The Market Landscape

As the trading bell tolled last week, the Nasdaq Composite modestly bristled while the S&P 500 and the Dow Jones Industrial Average gallivanted forward. The week was terse, initially lackluster until a quiver on the final day sparked hope. Investors, however, hover in duality over a potential rate cut and its turbulent ramifications as core PCE inflation flickers unpredictably.

Zacks Unveiled – A Glance at the Quarter

A tint of AI optimism hued the benchmark indexes for the quarter, with the Dow, Nasdaq, and S&P 500 escalating healthily by 5.6%, 9.1%, and 10.2%, respectively. In the wave of market variability, Zacks emerges as the steadfast lighthouse, illuminating the path for investors seeking to navigate the tumultuous waters.

Remaining true to its founding ethos, Zacks unfurls its tapestry of triumphs, offering a beacon of guidance amidst market uncertainties.

Modine and Nextracker – Zacks’ Bright Stars

The meteoric rise of Modine Manufacturing Company (MOD) and Nextracker Inc. (NXT) following their Zacks Rank upgrades is emblematic of the efficacy of the Zacks Rank methodology. Research attests to the profound connection between earnings estimate revisions and stock price dynamics, a correlation that shines brilliantly in Zacks’ empirical success.

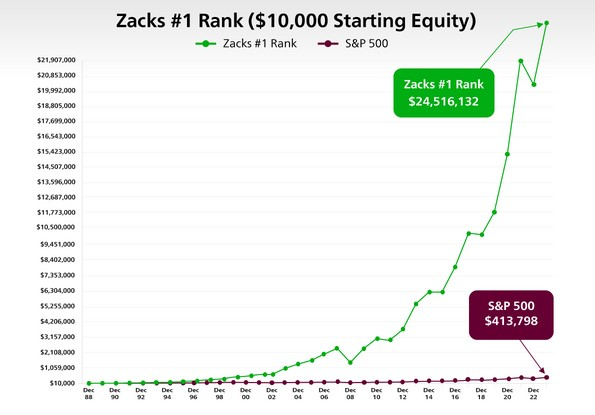

The Zacks Model Portfolio, bedecked with Zacks Rank #1 gems, outshines benchmarks since time immemorial, a testament to Zacks’ unwavering commitment to excellence.

Astute investors recognize the intrinsic value of Zacks’ recommendations, paving the way for informed and lucrative investment decisions.

Dell and Kodiak Sciences – Scaling New Heights

The specter of technological prowess embraced Dell Technologies Inc. (DELL) and Kodiak Sciences Inc. (KOD) following their Zacks Recommendation upgrades. Zacks’ predictive prowess spans not only the short term Zacks Rank but extends into the medium horizon with the Zacks Recommendation. Through meticulous analysis and forecasting, Zacks augments its quantitative models with qualitative acumen, offering investors a comprehensive outlook.

Zacks’ nuanced classification into Outperform, Neutral, and Underperform categories underpins a holistic approach, where analysts infuse their expertise to enhance the quantitative framework, reflecting an amalgamation of algorithmic precision and human insights.

Enter the Zacks Focus List – NVIDIA, Sea Limited in the Spotlight

The Zacks Focus List unleashes the prowess of NVIDIA Corporation (NVDA) and Sea Limited (SE), propelling them to staggering gains over the past 12 weeks. The portfolio’s performance eclipses benchmarks, underscoring a pattern of consistent excellence. Market aficionados gravitate towards the Focus List, a wellspring of unparalleled insights and strategic prowess.

Championing ECAP Stocks: AutoZone and Novo Nordisk

AutoZone, Inc. (AZO) and Novo Nordisk A/S (NVO) spearhead the league of Zacks Earnings Certain Admiral Portfolio (ECAP) stocks, reaping substantial gains. The ECAP, a bastion of 30 ultra-defensive Buy and Hold stalwarts, exhibits a judicious balance of prudence and profitability, a shield against market vagaries.

Amidst the ebb and flow of market sentiments, Zacks remains the pillar of strength, empowering investors with unparalleled research, anchoring them in the tempestuous sea of financial markets.

Zacks Premium – a treasure trove of insights encompassing the Focus List, Zacks #1 Rank List, Equity Research Reports, and more – stands as a gateway to enriched decision-making, epitomizing Zacks’ unwavering dedication to market mastery.

Zacks Portfolio Performance: Navigating the Market Storms

Zacks ECDP Stocks Fastenal and Tractor Supply Outshine Peers

Amidst the tempestuous waves of market volatility, few vessels manage to navigate with grace. Fastenal and Tractor Supply, part of Zacks’ Earnings Certain Dividend Portfolio (ECDP), have emerged as beacons of resilience and strength. Fastenal Company (FAST) has charted a course of 24.5% growth over the past 12 weeks. Meanwhile, the sturdy Tractor Supply Company (TSCO) has climbed 19.6% during the same turbulent period. Such feats are a testament to the steadfast nature of quality dividend stocks, sought after by investors for their ability to provide a steady income stream in the midst of choppy waters.

Zacks Top 10 Stocks — e.l.f. Beauty Delivers Solid Returns

While some stocks flounder in the stormy seas of market dynamics, e.l.f. Beauty, Inc. (ELF) has unfurled its sails and soared, showcasing a remarkable 35.8% jump year-to-date. This success story is part of Zacks’ Top 10 Stocks for 2024, a collection of equities that have consistently outperformed the S&P 500 Index. The Top 10 portfolio reaped a bountiful harvest of +25.15% in 2023, outshining the S&P 500 index. Over the years, this illustrious portfolio has accumulated a cumulative return of +1060.9% by the end of 2023, leaving the S&P 500 index in its wake.

In the realm of finance, where fortunes rise and fall like the tide, the Zacks Top 10 portfolio stands as a lighthouse of consistent growth. Since 2012, it has boasted an annualized return of +22.67% through the close of 2023, a testament to its enduring strength in the face of market vicissitudes.

As the market ebbs and flows, knowing where to place your bets is crucial. Zacks Investment Research offers a glimpse into the world of stocks, inviting investors to explore a treasure trove of opportunities for a mere $1. This exclusive peek into the realm of financial prowess includes access to an array of services like Surprise Trader, Stocks Under $10, and Technology Innovators, each a gem waiting to be unearthed. The allure of unparalleled gains beckons – are you ready to set sail into the vast ocean of investment possibilities?