Mutual Funds

Bear of the Day: Cracker Barrel Old Country Store (CBRL)

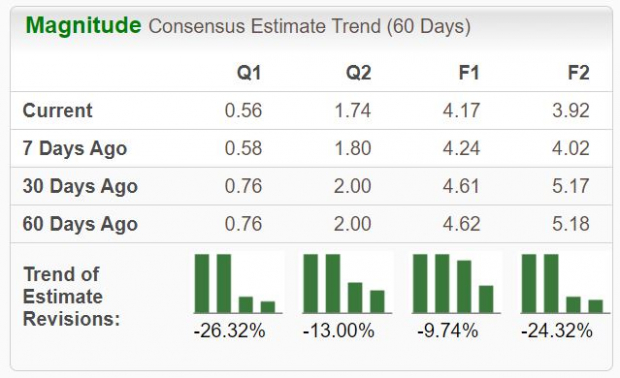

Cracker Barrel Old Country Store CBRL owns and operates full-service dining locations with a restaurant and a retail store in the same unit. Analysts ...

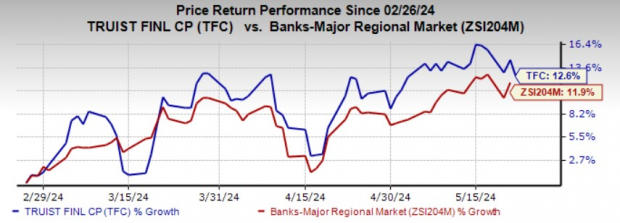

Truist’s (TFC) Business Restructuring to Aid Amid Cost Woe

Truist Financial TFC remains well-positioned for revenue growth on the back of decent loan demand, high rates, strategic restructuring initiatives and fee income growth. ...

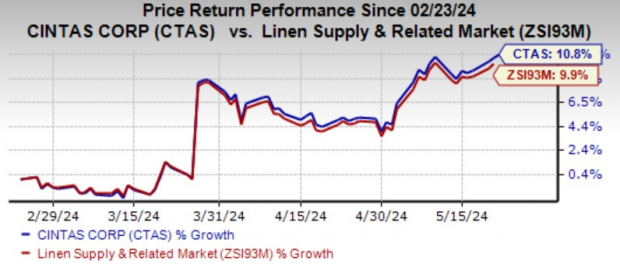

Here’s Why You Should Retain Cintas (CTAS) in Your Portfolio for Now

Cintas Corporation CTAS has been benefiting from strength in its Uniform Rental and Facility Services segment, driven by strong demand in the energy market. ...

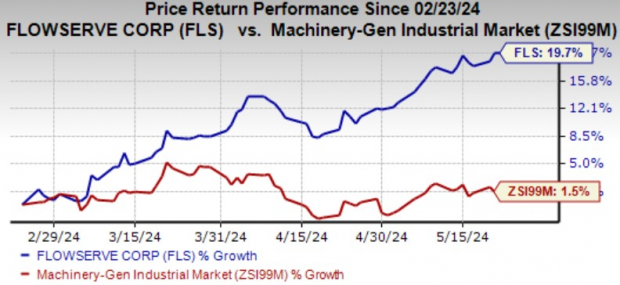

Here’s Why Flowserve (FLS) Stock Should Grace Your Portfolio

Flowserve Corporation FLS stands to benefit from strength across its businesses, focus on operational excellence and a sound liquidity position. The company remains focused ...

Reasons to Buy Pinnacle West Capital (PNW) Stock Right Away

Pinnacle West Capital Corporation’s PNW strategic capital investment plans should further enhance its infrastructure and help to expand its clean generation portfolio. Given its ...

Netflix’s (NFLX) The Victims’ Game Set to Return on Jun 21

Netflix’s NFLX highly anticipated crime thriller series, The Victims’ Game, is set to return for a second season on Jun 21, after a four-year ...

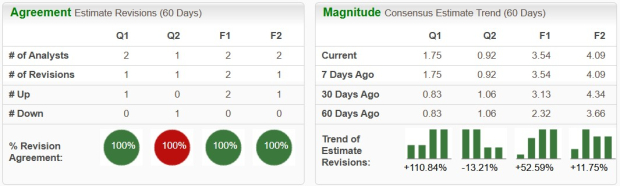

Radcom’s (RDCM) Q1 Earnings Meet Estimates, Revenues Up Y/Y

Radcom RDCM reported first-quarter 2024 non-GAAP earnings per share (EPS) of 18 cents, meeting the Zacks Consensus Estimate. The bottom line increased 50% year ...

Oracle (ORCL) NetSuite’s Innovations to Help Mexican Businesses

Oracle’s ORCL NetSuite has unveiled a suite of new product innovations aimed at assisting businesses in Mexico to streamline their finance processes, enhance insights ...

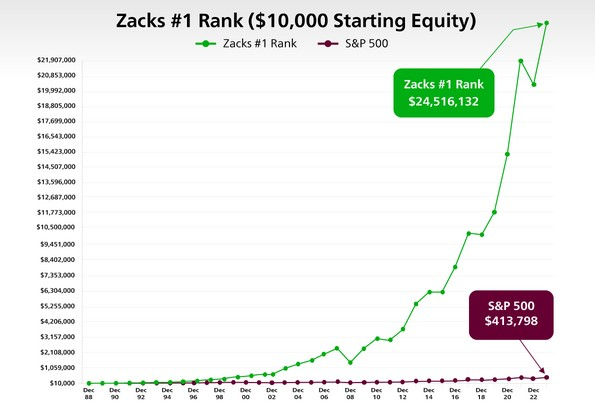

Beat the Market the Zacks Way: Micron, Freshpet, Colgate-Palmolive in Focus

All of the three most widely followed indexes closed out a gaining week last Friday. The Nasdaq Composite, the S&P 500 and the Dow ...

Is Trending Stock Taiwan Semiconductor Manufacturing Company Ltd. (TSM) a Buy Now?

TSMC (TSM) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of ...