Holiday Retail Surge: Target, Five Below, Genesco, and Abercrombie Shine

Key Insights

- Core retail sales increased 4% year over year to a record $994.1 billion, exceeding the National Retail Federation’s estimate.

- A strong holiday shopping surge prompted Target to raise its sales growth forecast to 1.5% compared to last year.

- Retailers such as Five Below, Genesco, and Abercrombie & Fitch reported notable sales gains this holiday season.

The holiday shopping period is crucial for retailers like Target Corporation (TGT), as consumer spending playing a significant role in their financial outcomes. This year, it turned out to be a successful season for Target. The company achieved better-than-expected results, significantly driven by increased customer traffic. Its user-friendly shopping experience and popular products attracted consumers both in-store and online.

Target’s performance peaked during promotional events, with Black Friday and Cyber Monday reporting record sales figures. Thanks to these strong results, the Minneapolis-based retailer updated its comparable sales forecast for the last quarter of fiscal 2024, though it still maintained its profit outlook.

Target’s remarkable holiday results place it alongside Five Below, Inc. (FIVE), Genesco Inc. (GCO), and Abercrombie & Fitch Co. (ANF). During the 2024 holiday season, core retail sales saw a 4% increase to a record $994.1 billion, exceeding the National Retail Federation’s forecast of $979.5-$989 billion and surpassing the 2023 record of $955.6 billion.

Target’s Holiday Performance Breakdown

In November and December, Target’s total sales rose by 2.8% compared to last year, leading to a comparable sales growth of 2%. Customer traffic increased nearly 3%, with notable performances from both physical stores and online platforms. This improves upon an ongoing trend of positive traffic growth, marking December as the eighth consecutive month of year-over-year increases.

Digital sales increased by 9% compared to the previous year, with the same-day delivery service, Target Circle 360, seeing growth of over 30%. Additionally, the company’s third-party marketplace, Target Plus, posted a 50% increase, underscoring the importance of online channels in driving sales, as over 97% of Target’s sales were fulfilled by its stores.

When evaluating performance against third-quarter results, Target noted a significant uptick in discretionary categories during the holiday season. Sales of apparel and toys surged, while beauty and other frequent purchase categories remained strong. Consumers showed a preference for both seasonal and everyday products, establishing Target’s position as a go-to shopping destination.

Looking to the fourth quarter, Target now expects comparable sales growth of approximately 1.5%, an improvement from its earlier forecast suggesting flat comparable sales. However, this Zacks Rank #5 (Strong Sell) company projects its GAAP and adjusted earnings per share (EPS) for the fourth quarter to be between $1.85 and $2.45, with full-year GAAP and adjusted EPS estimated between $8.30 and $8.90.

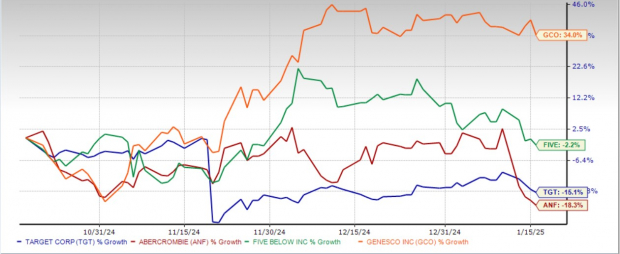

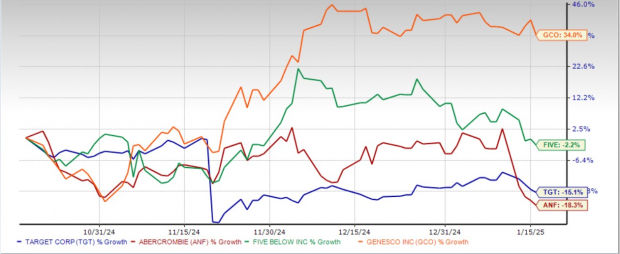

Recent Performance of TGT, FIVE, GCO & ANF

Image Source: Zacks Investment Research

How FIVE, GCO & ANF Performed This Holiday Season

Five Below reported holiday results that met expectations, with net sales reaching $1.19 billion during the holiday season (from Nov. 3, 2024, to Jan. 4, 2025), up from $1.10 billion for the same nine-week period last year. However, comparable sales fell by 3.2%, indicating some weakness in same-store performance despite overall revenue growth.

Following this holiday performance and the forecasts for January, Five Below now anticipates fourth-quarter sales to fall within the upper half of its previous guidance. The Zacks Rank #1 (Strong Buy) company had set a prior net sales forecast between $1.35 billion and $1.38 billion, with a comparable sales drop expected between 3% to 5%.

Genesco reported a strong 10% rise in comparable sales for the quarter-to-date period ending Dec. 28, 2024. Same-store sales grew by 6%, while e-commerce sales surged by 20%, reflecting the effectiveness of the company’s omnichannel strategy.

The Journeys Group led Genesco’s performance with a 14% year-over-year increase in comparable sales. The Schuh Group reported growth of 3%, while the Johnston & Murphy Group saw a slight decline of 1%. Based on these results, Genesco, also a Zacks Rank #1 company, confirmed its fiscal 2025 earnings guidance of 80 cents to $1.00 per share.

Abercrombie & Fitch has adjusted its net sales outlook for the fourth quarter and fiscal 2024 positively due to strong holiday sales. This Zacks Rank #1 company now expects fourth-quarter net sales growth between 7% and 8%, up from previous forecasts of 5% to 7%. The full fiscal year shows projected net sales growth of about 15%, an increase from the earlier range of 14%-15%.

Management stated that quarter-to-date net sales through December reached new highs. This success reflects strong comparable sales across various regions and brands, aided by compelling product offerings and effective marketing strategies.

Just Released: Zacks’ Top 10 Stocks for 2025

Act quickly to see our top ten stock recommendations for 2025. Designed by Zacks Director of Research Sheraz Mian, this set of stocks has a strong track record. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has achieved a gain of +2,112.6%, far exceeding the S&P 500’s +475.6%. After reviewing 4,400 companies covered by the Zacks Rank, Sheraz has selected the ten best stocks to buy and hold in 2025. Be among the first to view these just-released stocks with great potential.

Target Corporation (TGT): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Genesco Inc. (GCO): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.