Tenet Healthcare Surges: A Positive Outlook for Investors

Tenet Healthcare THC, currently holding a Zacks Rank #1 (Strong Buy), operates hospitals and related facilities across various urban and rural regions.

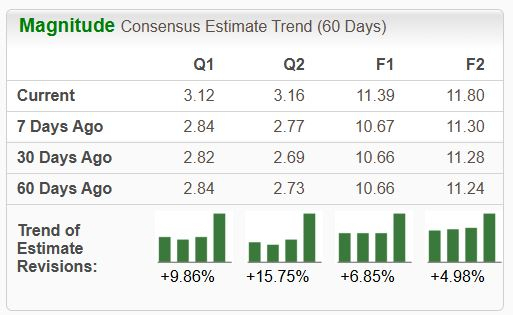

The company’s adjusted earnings outlook has seen an overall positive shift, indicating a strong potential for stock performance in the short term.

Image Source: Zacks Investment Research

Alongside favorable earnings revisions, Tenet is part of the Zacks Medical – Hospital industry, which is currently among the top 10% of all industries tracked by Zacks. Here’s a closer look at the company’s standing.

Positive Adjustments in Earnings Guidance

Tenet Healthcare’s stock has performed remarkably well this year, up 115% in 2024, even surpassing many members of the popular “Mag 7” stocks. This growth is driven by consistently strong quarterly results, which were further boosted by a recent update on adjusted EBITDA guidance.

Image Source: Zacks Investment Research

The company’s cash flow also improved significantly, with free cash flow increasing by nearly 80% to $1.8 billion compared to the previous year. Shareholders may appreciate Tenet’s decision to buy back $124 million worth of its own shares during this period.

As illustrated below, THC has been proactive in repurchasing its shares over recent years, helping stabilize its stock price.

Image Source: Zacks Investment Research

Currently, Tenet trades at a 14.1X forward 12-month earnings multiple. While this is slightly above its five-year median of 12.2X, it remains well below its five-year high of 18.7X. The company’s PEG ratio stands at 0.7X, reflecting its potential for both growth and value, and it earns a Style Score of ‘A’ for Value.

CEO Saum Sutaria summed up the quarterly results with optimism:

“Our businesses continue to produce strong results and generate robust free cash flow, with same-store revenue growth and profitability exceeding our expectations due to focused execution and disciplined operations.”

He added:

“We are advancing our portfolio transformation and are well-positioned to deliver enhanced value to our patients, physician partners, and shareholders.”

Conclusion: A Strong Option for Investors

For investors looking to identify potential winners, leveraging the Zacks Rank can be a powerful strategy. Stocks receiving the top Zacks Rank #1 (Strong Buy) are anticipated to outperform the market significantly.

With its strong position and Zacks Rank #1 (Strong Buy), Tenet Healthcare Inc. (THC) stands out as a promising stock to consider.

Discover the #1 Semiconductor Stock

This stock is considerably smaller than NVIDIA, which has seen an increase of over 800% since our recommendation. While NVIDIA remains a robust player, our new top semiconductor stock shows even greater potential for growth.

With impressive earnings growth and an increasing customer base, it is set to capitalize on the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

Click here to see this stock for free >>

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double. Click here for your free report.

Tenet Healthcare Corporation (THC): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.