Super Micro Computer Faces Severe Financial Troubles Amid Auditor Resignation

Super Micro Computer (NASDAQ: SMCI) is experiencing a significant downturn. Following a critical short report that raised issues about its accounting practices, the company’s auditor has resigned, leaving it unable to file its annual report on time. Once a favorite in the AI market, red flags are now popping up for this stock, prompting investors to make a swift exit.

As of now, Super Micro Computer’s stock has plummeted 82% from its earlier highs this year, resulting in billions of dollars in lost shareholder value. Is the lowest point now? Or is there a looming risk of accounting fraud?

Auditor Resignation Raises Concerns about Financial Accountability

Super Micro Computer’s stock reached its peak in March before experiencing a normal price correction after a staggering 250% increase in just a few months. The company was celebrated for its role in the AI spending boom, showcasing impressive revenue growth by constructing data centers for third-party clients, utilizing advanced computer chips from companies like Nvidia.

However, questions about this growth emerged on August 27, when well-known short-seller Hindenburg Research published a report alleging accounting manipulation and self-dealing involving executive family members, plus accusations of circumventing U.S. foreign sanctions by selling to restricted countries. With Hindenburg’s strong history of accurate assessments, Super Micro Computer’s stock began to decline sharply in response.

The situation worsened by the end of October when the company’s auditor, Ernst & Young, resigned, opting not to associate with management’s financial statements. This rare and serious move raises significant concerns, especially considering auditors often favor leniency. For example, Ernst & Young had previously approved the financial statements of Wirecard, a company later implicated in a major fraud case. Adding to the turmoil, Super Micro Computer has postponed its quarterly filing with the Securities and Exchange Commission (SEC), causing further drops in stock value.

Delisting Risks and Slowing Business Performance

Due to the lack of SEC filings, Super Micro Computer is at risk of being delisted from the Nasdaq exchange. The company has 180 days to file its overdue annual report after submitting a compliance plan to Nasdaq regulators. Failure to do so could lead to its removal from the exchange.

Aside from accounting and filing issues, the company’s business appears to be stagnating. Projections for revenue in the quarter ending in September are now around $5.9 billion, down from previous estimates of $6 billion to $7 billion. Additionally, gross margin is a concern; it has fallen to 14% over the last 12 months, down from 18% in 2023, which could significantly hamper Super Micro Computer’s ability to generate cash flow for investors.

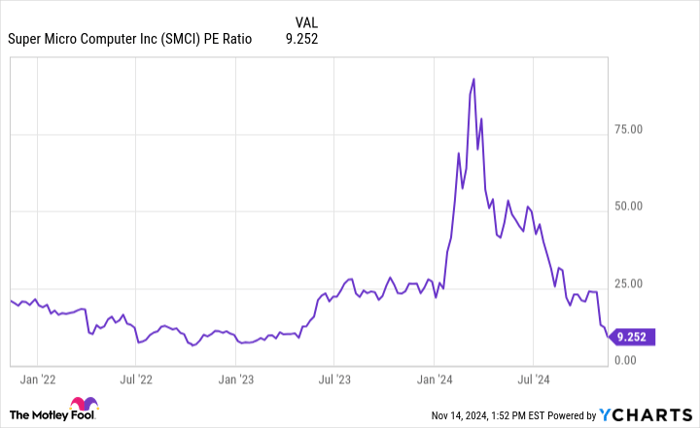

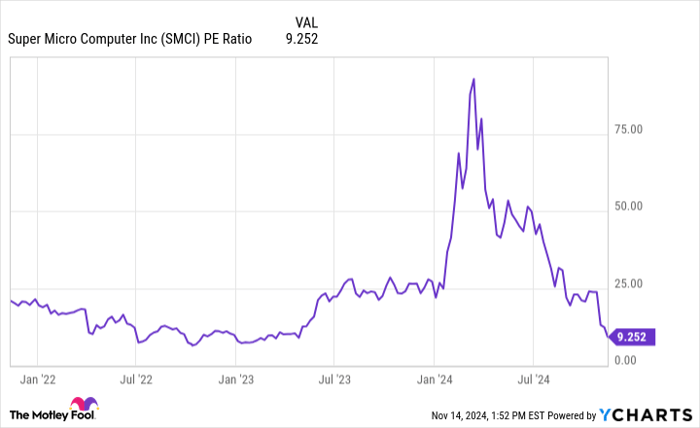

SMCI PE Ratio data by YCharts

Is It Time to Invest or Avoid?

Based on current figures, Super Micro Computer’s stock may appear attractively priced, boasting a trailing price-to-earnings ratio (P/E) of 9, which is low for a company expected to benefit from the AI sector.

However, doubts about the accuracy of Super Micro Computer’s financials linger. With short-sellers questioning its legitimacy, an auditor resignation, and delays in financial reporting, these developments in a short span should certainly raise concerns.

The stock has surged over 700% in the past five years and now flaunts a single-digit P/E ratio. Yet, regardless of how inexpensive a stock might appear, investing becomes risky if the accuracy of the financial statements cannot be guaranteed. It might be wise to steer clear of purchasing Super Micro Computer stock at this moment, as it is possible for the price to continue to decline.

Missed Opportunities in the Stock Market

Have you ever felt you passed up on investing in the most successful stocks? If so, this might catch your attention.

Sometimes, our team of analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you think you have already missed out, now presents an opportunity to invest before it may be too late. The numbers provide compelling evidence:

- Amazon: If you invested $1,000 when we double-downed in 2010, you’d have $22,819!*

- Apple: If you invested $1,000 when we double-downed in 2008, you’d have $42,611!*

- Netflix: If you invested $1,000 when we double-downed in 2004, you’d have $444,355!*

Currently, we have “Double Down” alerts for three promising companies, and another opportunity like this may not come again soon.

Find out more about the three “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Brett Schafer has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.