Semiconductor ETF Sees Strong Week with $318.4 Million Inflow

Notable Increase in Outstanding Units Signals Investor Interest

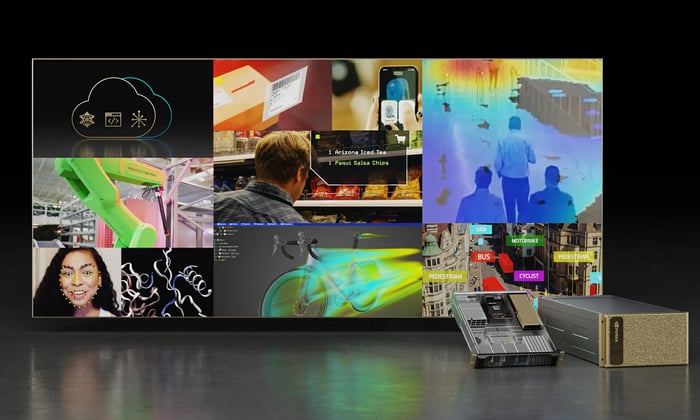

Today, the Semiconductor ETF (Symbol: SMH) is in the spotlight as it recorded an approximate inflow of $318.4 million. This represents a 1.3% rise in outstanding units, increasing from 99,541,874 to 100,791,874 over the past week.

The chart indicates that SMH has ranged between a low of $150.44 and a high of $283.07 in the past year. Currently, the ETF trades at $259.93, which allows for useful comparisons with its 200-day moving average. This analysis can help investors make informed decisions based on market trends.

Free Report: Top 8%+ Dividends (paid monthly)

Exchange traded funds (ETFs) function similarly to stocks but involve buying and selling “units.” These units can be created or destroyed in response to investor demand. Each week, we examine the changes in outstanding shares to identify ETFs experiencing significant inflows or outflows. A creation of new units typically necessitates purchasing the ETF’s underlying holdings, while an outflow involves selling those holdings. Thus, substantial shifts can influence the individual components within the ETFs.

![]() Click here to find out which 9 other ETFs had notable inflows »

Click here to find out which 9 other ETFs had notable inflows »

Also see:

- MLPs Hedge Funds Are Buying

- Institutional Holders of HYLN

- Institutional Holders of PXLV

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.