Earnings

Understanding Q2 Earnings Forecasts: What to Anticipate

Costco and AutoZone Kick Off Earnings Season with Strong Results Costco (COST) and AutoZone (AZO) reported their fiscal quarters ending in May, marking the ...

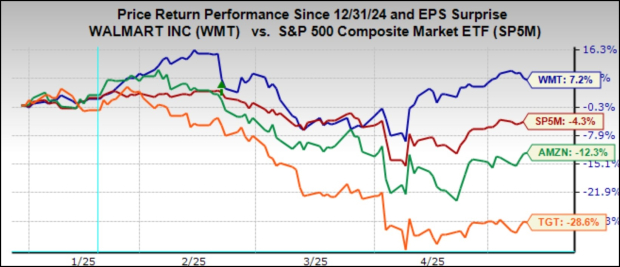

Upcoming Earnings: Analyzing Walmart and the Retail Sector

Walmart Stock Outpaces Peers Ahead of Quarterly Earnings Report Walmart (WMT) shares have demonstrated strong performance this year, significantly outperforming broader market indexes and ...

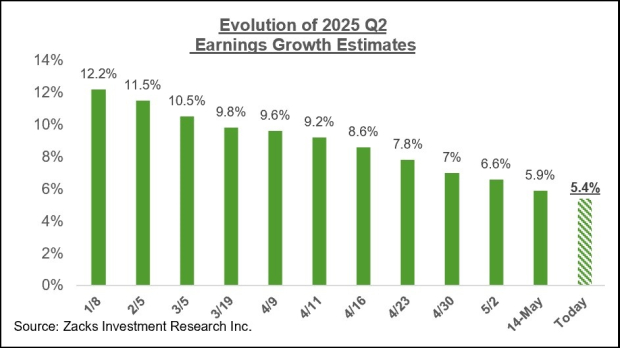

How Tariff Concerns are Impacting Earnings Projections

Market Watches Q1 Earnings Amid Tariff Uncertainty and Financial Reports Investors are keenly observing the Q1 reporting cycle that began with quarterly earnings from ...

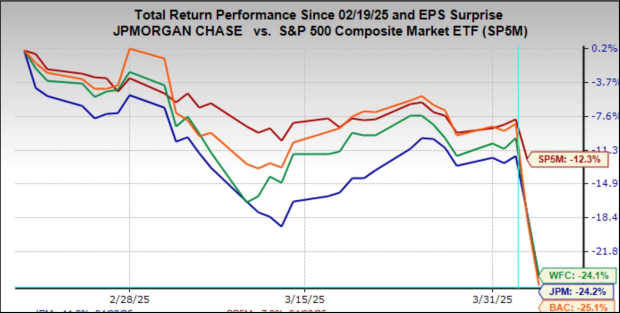

Analyzing Bank Stocks Amid Rising Tariff Concerns

Bank Stocks in Focus Amid Tariff-Induced Market Turbulence Understanding how banks operate reveals their business isn’t as affected by tariffs as one might think. ...

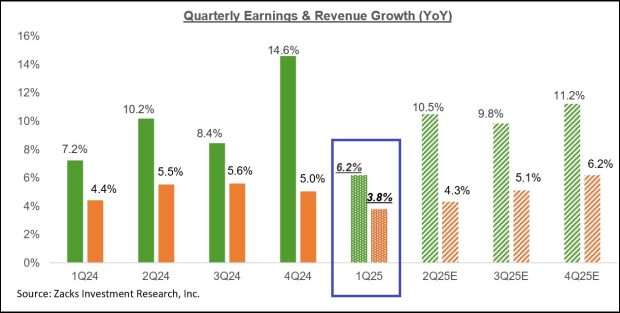

Understanding the Insights from Early Q1 Earnings Reports

Early Q1 Earnings Reports Show Mixed Results Ahead of Big Banks The Q1 earnings reporting cycle officially begins on April 11th when major banks ...

