Synopsys Takes Steps to Secure Approval for $35 Billion Ansys Acquisition

Subheading: EU Review Prompts Divestiture Plans from Leading Tech Firms

Synopsys Inc. SNPS, an American company specializing in electronic design automation, is planning to sell a unit from Ansys Inc. ANSS along with one of its own units to gain European Union approval for its significant $35 billion acquisition. This move comes as the company navigates regulatory scrutiny tied to its pending deal. Ansys is well-known for developing software that simulates sensors for autonomous vehicles, covering technologies like lidar, radar, and cameras.

The European Commission is currently collecting responses from competitors and customers regarding Synopsys’ proposal, with feedback due by December 16.

Additional Context: Goldman Sachs Launches Coverage of Similarweb Amid Upbeat Upgrades

As part of its divestiture strategy, Synopsys has agreed to transfer its Optical Solutions Group to Keysight Technologies Inc. KEYS, a company focused on design and emulation. Furthermore, Synopsys has offered to divest Ansys PowerArtist, which is used for analyzing and minimizing power consumption, a crucial feature for creating power-efficient designs.

According to reports, Synopsys anticipates that the Ansys transaction will conclude in the first half of 2025.

Notably, Synopsys has not provided any changes to its business practices that might raise concerns about interoperability or product bundling, suggesting a lack of regulatory pushback on these issues.

Back in January 2024, Synopsys committed to acquiring Ansys for $35 billion, a substantial investment comprising $19 billion in cash and $16 billion in debt. Earlier in May, the company sold its Software Integrity Group to Clearlake Capital Group and Francisco Partners for approximately $2.1 billion.

In a development from October, the UK’s antitrust authority began an investigation into the Synopsys-Ansys acquisition due to concerns over competition.

As of October 31, 2024, Synopsys reported holding $4.05 billion in cash and equivalents. The company projects first-quarter revenue between $1.435 billion and $1.465 billion, which falls short of the consensus forecast of $1.643 billion, alongside adjusted earnings per share (EPS) expectations of $2.77 to $2.82, lower than the anticipated $3.53.

The landscape for major technology firms is increasingly fraught with antitrust challenges. The EU is also scrutinizing Nvidia Corp‘s Run:ai acquisition for its potential to limit competition in the AI sector. In parallel, the Federal Trade Commission (FTC) is investigating investments in AI startups made by big players like Microsoft Corp, Amazon.com Inc, and Alphabet Inc, the parent company of Google.

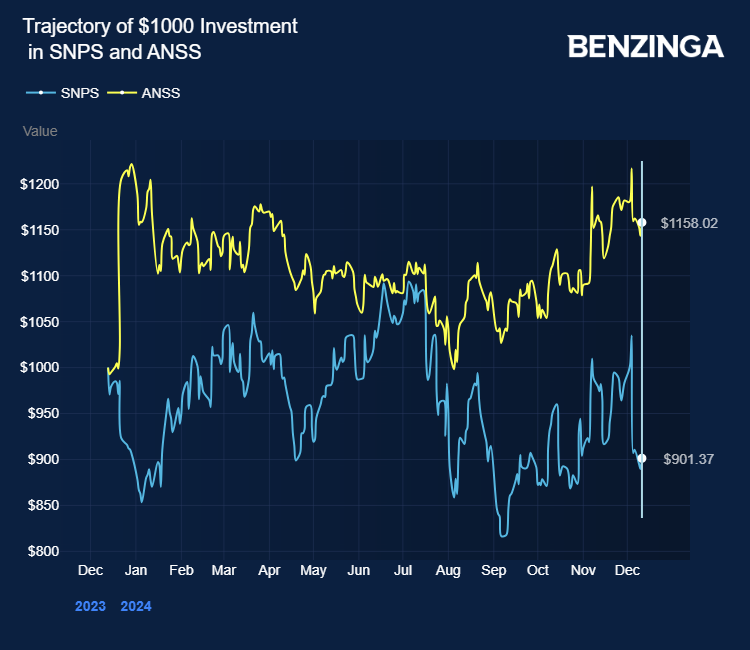

Stock Performances: On Wednesday, ANSS stock rose by 1.27%, closing at $344.00, while SNPS shares increased by 1.33%.

Additional Insights:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs