Stocks

Unleashing the Zacks Advantage: Dive into Carrols, Nextracker, and Costco

Delight swept investors as the previous week concluded, unveiling significant gains across prominent indices. The S&P 500, the Nasdaq Composite, and the Dow Jones ...

A Steely Resolve: Illinois Tool (ITW) Bolstered by Business Strength Amid Lingering Risks

Illinois Tool Works Inc. (ITW), a stalwart in its segment, continues to navigate a landscape filled with both opportunities and perils. The company has ...

The Allure of Applied Industrial Technologies (AIT) for Investors

Applied Industrial Technologies, Inc. AIT is currently basking in the glow of robust performance in its end markets, strategic acquisitions, and investor-friendly strategies. Delving ...

The Bittersweet Symphony of Brookdale Senior’s Q4 Earnings Performance

Brookdale Senior Living Inc., commonly known as BKD, recently found itself in turbulent waters as its shares spiraled down by 13.1% following the release ...

Innovative Q4 Performance Highlights Encouraging Growth Trajectory

Nice presented impressive figures for the fourth quarter of 2023. The company reported adjusted earnings of $2.36 per share, surpassing the Zacks Consensus Estimate ...

Chubb (CB) Dividend Proposal Highlights

Chubb (CB) Delights Investors with 5.8% Dividend Hike

Chubb Limited’s proposed 5.8% dividend increase showcases the insurer’s commitment to sharing its profits with shareholders. If approved, the annual dividend will rise to ...

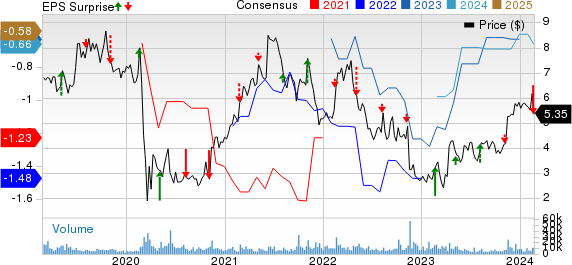

MercadoLibre Shocks with Q4 Earnings Shortfall but Sees Revenues Soar

MercadoLibre’s Financial Rollercoaster Disappointment looms over the market as MercadoLibre (MELI) unveils fourth-quarter 2023 earnings, missing the Zacks Consensus Estimate by a staggering 51.2%. ...

HCA Revolutionizes Patient Care Through Innovative Outpatient Model

Driving Efficiency Through Integration HCA Healthcare, Inc. has set the wheels in motion by transitioning over 75% of their CAR T-cell therapy patients into ...

The Tale of ProAssurance Amidst Rising Expense Ratios

The upcoming earnings report from ProAssurance Corporation (PRA) on February 27, 2023, after market close is anticipated with bated breath. The previous quarter’s earnings ...

The Trinity Triumph: Q4 Performance Soars Above Estimates and Y/Y Growth

Q4 Earnings Exceed Expectations Trinity Industries, Inc. (TRN) has showcased a remarkable performance in the fourth quarter of 2023. The company reported earnings per ...