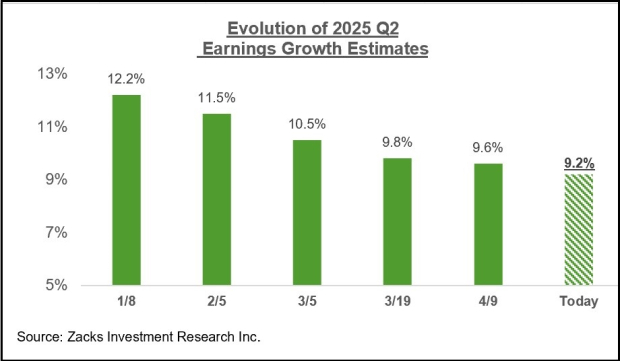

Anticipating the Upcoming Q1 Earnings Reports

Q1 Earnings Season Begins with Mixed Results and Concerns As the Q1 reporting cycle heats up, major banks are set to release their March-quarter ...

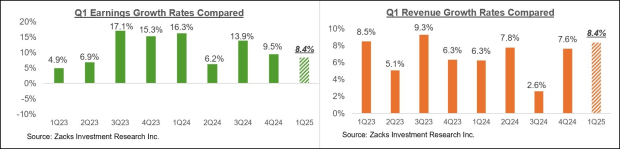

A Glimpse into the Upcoming Q1 2025 Earnings Season

Costco and AutoZone’s Earnings Signal New Trends for Q1 2025 The kickoff to the Q1 2025 earnings season was marked by the recent releases ...

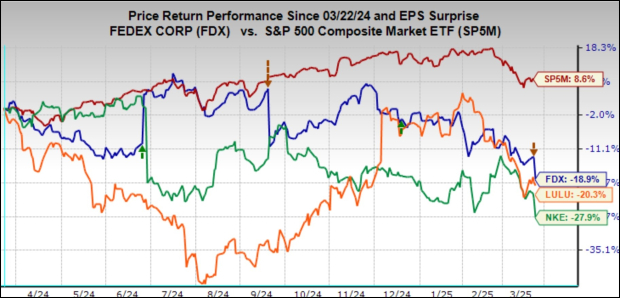

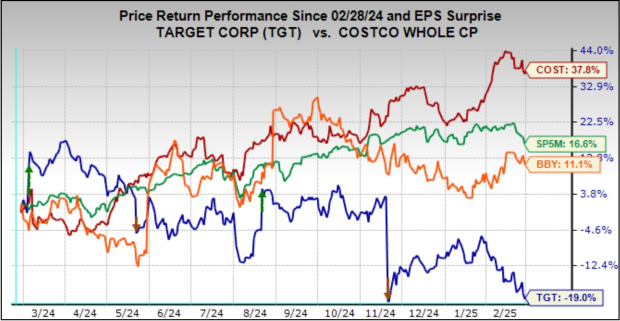

“Retail Performance Takes Center Stage in Q4 Earnings Roundup”

Retail Sector Earnings Reports: Key Insights and Trends The retail sector remains in the spotlight this week, with major companies like Target (TGT), Best ...

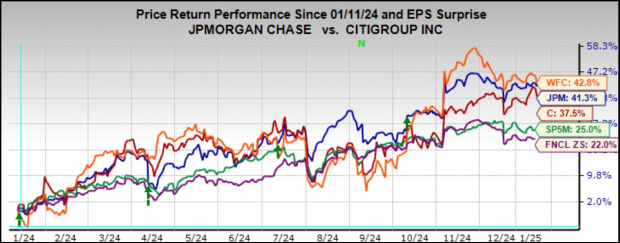

Will Bank Stocks Maintain Their Current Growth Trajectory?

Bank Earnings Preview: JPMorgan, Wells Fargo, and Citigroup Set to Report JPMorgan’s shares have declined slightly, down just over 3% since their highs in ...

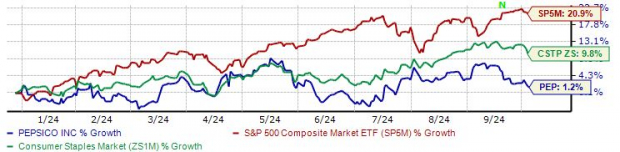

Is PepsiCo Stock Worth Buying Ahead of Earnings Report?

PepsiCo Q3 Expectations PepsiCo (PEP) shares have only risen 1.2% in 2024, staying flat as investors have been favoring technology stocks over consumer staples. ...