Target’s Stock Shows Resilience Ahead of Q3 Earnings

Target’s TGT stock is making strides as it prepares for its Q3 results on Wednesday, November 20. The company seems to be improving its inventory issues.

With a Zacks Rank #1 (Strong Buy) and earning the title of Bull of the Day, let’s explore why Target is looking like a good investment again.

What to Expect for Q3

Zacks estimates indicate that Target’s Q3 sales are expected to rise by 2%, reaching $25.97 billion. On the earnings side, Q3 EPS is predicted to increase by 8% to $2.28, compared to $2.10 per share in the same quarter last year.

In August, Target exceeded Q2 earnings projections by nearly 19%, reporting an EPS of $2.57 against estimates of $2.16 a share. Impressively, the company has beaten the Zacks EPS Consensus in three of its last four quarterly reports, achieving an average earnings surprise of 20.26%.

Image Source: Zacks Investment Research

Tackling Theft Issues

Target has taken proactive measures to combat shrinkage caused by theft and damaged goods, which challenge many retailers today. Other retailers like Walmart WMT, TJX Companies TJX, and Dollar General DG have also faced similar troubles.

According to Yahoo Finance, Target has enhanced its security by using locking cases for high-theft items and increasing investments in security personnel and third-party training.

Moreover, Target aims to collaborate with the US Department of Homeland Security to develop technology focused on curbing organized retail crime. These initiatives are crucial, especially since shrinkage has impacted Target’s profits by a staggering $1.2 billion over the past two years.

Analyzing Target’s Recovery & Valuation

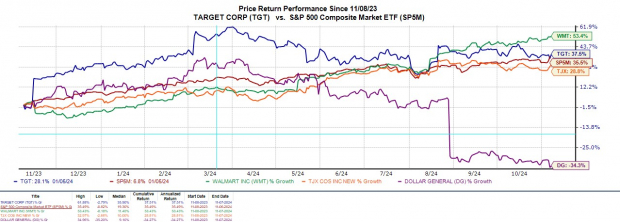

By effectively tackling shrink-related issues, Target’s stock has modestly risen by 6% this year and impressively by 37% over the past year. While this performance is slightly below Walmart’s 53%, it surpasses TJX’s 28% gain and outshines Dollar General’s dramatic decline of 34%.

Image Source: Zacks Investment Research

Notably, TGT shares trade at 15.4 times forward earnings, an attractive discount compared to the S&P 500’s 25.1 times and Walmart’s 34.2 times. Target’s projected annual earnings are set to grow by 7% in fiscal 2025 and 11% in fiscal 2026, reaching $10.56 per share.

Additionally, TGT trades at 0.6 times sales, as revenues are expected to remain stable in FY25 but to rise by 3% in FY26, totaling $110.27 billion.

Image Source: Zacks Investment Research

Conclusion

Target’s strong buy rating is backed by positive earnings estimate revisions for FY25 and FY26. The average Zacks price target of $177.28 per share indicates a potential upside of 20%. Additionally, Target achieves an overall “A” grade in Zacks Style Scores based on Value, Growth, and Momentum.

Explore: 5 Stocks to Buy Amid Infrastructure Growth

The federal government is set to invest trillions in America’s infrastructure, affecting not just roads and bridges but also AI data centers and renewable energy initiatives.

Find out about 5 surprising stocks well-positioned to benefit from this wave of spending.

Get the guide on Profiting from the Infrastructure Boom at no cost today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Target Corporation (TGT): Free Stock Analysis Report

The TJX Companies, Inc. (TJX): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.