Tyson Foods Faces Challenges Despite Growth Opportunities

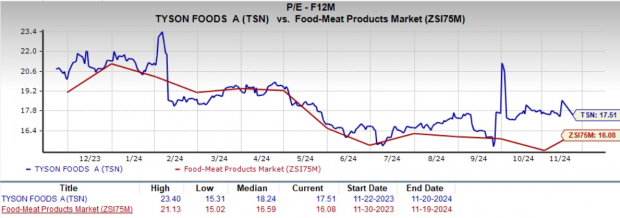

Tyson Foods, Inc. TSN is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 17.51, which is higher than the industry average of 16.08. This premium valuation reflects the market’s confidence in the company’s potential to deliver strong profit growth. However, it remains to be seen if the company can report results that justify such a premium.

Image Source: Zacks Investment Research

Shares of Tyson Foods have witnessed modest performance, with only a 0.4% gain over the past three months. In contrast, the industry has grown by 1.2% and the S&P 500 has risen by 6.4%. The high P/E ratio combined with stock underperformance raises caution, yet the company’s growth strategies may still attract investors.

Challenges Ahead for Tyson Foods

Tyson Foods, like many global companies, grapples with macroeconomic uncertainties that could affect demand for protein products. Issues such as volatile currency exchange rates, fluctuating commodity prices, and potential decreases in consumer spending pose risks to both international and domestic operations.

The Beef segment is facing substantial challenges, primarily due to reduced profit margins and tight cattle supplies. The United States Department of Agriculture (USDA) projects a nearly 2% decline in domestic beef production for fiscal 2025. Tyson Foods expects a loss of between $400 million and $200 million in this segment, similar to fiscal 2024 outcomes.

During the fourth quarter of fiscal 2024, profitability in the Beef segment remained limited, even with a 4.6% increase in revenue. Despite operational efficiencies like cost reductions and improved yields, about 85% of the segment’s performance is subject to uncontrollable market dynamics, including cattle availability and price volatility. These ongoing challenges signal continued difficulty in achieving recovery in the Beef segment.

The Pork segment faces its own hurdles, primarily due to pricing pressures in a constrained market. In the fourth quarter, revenues dropped by 3.7%, attributed to lower prices on dropped credit items. Although Tyson Foods has made strides in optimizing its pork operations and expanding its portfolio, unfavorable market conditions could counteract these gains and potentially stall momentum.

Despite a year-over-year increase of $270 million in adjusted operating income (AOI) in fiscal 2024, the company anticipates flat profitability for fiscal 2025, with AOI expected between $100 million and $200 million. This limited potential indicates the risk of tightening profit margins in a competitive protein market.

Tyson’s Growth Strategy Remains Strong

Tyson Foods’ diverse protein portfolio is key to navigating market fluctuations effectively. While the company deals with near-term challenges in beef and pork, its strong performances in chicken and prepared foods highlight the resilience of its multi-protein strategy. Further, Tyson plans to enhance its international operations by optimizing capacity utilization and aligning with regional market needs.

The company’s growth strategy centers on operational excellence, customer focus, and sustainability. Continuous improvement initiatives ensure productivity and efficiency across all segments, fostered by strong supply-chain management. A commitment to understanding customer preferences drives Tyson’s consumer focus, while sustainability efforts reflect its dedication to ethical sourcing and responsible practices.

Tyson’s fiscal 2024 showed a turnaround, with AOI reaching $1.8 billion—almost double from fiscal 2023. In the fourth quarter, AOI surged to $512 million from $236 million a year earlier, marking the company’s strongest quarterly performance in two years. Enhanced operational efficiency and prudent cost management have contributed to this positive outcome.

Looking Ahead for TSN

For fiscal 2025, Tyson Foods forecasts flat or slightly declining net sales, with prepared foods and chicken volume growth potentially offsetting decreases in beef and pork. Particularly, beef volumes face risks from supply restrictions, while pork may encounter challenges due to tighter profit margins despite operational innovations. This stagnation in volume growth could affect investor confidence in the company’s ability to expand revenues.

However, the fiscal 2025 AOI is projected between $1.8 billion and $2.2 billion, suggesting a nearly 10% increase at the midpoint, driven by strength in prepared foods and chicken. This positive outlook is further supported by operational excellence, a strategic brand focus, and solid free cash flow generation.

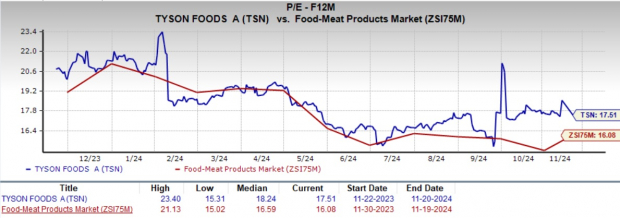

Analysts seem optimistic about Tyson Foods, as estimates have been revised upward. The Zacks Consensus Estimate for earnings per share for the current and next fiscal year has risen in the past week, indicating anticipated growth rates of 12.9% and 22.8%, respectively.

Image Source: Zacks Investment Research

Guidance for TSN Investors

The profit growth potential for Tyson Foods, supported by its diverse protein portfolio and strategic initiatives, is somewhat tempered by challenges in key segments like beef and pork. While operational efficiencies and sustainability efforts enhance TSN’s long-term outlook, investors should consider the immediate challenges ahead. Balancing Tyson Foods’ robust strategic framework against market uncertainties will be crucial for evaluating whether its premium valuation is justified. The company holds a Zacks Rank #3 (Hold).

Top Consumer Staple Stock Picks

Ingredion Incorporated INGR manufactures

Top Stocks to Watch: Ingredion, Freshpet, and McCormick Show Promising Growth

Ingredion Incorporated (INGR), a leader in sweeteners, starches, and nutrition ingredients derived from corn, holds a Zacks Rank of #1 (Strong Buy). With an average trailing four-quarter earnings surprise of 9.5%, the company’s financial outlook appears solid. The Zacks Consensus Estimate predicts a 12.5% growth in earnings for this financial year compared to last year.

Freshpet Inc. (FRPT) is recognized for manufacturing and distributing natural meals and treats for pets. The company enjoys a Zacks Rank of #2 (Buy) and boasts a remarkable trailing four-quarter earnings surprise of 144.5% on average. This year, Freshpet’s sales and earnings are expected to grow by 27.3% and 224.3%, respectively, compared to last year’s figures.

McCormick & Company (MKC) produces a wide variety of spices, seasoning mixes, and condiments. Currently rated #2 by Zacks, it has a trailing four-quarter earnings surprise of 13.8%. The forecast for McCormick’s fiscal year indicates sales and earnings growth of 0.6% and 8.2%, respectively, when compared to the previous year.

Expert Picks Point to a “Best Choice” for Major Returns

Among various stocks, five Zacks experts have each identified a favorite stock anticipated to increase by 100% or more in the coming months. Director of Research Sheraz Mian has handpicked one stock projected to have the most significant upside.

This company is targeting millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter. A recent price dip could present a great opportunity to invest. While not every elite pick leads to success, this particular stock might outperform others like Nano-X Imaging, which soared by 129.6% within just nine months.

Free: Discover Our Top Stock and Additional Picks

Interested in Zacks Investment Research recommendations? You can currently download “5 Stocks Set to Double.” Click to receive this complimentary report.

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Freshpet, Inc. (FRPT): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.