TSMC vs. ASML: Who Will Lead in the Semiconductor Race?

Both Taiwan Semiconductor Manufacturing (NYSE: TSM) and ASML (NASDAQ: ASML) are vital players in the semiconductor industry. TSMC, known as the world’s top semiconductor contract manufacturer, provides manufacturing services for various tech companies that prefer to design chips rather than build expensive manufacturing facilities. ASML is essential too, as it produces the complex machines TSMC and others use to manufacture semiconductors, particularly holding a near monopoly in extreme ultraviolet (EUV) lithography technology.

Start Your Mornings Smarter! Receive Breakfast News daily to stay informed every market day. Sign Up For Free »

In 2023, TSMC’s stock has surged over 90%, while ASML’s has declined around 5% so far this year. This article will analyze which stock could outperform in 2025.

Riding the Chip Wave

TSMC has greatly benefited from a surge in chip demand and the growing artificial intelligence (AI) market. The company’s expertise positions it as the go-to manufacturer for major players like Apple, Nvidia, and Broadcom.

Interestingly, not all manufacturers have thrived in the AI chip boom. Competitors like Intel and Samsung have struggled, allowing TSMC to gain market share and maintain strong pricing. This dynamic has bolstered TSMC’s profit margins, leading to impressive financial results.

In the third quarter, TSMC reported a 36% year-over-year revenue increase, totaling $23.5 billion. The company’s gross margin rose by 460 basis points to 57.8%, driving a 50% rise in earnings per American depositary receipt (ADR).

Looking ahead to 2025, analysts at Morgan Stanley predict TSMC will raise prices, continuing to expand to meet AI and chip demand. They recently announced that a new fabrication plant in Japan has begun mass production.

This expansion benefits ASML, as TSMC is one of its primary customers, alongside Samsung and Intel. Although ASML is transitioning to its next-generation high-NA EUV technology, which has slowed some orders, TSMC is expected to receive a new machine by year-end. However, TSMC has indicated that it won’t need this technology for current chip production until at least 2030.

Intel is currently the most active user of ASML’s new technology and was the first recipient of a high-NA EUV machine. However, the company’s foundry operations are struggling, as revenue for this segment declined recently amid leadership changes and potential plans to spin off this business.

Almost half of ASML’s revenue in 2024 is expected to come from China, despite restrictions on selling its advanced technologies there. This marks a significant shift, as China represented just 9% of ASML’s revenue in late 2022. This may indicate that Chinese companies are hastily acquiring equipment amid fears of broader export bans.

Despite uncertainties surrounding ASML, the company maintains a stronghold as a leading supplier of high-end semiconductor equipment. With continued growth in chip production anticipated, it will likely benefit in the long run.

Image source: Getty Images.

Evaluation and Conclusion

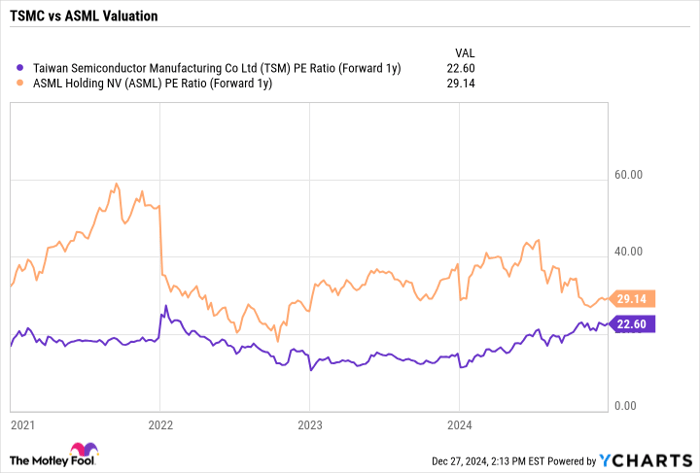

Evaluating both companies reveals that TSMC is trading at a more favorable forward price-to-earnings (P/E) ratio of about 22, compared to ASML’s forward P/E of 29. Additionally, TSMC’s revenue growth of 36% outpaced ASML’s 12% growth last quarter.

TSM PE Ratio (Forward 1y) data by YCharts

While TSMC appears to be the more affordable and faster-growing option currently, ASML shouldn’t be underestimated. The semiconductor equipment market can be unpredictable, yet ASML holds a strong position in a sector with rising demand for advanced chips, setting it up for future success.

In short, for 2025, TSMC seems to have the edge. However, investors can comfortably invest in both companies moving forward.

Catch the Next Big Investment Opportunity

Have you ever felt you missed out on lucrative stock investments? If so, read on.

Occasionally, our analysts identify stocks with high growth potential, which we call “Double Down” recommendations. If you are worried about missing another investment opportunity, act now to capitalize on these promising stocks.

Nvidia: A $1,000 investment in 2009 would now be worth $355,269!*

Apple: A $1,000 stake in 2008 would now be worth $48,404!*

Netflix: A $1,000 investment in 2004 now sits at $489,434!*

We are currently issuing “Double Down” alerts for three outstanding companies. Seize this moment; opportunities like this might not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool recommends ASML, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.