Striding Ahead

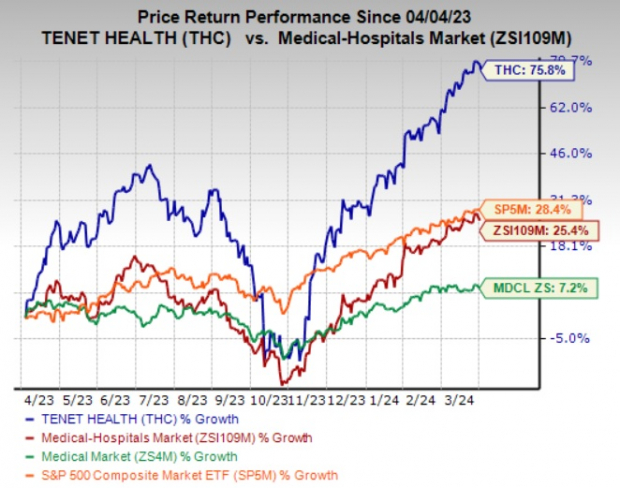

In the competitive world of healthcare services, Tenet Healthcare Corporation (THC) emerges as a beacon of success, with its shares skyrocketing by an astounding 75.8% over the past year, outshining the industry’s 25.4% rise. This achievement stands in stark contrast to the Medical sector’s 7.2% gain and the S&P 500 composite index’s 28.4% uptick during the same period. With a robust market capitalization of $10.3 billion and an average trading volume of 1.2 million shares in the last three months, Tenet Healthcare stands tall among its peers.

The surge in Tenet Healthcare’s stock value can be attributed to a combination of factors, including increasing admissions and hospital surgeries, strategic acquisitions, and divestitures aimed at optimizing long-term growth opportunities. A formidable financial position further consolidates its position as a leader in the healthcare sector.

The Momentum Continues

Despite its impressive performance, the question looms – can Tenet Healthcare sustain its upward trajectory? The current Zacks Rank #3 (Hold) company shows promise with a track record of surpassing earnings estimates in each of the past four quarters, with an average surprise of 31.58% – instilling confidence in investors about its future outlook.

Analysts project a bright future for THC, with the Zacks Consensus Estimate for 2024 earnings at $6.09 per share, reflecting a 3.6% improvement backed by four upward estimate revisions in the last 60 days. The 2025 estimate stands at $6.71 per share, indicating a robust 10.2% growth trajectory. Revenue estimates are equally promising, pegged at $21 billion, hinting at a 4.2% increase from the 2024 estimates.

The growth in adjusted admissions and hospital surgeries has been a significant revenue driver for Tenet Healthcare, reflecting a positive trend that bodes well for its future performance. With a strong operational forecast predicting revenues between $19.9 billion and $20.3 billion for 2024, the company is poised for sustained growth in the coming years.

A Strategic Roadmap

Tenet Healthcare’s strategic initiatives encompass a multi-faceted approach that includes acquisitions, partnerships, and divestitures aimed at refining its portfolio. By shedding non-core assets and enhancing its focus on high-growth areas, THC is strengthening its financial foundations, evident in its robust cash balance and cash-generating capabilities. With a prudent approach to managing debt levels and investing in profitable ventures, Tenet Healthcare is setting a benchmark for financial sustainability in the industry.

The company’s extensive network of ambulatory surgery centers (ASCs) and surgical hospitals across 35 states showcases its commitment to providing comprehensive healthcare services to a diverse patient base. Strategic acquisitions and partnerships further bolster its capabilities, positioning it as a formidable player in the dynamic healthcare landscape.

Looking Forward

As investors weigh their options in the Medical space, companies like Ligand Pharmaceuticals Incorporated (LGND), Edwards Lifesciences Corporation (EW), and The Pennant Group, Inc. (PNTG) emerge as noteworthy contenders. With Ligand Pharmaceuticals holding a Zacks Rank #1 (Strong Buy) and Edwards Lifesciences and Pennant sporting a Zacks Rank #2 (Buy), these companies present attractive investment opportunities.

Ligand Pharmaceuticals’ stellar performance in earnings, Edwards Lifesciences’ growth trajectory, and Pennant’s consistent revenue growth position them as formidable players in the market. As these companies continue to showcase resilience and innovation in the ever-evolving healthcare landscape, investors can expect promising returns on their investments.

Zacks Names #1 Semiconductor Stock

With the semiconductor market poised for exponential growth, savvy investors are keeping a close eye on the opportunities presented by innovative companies in this sector.

From Artificial Intelligence to the Internet of Things, the global semiconductor industry is projected to witness substantial expansion, presenting lucrative prospects for those keen on technological advancements.

With Tenet Healthcare (THC) at the forefront of healthcare innovation and financial prudence, investors can look forward to a future brimming with opportunities for growth and success in the dynamic healthcare sector.

To read this article on Zacks.com, click here.