Telsey Advisory Group Promotes Lowe’s Companies: A Closer Look at Fund Sentiment

On November 8, 2024, Telsey Advisory Group raised its rating for Lowe’s Companies (WBAG:LOWE) from Market Perform to Outperform.

Understanding Fund Sentiment

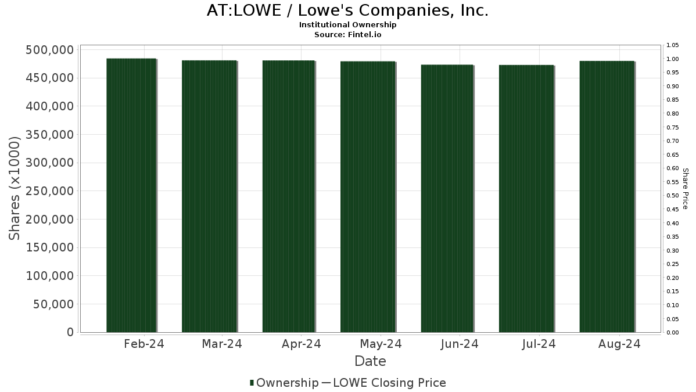

Currently, there are 3,627 funds or institutions with investments in Lowe’s Companies. This marks an increase of 79 funds, or 2.23%, in the past quarter. The average portfolio weight dedicated to LOWE has risen to 0.52%, up by 2.09%. In total, institutional ownership grew by 2.71% over the last three months, amounting to 483,723K shares.

JPMorgan Chase currently holds 26,275K shares, accounting for 4.63% of the company. This represents a 5.00% increase from the previous report, although the firm’s total share allocation in LOWE decreased by 91.92% over the past quarter.

The Vanguard Total Stock Market Index Fund Investor Shares owns 17,998K shares, which is 3.17% of Lowe’s. This indicates a minor decrease of 0.49% from its earlier total of 18,086K shares, alongside a portfolio allocation drop of 16.25% in the last quarter.

The Vanguard 500 Index Fund Investor Shares holds 14,686K shares, equating to 2.59% ownership. This marks a 1.31% increase from their previous reporting of 14,493K shares, yet they also reduced their portfolio share in LOWE by 16.99% within the last quarter.

Geode Capital Management now owns 11,546K shares, translating to 2.04% ownership, reflecting a 1.20% rise from 11,408K shares previously held. Nevertheless, their allocation in Lowe’s fell significantly by 56.60% over the last quarter.

Wells Fargo’s stake is currently 11,061K shares, representing 1.95% ownership. This share count has decreased by 1.48% from last quarter’s 11,225K shares, with a notable reduction of 71.31% in portfolio allocation.

Fintel provides extensive investing research tools for individual investors, traders, financial advisors, and small hedge funds. Our coverage includes fundamentals, analyst reports, ownership data, and more, all designed to enhance investment decision-making.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.