prices

Iron Ore Prices Surge to Weekly High Following Rio Tinto’s Simandou Project Shutdown Due to Fatality

“`html Rio Tinto (NYSE: RIO; ASX: RIO) suspended operations at its Simandou project in Guinea following the death of a contract worker, contributing to ...

“Copper Prices Surge Amid Tariff Relief for Traders”

Copper Prices Rise as Trump Delays Tariffs on Electronics Copper prices increased on Monday following U.S. President Donald Trump’s decision to grant exemptions from ...

Gold Price Predictions: Key Factors to Watch in 2025

Gold Prices Projected to Rise Amid Changing Economic Landscape Investment trends significantly impact gold prices, influencing everything from mine production to scrap recovery and ...

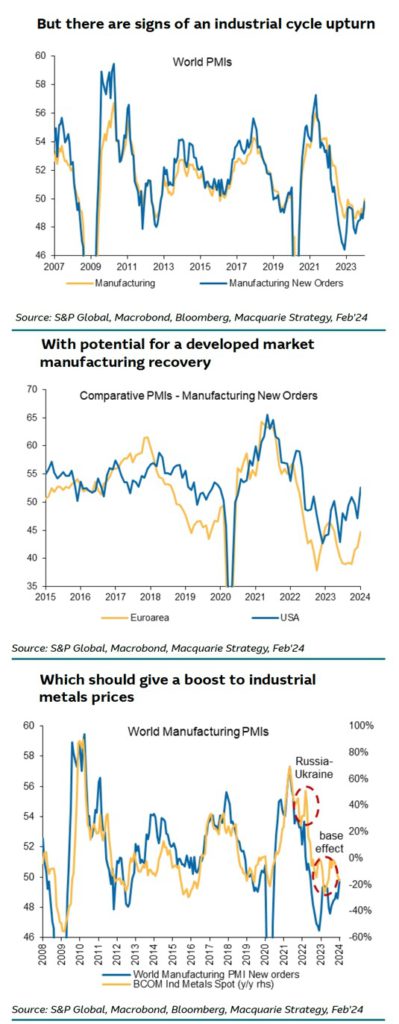

Turning the Corner: The Resurgence of Industrial Commodity Prices

Green shoots for copper, nickel, zinc, aluminium prices

In a recent trading desk note, Marcus Garvey, head of Macquarie commodities strategy based in Singapore, and a team of analysts, brought forth compelling ...

Albemarle Faces Layoffs Amid Weak Lithium Prices

Albemarle Faces Layoffs Amid Weak Lithium Prices

Amid a surplus of 200,000 tonnes of lithium carbonate equivalent, comprising a staggering 17% of global demand, Goldman Sachs dauntlessly anticipates that this dismal ...