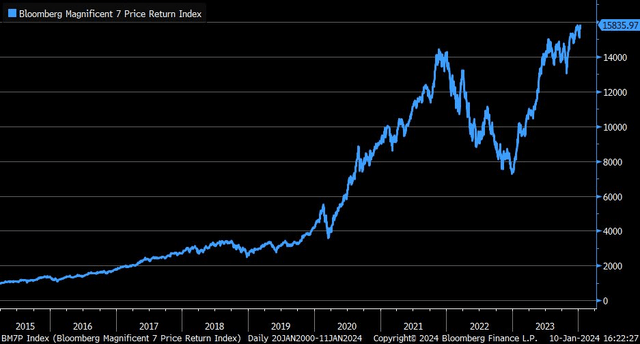

As we ease into 2024, the tech stocks and AI theme have not taken a back seat to value, contrary to some expectations. What worked during the first seven months of 2023, such as the

Magnificent Seven and AI equities, has returned to favor. With attention-grabbing bitcoin ETFs making headlines and AI still capturing the eyes of investors, shares of Super Micro Computer (

NASDAQ:SMCI

) have rallied sharply following a period of consolidation.

This stock is now upgraded from a hold to a buy. The valuation has improved from last year as earnings growth has verified well. Moreover, the technical situation looks better as the stock encroaches on all-time highs. However, sales growth risks are a concern.

Mag 7 Climbs to New Highs Following A Pause in the Growth Theme

According to Seeking Alpha, SMCI develops and manufactures high-performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

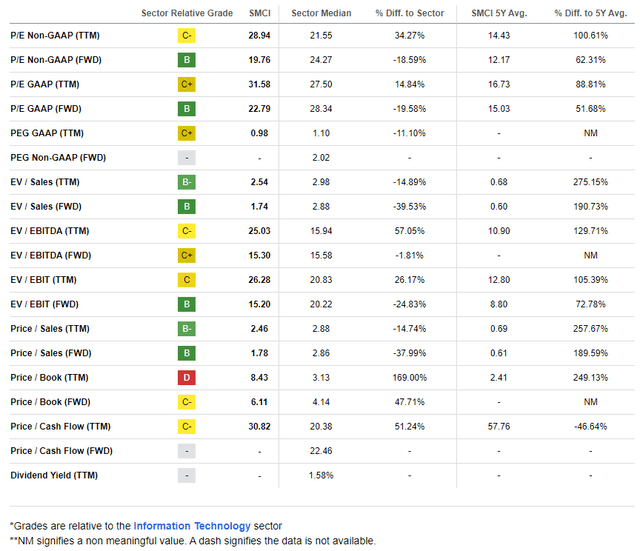

The California-based $19.1 billion market cap Technology Hardware, Storage, and Peripherals industry company within the Information Technology sector trades at a near-market 19.8 forward price-to-earnings multiple, a significant discount to the Information Technology sector’s P/E, and does not pay a dividend. Implied volatility ahead of its earnings report due out later this month is high at 78%, and short interest on the stock is elevated at 9.5% as of January 10, 2024.

It was a somewhat tough few months following SMCI’s stock price surge to near $360 last summer. Recall late last year there was a slew of negative headlines. First, on December 1, 2024, the company announced a $524 million securities

offering comprised of 2.1 million shares of common stock at a price of $262.

SMCI dipped following that issuance news, and then came the headline that both Super Micro’s CEO Charles Liang and CFO David Weigand

sold significant amounts of stock. Monitoring insider transaction trends is a key part of forming an investment outlook, and selling, while not inherently bearish, can cast clouds on a stock that has run up.

Finally, analysts at Susquehanna

cut their rating on SMCI to negative, citing concerns that margin pressures are intensifying amid heightened competition and rising costs for memory and storage. The stock is up more than 30% since that call, however. Despite these seemingly bearish catalysts, price action has told a different story.

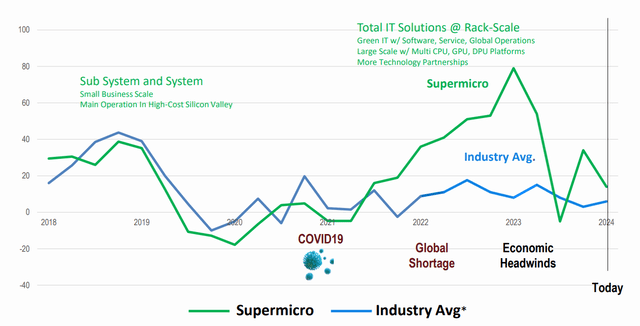

SMCI Growth Versus Its Industry

Bigger picture, Super Micro

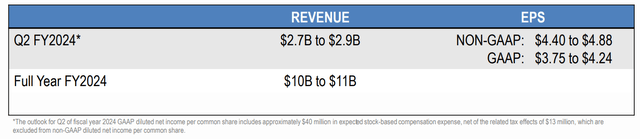

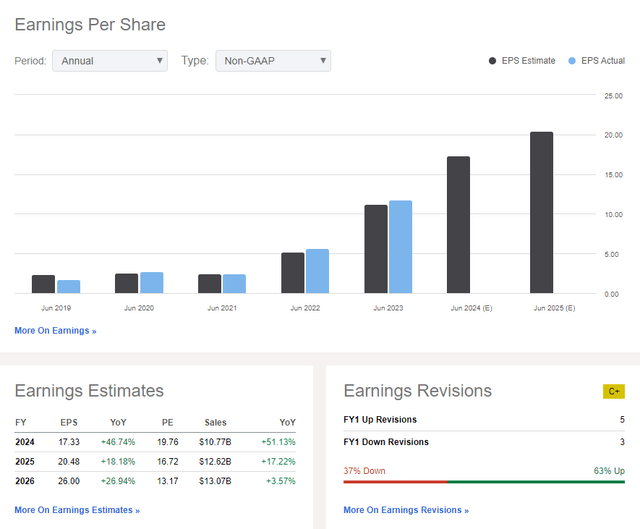

reported a strong set of Q1 2024 results back in early November last year. Non-GAAP EPS of $3.43 topped the Wall Street consensus estimate of $3.25 while revenue of $2.1 billion, up 15% from year-ago levels, was a modest beat. The management sees FY 2024 net sales between $2.7 billion and $2.9 billion, with Q2 2024 non-GAAP EPS in the $4.40 to $4.88 range.

