Super Micro Computer Faces Troubling Stock Plunge Amid Accounting Controversy

Super Micro Computer (SMCI) has witnessed a dramatic 45% drop in its stock price this past week, erasing its gains for the entire year. This downturn marks a stark contrast from just a few months ago, when SMCI was celebrated as the top performer in the S&P 500 index. The stock soared by 320% from January to mid-March, driven by excitement over artificial intelligence (AI) advancements.

The skyrocketing demand for Super Micro’s efficient servers tailored for AI applications significantly boosted its stock performance, even surpassing tech giants like chipmaker Nvidia (NVDA) and data analytics firm Palantir Technologies (PLTR). This remarkable growth prompted a 10-for-1 stock split just a month ago.

SMCI’s rise was impressive enough to land it a spot in the S&P 500 earlier this year, quickly becoming the index’s top performer. However, following its recent decline, SMCI is now down 7% for the year.

Turmoil Surrounding a Growing Accounting Scandal

Investors have fled Super Micro Computer, primarily due to an escalating accounting scandal that has erased $55 billion from its market capitalization. The company risks being delisted from the Nasdaq exchange as a result.

A critical report from short-seller Hindenburg Research in August accused Super Micro of engaging in accounting manipulation. While the company denied these claims, it still postponed its annual report submission to the U.S. Securities and Exchange Commission (SEC), resulting in a compliance notification from Nasdaq.

The stock’s value plummeted further this past week after Super Micro announced the loss of its second auditor within two years. Ernst & Young resigned from its role just 17 months after taking over from Deloitte & Touche, citing its reluctance to be associated with the company’s financial statements.

Should You Consider SMCI Stock?

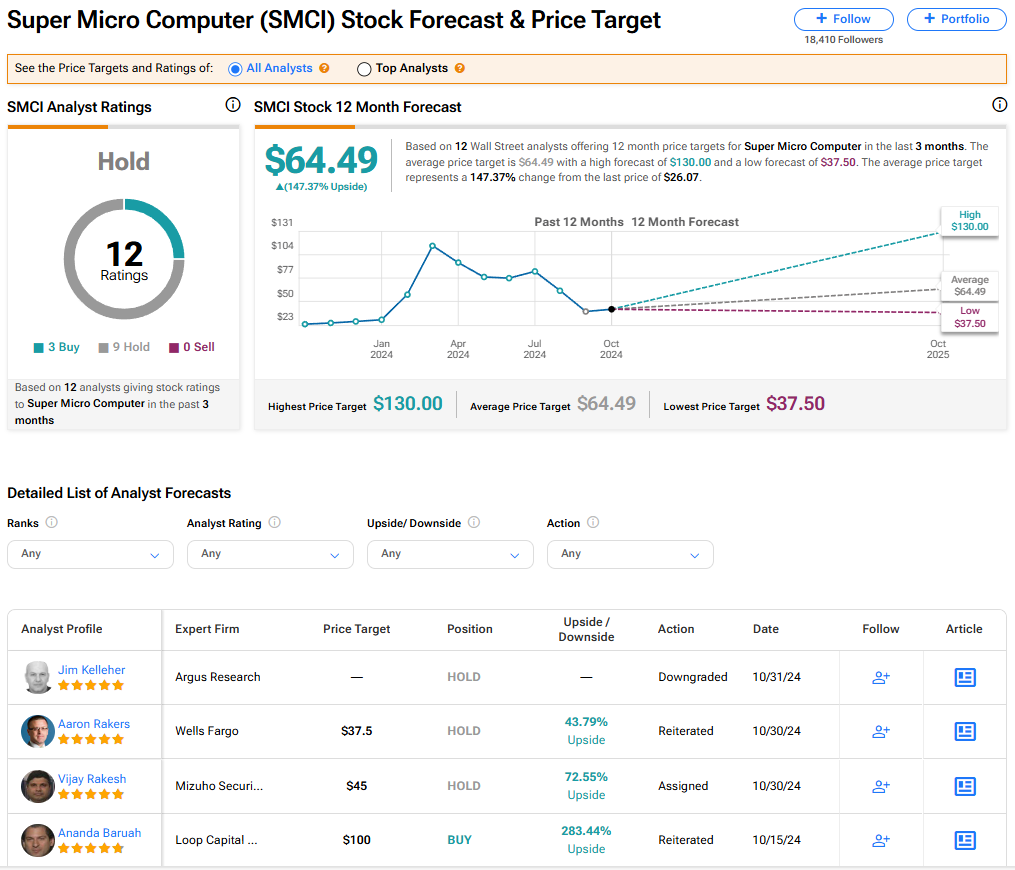

Among 12 Wall Street analysts, Super Micro Computer holds a consensus rating of Hold, with three Buy and nine Hold recommendations issued over the last three months. Interestingly, there are no Sell ratings on the stock. The average price target for SMCI stands at $64.49, suggesting a potential upside of 147.37% from its current value.

Read more analyst ratings on SMCI stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.