Micron Technology Set to Announce Strong Earnings Amid AI Boom

Micron Technology, Inc. (MU) is preparing to release its first-quarter fiscal 2025 results following the market close on December 18.

The company anticipates first-quarter revenues to be around $8.7 billion, with a possible variation of +/- $200 million. This projection aligns closely with the Zacks Consensus Estimate of $8.71 billion, reflecting a significant year-over-year growth rate of 84.3%.

Keep updated with all quarterly announcements: Check out the Zacks Earnings Calendar.

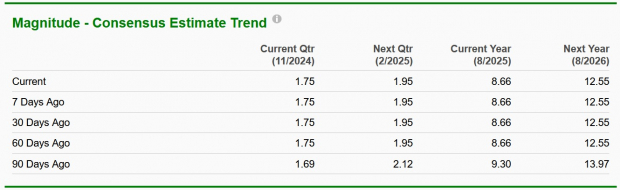

In terms of earnings, Micron expects adjusted earnings of $1.74 (+/- 8 cents). The consensus estimate for earnings has remained steady at $1.75 per share over the past two months, marking a substantial turnaround from a loss of 95 cents per share in the same quarter last year.

Image Source: Zacks Investment Research

Micron has outperformed the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 72.7%.

Micron Technology’s Price and EPS Surprise

Now, let’s review the factors that may influence this upcoming announcement.

Key Drivers for Micron’s Upcoming Results

Micron’s performance in the first quarter is expected to benefit significantly from the rising demand for memory chips, particularly due to the increasing deployment of GPU-enabled artificial intelligence (AI) servers. As data center providers enhance their capabilities to accommodate generative AI and large language models, memory chips have emerged as critical components. This growing demand for AI technologies is likely to boost Micron’s revenues for the quarter.

Another encouraging trend is the improving balance between supply and demand in the memory chip sector. Micron previously faced challenges stemming from excess inventory, which adversely affected its financial performance. However, conditions have notably improved over the past year, leading to better prices for its main products—DRAM and NAND chips.

The Zacks Consensus Estimate suggests DRAM revenues for the first quarter could reach $5.92 billion, showcasing an impressive 91% growth year-over-year. Similarly, NAND revenues are projected to hit $2.6 billion, reflecting a remarkable 111.5% increase compared to the previous year. These projections underscore Micron’s ability to leverage favorable market conditions.

Yet, challenges remain. Inflation and ongoing economic uncertainties may hinder consumer spending, potentially leading to diminished demand for memory chips in vital sectors like smartphones and personal computers. Furthermore, Micron’s significant dependence on the Chinese market poses risks, especially amid current U.S.-China trade tensions. Margins could also come under pressure due to a higher sales mix of lower-margin NAND products and limited progress in cost-saving measures.

Micron Stock Performance & Valuation

So far this year (YTD), Micron shares have risen 19.6%, but this growth is less than the Zacks Computer and Technology sector’s 34.5% increase. When compared to other semiconductor giants like NVIDIA (NVDA), Marvell Technologies (MRVL), and Texas Instruments (TXN), Micron has underperformed, as these companies have posted YTD gains of 181.3%, 84.6%, and 12.4%, respectively.

YTD Price Return Performance

Image Source: Zacks Investment Research

Currently, it’s essential to assess Micron’s value proposition for investors. MU stock trades at a discount with a forward 12-month price-to-sales ratio of 2.79X, compared to the broader tech sector’s ratio of 6.28X.

Image Source: Zacks Investment Research

Investment Outlook for MU Stock

Micron is benefiting from favorable market dynamics, effective sales strategies, and solid performance across various segments. The enhancement in data center inventory levels, alongside stability in markets like automotive and industrial, has improved demand conditions, bolstering the company’s revenue growth.

Looking ahead, Micron expects a positive pricing environment for DRAM and NAND chips, which could further amplify revenue opportunities. The spike in demand for AI servers has created a tight supply for advanced DRAM and NAND, setting the stage for potential price hikes. Additionally, the rising establishment of 5G in Internet of Things (IoT) and wireless infrastructure will escalate the demand for Micron’s memory and storage solutions, strengthening its market position.

However, Micron must navigate several hurdles. The ongoing U.S.-China trade tensions remain significant risk factors. With the company’s considerable exposure to the Chinese market, any escalation in tensions could disrupt its supply chain or lead to new tariffs, affecting its margins. Moreover, while the pricing outlook for memory chips appears positive, Micron’s reliance on lower-margin NAND products and slow advancements in manufacturing efficiencies could hinder profitability growth in the near term.

The outlook for Micron is encouraging, but it will need to address these challenges effectively to maintain its growth trajectory.

Conclusion: Hold onto MU Stock for Now

Micron finds itself in a robust position to achieve sustainable growth, driven by increasing demand for memory chips in AI servers and improved market conditions. Nonetheless, obstacles such as trade tensions and profit margin pressures suggest that expectations for a major breakout in the near future should be tempered.

In light of its attractive valuation and strengthening fundamentals, holding Micron stock currently seems advisable. The company possesses significant potential, but investors would be wise to await developments in the macroeconomic landscape and trade relations prior to making bold decisions. For now, patience will be essential as the company approaches its first-quarter earnings report. As of now, Micron carries a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Presents Top 10 Stocks for 2025

Interested in discovering our ten top picks for 2025?

Historical performance suggests these stocks could yield impressive returns.

Since 2012, when our Director of Research Sheraz Mian assumed management of the portfolio, the Zacks Top 10 Stocks portfolio has generated returns exceeding +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Presently, Sheraz is analyzing 4,400 companies to select the best 10 stocks for 2025. Don’t miss the chance to invest in these selections when they are unveiled on January 2.

Stay updated on Zacks Investment Research’s latest recommendations. You can currently download “5 Stocks Set to Double.” Click to access this free report:

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.