SMCI: Guidance Released in November

On

valuation, with current consensus EPS forecasts above $17 this year and above $20 for the out year, the stock is not all that expensive. The significant risk is that sales growth is slowing from a high 51% rate this year to just 4% by 2026. Thus, I assert that a very high earnings multiple is not warranted. Rather, if we apply a 20 multiple on $18.50 of non-GAAP EPS over the coming 12 months, then shares should trade near $370 fundamentally. That is up about 10% from my

previous outlook given that

earnings growth has materialized. There are upside risks to that valuation, and a strong technical situation warrants an upgrade.

SMCI: Rising EPS Trends, Sales Growth Slowing

SMCI: A Forward P/E Under 20

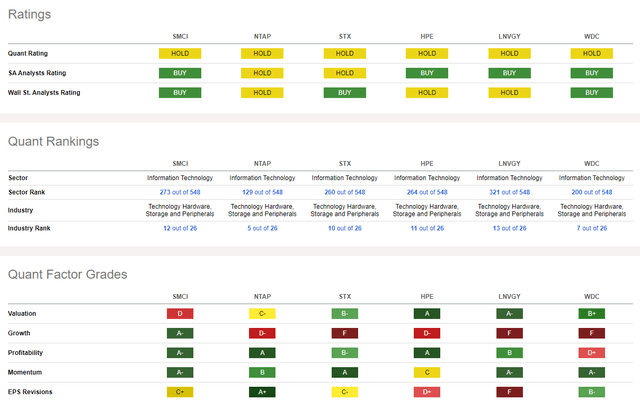

Compared to SMCI’s

peers, the company sports very healthy growth metrics, while the valuation view is not as sanguine. I found that a high price-to-book ratio on SMCI may be the culprit bringing down the valuation rating (a price-to-book ratio is not an especially useful metric for a high-growth tech company, however).

Still,

profitability trends are robust while share-price

momentum with SMCI is stout – I will detail that later. Finally,

EPS revisions have been lackluster lately, but another earnings beat later this month, should it occur, would likely cause some bearish analysts to rethink their outlook. SMCI has topped bottom-line estimates in 11 of the past 12 quarters.

Competitor Analysis

Traders have priced in a high 9.9% implied move after the January 30 earnings report, according to Option Research & Technology Services (ORATS).

Earnings History: 11 Out of 12 Beats, 9.9% Implied

SMCI Upgraded to Buy on Solid Earnings Growth and Improved Technicals

Corporate Event Risk Calendar

The company holds its annual virtual shareholders’ meeting on Monday, January 22 and the management team is slated to present at the Needham 26th Annual Growth Conference 2024 in New York from January 11 through 19. It’s not surprising why implied volatility is so high given this set of key events on tap.

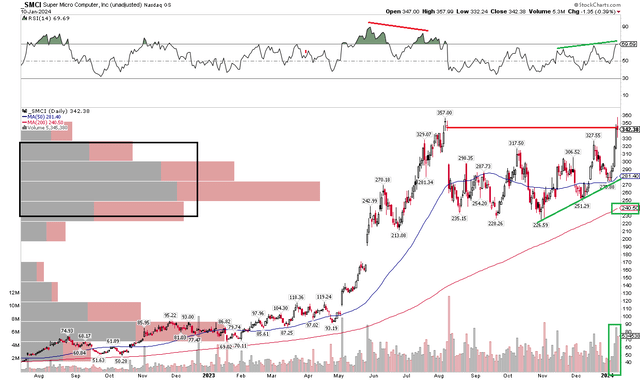

The Technical Take

SMCI finally made a move back towards all-time highs. Earlier this week, shares approached the $357 peak from early August, filling a gap that took place shortly after the market’s near-term peak in late July. Amid the S&P 500’s and Nasdaq’s Q3-Q4 correction, SMCI fell to key support around $230 – a level highlighted in previous analyses. Given a significant churn in the $230 to $330 range, an ample amount of shares traded now exists in that zone, which is bullish from a technical point of view now that price has rallied through it. That range should act as a zone of potential buyers.

What is also noteworthy about SMCI today, something that could not have been said of the high-growth stock back in Q2 2023, is that the RSI momentum gauge at the top of the chart is making new highs along with price (relative to the last few months). There was a bearish RSI divergence last summer, by contrast. Moreover, it is observed that volume has ticked up along with the share-price appreciation lately. In the big picture, with a rising long-term 200-day moving average, the bulls appear to be in control. SMCI has continued to hold an uptrend support line, strengthening the bullish technical thesis.

Overall, there is a technical upside ahead and support may be found near $280 with long-term support in the $225 to $235 area. A bullish breakout above $357 would portend a technical target of near $490 based on the height of the recent consolidation pattern ($357-$227).

SMCI: Improved RSI Momentum, Shares Testing All-Time Highs After A Consolidation

The Bottom Line

SMCI is upgraded from a hold to a buy on solid earnings growth verification and improved technicals. Momentum has ticked up, and a key set of events is on tap for the balance of the month.