Strong Q3 Results Propel Tesla, Micron, and Arista Networks Stocks

Key Takeaways

- Tesla, Micron, and Arista Networks stocks all turned bullish after posting positive Q3 returns.

- Tesla’s profit margins are up; Micron and Arista are capitalizing on AI demand.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

The end of the 2024 Q3 earnings cycle is approaching, and it continues to deliver positive surprises. Analysts predict S&P 500 earnings will remain strong, marking a continuation of the recent growth trend.

Stay informed with all quarterly releases: See Zacks Earnings Calendar.

Several companies have delivered impressive results that have resulted in bullish stock movements after earnings reports. Notable names include Tesla TSLA, Micron MU, and Arista Networks ANET. Let’s delve into the details of their quarterly performances.

Tesla’s Profitability Recovers

The performance indicator that typically influences Tesla’s stock price has been its EV production/delivery numbers. However, recent focus has shifted towards profit margins. During this period, Tesla delivered approximately 463,000 EVs and produced nearly 470,000.

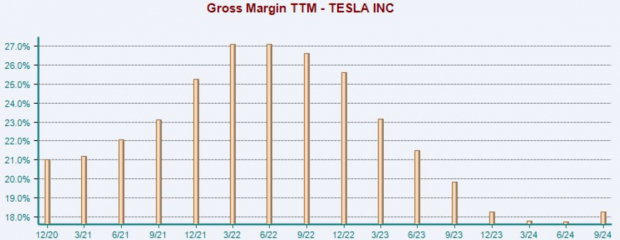

While these numbers remain significant, the standout feature of Tesla’s release was the expansion of profit margins. The company’s gross margin increased to 19.8%, compared to 17.9% from the same quarter last year. This upward trend in margins is noteworthy.

It’s essential to recognize that the figures in the chart are based on a trailing twelve-month period.

Image Source: Zacks Investment Research

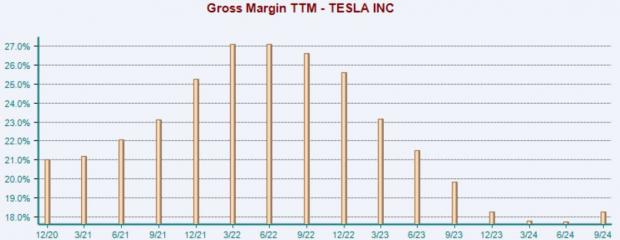

Despite remaining below the record highs of 2022, the latest improvement in margins is promising. This is bolstered by Tesla reporting its lowest-ever cost of goods sold (COGS) per vehicle this quarter. The positive assessment of profitability has pushed Tesla’s stock to a Zacks Rank #1 (Strong Buy), prompting analysts to raise their earnings per share (EPS) forecasts.

Image Source: Zacks Investment Research

This upward momentum is notable, especially in the context of the recent U.S. election, making Tesla a preferred choice for those looking to invest in EVs.

Micron Benefits From AI

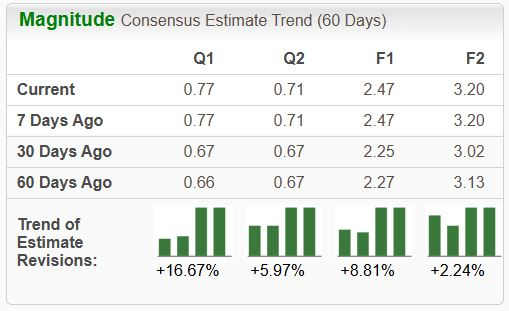

Micron set the stage for tech stocks in Q3 with an impressive EPS growth of 181% and a 93% rise in sales. This significant growth stemmed from strong demand for the company’s data center products.

The results highlight that the AI boom is not just a trend but a lasting force, with Micron also anticipating record profitability in its next quarterly release. The recovery in sales becomes evident in the chart below.

Image Source: Zacks Investment Research

Although the stock has given back much of its post-earnings gains due to broader weakness in the semiconductor sector, the outlook remains positive. Micron’s current price-to-sales ratio stands at 2.8X, below its five-year median of 2.9X and high of 4.9X.

Image Source: Zacks Investment Research

ANET Sales Continue Growing

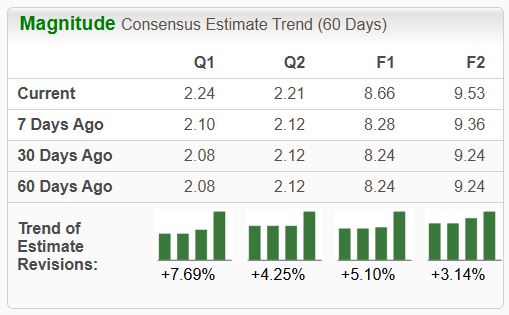

Arista Networks is also capitalizing on the AI surge, being a leader in networking solutions for large data centers and cloud environments. It currently holds a Zacks Rank #2 (Buy), and its earnings outlook has improved following recent results.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

CEO Jayshree Ullal has noted:

“Arista remains at the forefront of next-generation data centers across client-to-cloud and AI-focused environments.”

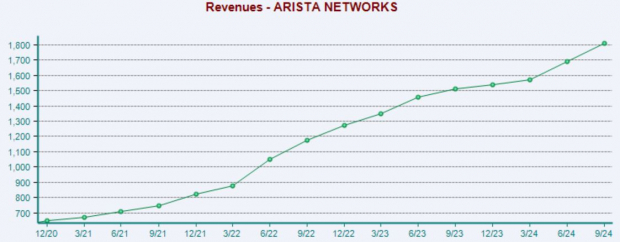

The growth in AI has positively impacted Arista’s revenue, with the company experiencing sequential revenue growth for the past ten quarters. The chart below illustrates the quarterly sales performance.

Image Source: Zacks Investment Research

Similar to Micron, Arista’s shares have lost most of their post-earnings gains, which could reflect profit-taking after an impressive year-to-date performance.

Bottom Line

The 2024 Q3 earnings cycle is winding down, with only a few S&P 500 companies left to report. However, Tesla TSLA, Micron MU, and Arista Networks ANET have all delivered results that have pleased investors.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry is expected to rebound as technology companies and the economy shift from fossil fuels to support the AI revolution.

Trillions of dollars will flow into clean energy in the coming years, with analysts projecting that solar will account for 80% of renewable energy growth. This presents substantial profit potential, but selecting the right stocks is crucial.

Discover Zacks’ hottest solar stock recommendation FREE.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Micron Technology, Inc. (MU): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.