to shareholders, Bank of America raised its quarterly dividend by 8% to 26 cents per share after passing the 2024 stress test. Over the past five years, the bank has increased dividends four times, achieving an annualized growth rate of 8.4%. Currently, the company’s payout ratio stands at 33% of earnings.

Dividend Yield

Image Source: Zacks Investment Research

In July, the company authorized a $25 billion stock repurchase program effective August 1, to replace the previous program. As of September 30, 2024, approximately $22.4 billion of buyback authority remains available.

Should You Hold on to BAC Stock?

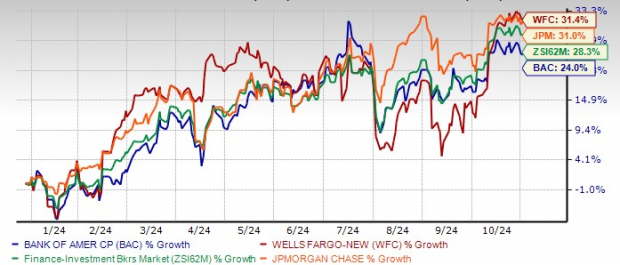

After a strong start to 2024, where BAC stock ranked among the top five banks on the S&P 500 Index, it appears to have lost some momentum. So far this year, BAC shares have risen 24%, while the banking industry as a whole has increased by 28.3%. Additionally, BAC’s stock is trading below both JPMorgan and Wells Fargo (WFC).

YTD Price Performance

Image Source: Zacks Investment Research

Currently, Bank of America stock has a trailing price-to-tangible book (P/TB) ratio of 1.63X, significantly lower than the industry’s 2.61X. This indicates that the stock is relatively inexpensive at present.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

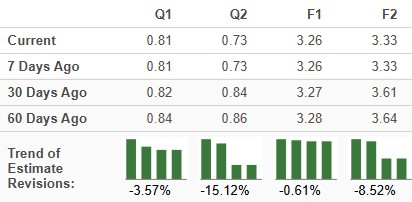

BAC’s P/TB ratio is more appealing compared to JPM’s 2.46X and slightly below WFC’s 1.66X. Analysts, however, are showing caution regarding Bank of America’s outlook. Over the past month, the Zacks Consensus Estimate for earnings in both 2024 and 2025 has trended down.

Estimate Revision Trend

Image Source: Zacks Investment Research

This trend indicates a bearish sentiment among analysts regarding the bank’s future earnings.

Despite this, Bank of America’s global presence, diverse revenue streams, branch expansions, and advancements in technology provide a solid foundation for growth. The upcoming clarity on the Fed’s interest rate cuts and Bac’s current valuation suggest that the stock might be worth considering. However, investors should remain cautious of potential challenges, such as high funding costs and increased regulatory capital requirements under Basel 3. Additionally, the pessimistic outlook from analysts warrants attention.

Investors need to weigh these factors carefully against their risk tolerance before making decisions regarding BAC stock. For those already holding this Zacks Rank #3 (Hold) stock, it may be a good idea to maintain ownership, as it is expected to maintain stability in the long run. You can access the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners, but this one could greatly surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging, which jumped +129.6% in just over 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Bank of America Corporation (BAC): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.