J.B. Hunt Transport Services Gets Positive Rating Boost from Susquehanna

Analysts Predict Significant Stock Price Increase

On January 3, 2025, Fintel reported that Susquehanna upgraded its outlook for J.B. Hunt Transport Services (LSE:0J71) from Neutral to Positive.

Average Price Target Indicates 12.54% Growth

As of December 23, 2024, the average one-year price target for J.B. Hunt Transport Services stood at 195.19 GBX/share. Price forecasts range from a low of 159.15 GBX to a high of 236.21 GBX. This average target signals an expected increase of 12.54% compared to its most recent closing price of 173.44 GBX/share.

For a comprehensive view, check our leaderboard highlighting companies with the largest price target upsides.

Revenue Projections Show Continued Growth

The projected annual revenue for J.B. Hunt Transport Services is estimated at 15,918 million, reflecting a substantial increase of 30.00%. Meanwhile, the expected annual non-GAAP EPS is forecasted to be 11.93.

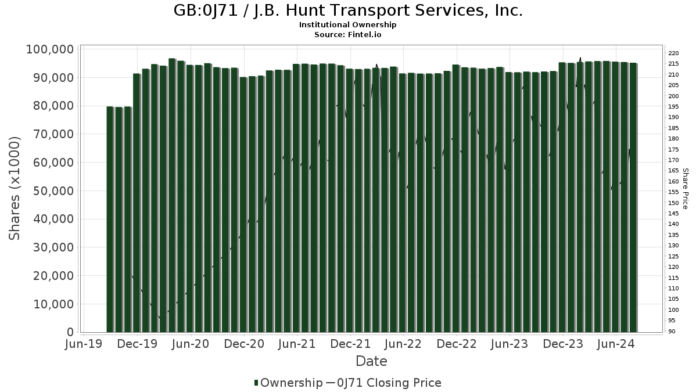

Current Fund Sentiment

Currently, 1,328 funds or institutions have reported positions in J.B. Hunt Transport Services, reflecting a decrease of 18 owners or 1.34% over the last quarter. The average portfolio weight of all funds invested in 0J71 is at 0.23%, which is an increase of 0.88%. Total institutional shares declined by 2.51% to 94,688K shares over the last three months.

Institutional Investors’ Latest Moves

T. Rowe Price Investment Management holds 5,296K shares, equating to 5.25% ownership of the company. In contrast, its previous filing showed 5,317K shares, indicating a decrease of 0.40%. Nevertheless, T. Rowe Price has increased its portfolio allocation in 0J71 by 2.50% over the last quarter.

Janus Henderson Group owns 3,375K shares, or 3.35% of J.B. Hunt. Their latest reports noted an ownership of 3,352K shares previously, marking a small increase of 0.67%. However, the firm has significantly decreased its allocation in 0J71 by 64.02% compared to the previous quarter.

JAENX – Janus Henderson Enterprise Fund Class T holds 2,580K shares, stable from the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 2,575K shares, representing 2.55% ownership of J.B. Hunt. Their last report indicated ownership of 2,611K shares, which is a decrease of 1.42%. Additionally, the firm has reduced its portfolio allocation in 0J71 by 0.25% in the last quarter.

RPMGX – T. Rowe Price Mid-Cap Growth Fund manages 2,565K shares, accounting for 2.54% ownership. Its previous investment showed 2,572K shares, marking a slight decrease of 0.28%. However, the firm has increased its allocation in 0J71 by 2.58% since the last quarter.

Fintel is a leading research platform for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses comprehensive insights including fundamentals, analyst reports, and fund sentiment among other critical data.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.