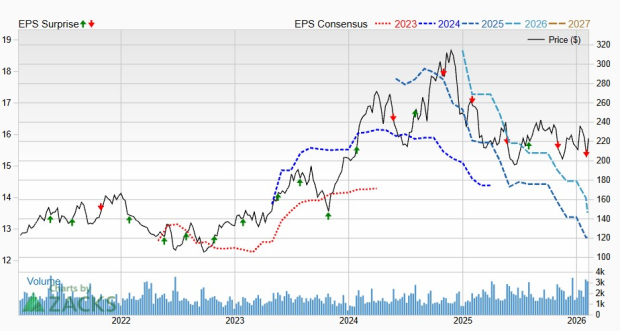

A Glimpse Into Earnings Season Trends

As the curtain nears on Q4 earnings season, a tale of two sectors unfolds. With 95% of S&P 500 companies declaring their results, it’s evident that large caps have emerged as the victors, defying initial projections. Instead of a contraction, Q4 earnings have showcased a growth of +3.9% YoY. Impressively, three-quarters of S&P 500 firms have exceeded earnings estimates, aligning closely with the 5-year average.

Struggles Persist for Small Caps

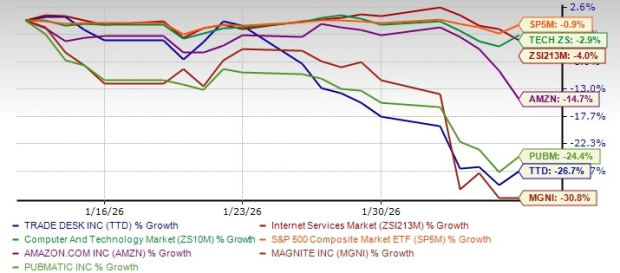

In stark contrast, smaller players have faced a tougher road to recovery. The S&P 400 mid-caps are on the brink of exiting their earnings recession in Q4 following four consecutive quarters of negative growth. However, the sector-specific outcomes paint a mixed picture, with 6 out of 11 sectors reporting negative growth.

Conversely, the prospects remain dim for S&P 600 small caps, as they are poised to endure their sixth consecutive quarter of earnings recession in Q4. Analysts foresee this dreary trend persisting until Q2 2024. With 7 out of 11 sectors grappling with negative earnings in Q4, the only silver lining was Utilities (+38% YoY). The root cause behind the small caps’ earnings plight lies in their heavy reliance on floating rate debt, subjecting them to margin pressures exacerbated by the spike in the fed funds rate over recent years.

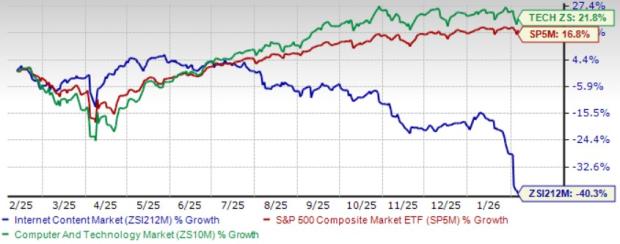

Performance Reflecting Earnings Disparities

The divergence in earnings performance has been aptly mirrored in price returns this year, with large caps boasting the strongest earnings and consequent gains YTD (+6%). In comparison, mid-caps have seen moderate growth (+3%), while small caps, entrenched in an earnings recession, have faced a decline in prices (-1%).

Unsurprisingly, this correlation between earnings and prices reaffirms the paramount influence of earnings on long-term stock performance.

Anticipated Rebound for Small and Mid-Caps

Analysts are optimistic about a significant rebound in earnings for smaller stocks in the latter half of 2024. This positive outlook could potentially propel mid-caps, particularly small caps, to outperform as the year progresses, especially in a scenario where interest rates start to retreat.

The content above serves educational and informational purposes solely. Nasdaq, Inc. and its affiliates do not provide any investment advice, whether pertaining to specific securities or broader investment strategies. Neither do they advocate for buying or selling any securities or make claims regarding the financial status of any company. Instances referencing Nasdaq-listed entities or indexes should not be construed as indicative of future performance. Actual outcomes may significantly differ from implied projections. Past performance does not guarantee future results. Prior to making investment decisions, investors are recommended to conduct thorough due diligence and perform a comprehensive evaluation of companies. Seeking advice from a qualified securities professional is highly advisable. © 2024. Nasdaq, Inc. All Rights Reserved.