US Markets

Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

Exxon Mobil (NYSE: XOM), a leading explorer, producer, transporter, and seller of crude oil and natural gas, and North America’s largest energy company by ...

West Pharmaceutical (WST) Q1 Earnings Beat, HVP Sales Weak

West Pharmaceutical Services, Inc. WST reported first-quarter 2024 adjusted earnings per share (EPS) of $1.56, which beat the Zacks Consensus Estimate by 20.9%. The ...

4 Large Drug Stocks to Hold on to Amid Industry Challenges

After a rather weak 2023, the drug and biotech sector made a comeback initially in 2024 amid a slew of takeover deals. However, the ...

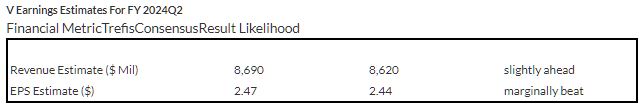

Visa Stock Is Up 15% In the Last 12 Months, Will The Trend Continue Post Q2 Results?

Visa (NYSE: V) is scheduled to report its fiscal Q2 2024 results on Thursday, April 25, 2024. We expect Visa to edge past the consensus ...

Tesla Pre EPS Turmoil: 3 Long-Term Factors to Consider

Beyond Bitcoin, finding a more controversial, “battleground” investment than Tesla (TSLA) is difficult.Depending on whom you ask and their investment timeframe, the stock is ...

Insights into the Q1 Earnings Prospects of M&T Bank (MTB)

M&T Bank Corporation (MTB) is set to unveil its first-quarter 2024 financial results on April 15, before the morning bell amidst expectations of a ...

Finding Stability in Market Volatility: A Dive into Blue-Chip Retail Stocks

Navigating the tumultuous waters of investment is akin to a tightrope walk, balancing risk and reward. As whispers of potential Federal Reserve policy shifts ...

Acquisition Bonanza: Prosperity Bancshares (PB) Completes Lone Star Acquisition

Prosperity Bancshares, Inc. has solidified its foothold in the financial landscape with the recent conclusion of its merger with Lone Star State Bancshares, Inc. ...

Should You Pick Boeing Stock At $190?

Analysis of Boeing Stock: A Flight Towards Prosperity? Boeing Stock Trends Boeing stock (NYSE: BA) has taken investors on a tumultuous ride lately, seeing ...

Deciding on Humana Stock Amidst a 25% Decline This Year

Humana’s Recent Decline and Future Potential Humana (NYSE: HUM) currently trades at $350 per share, down 30% from its peak of over $500 in ...