Teradyne’s Stock Struggles Amid Promising Earnings

Despite a robust market cap of $18.6 billion, Teradyne, Inc. (TER) has not kept pace with the overall market. The company, known for its automated test systems and robotics products, is based in North Reading, Massachusetts. Its primary revenue source is the semiconductor test market, which is accompanied by specialized equipment for various end markets.

Over the last year, Teradyne’s shares have lagged behind the broader market. The stock has gained only 11.5% in this period, while the S&P 500 Index ($SPX) rose by 20.7%. Looking at year-to-date performance, Teradyne’s stock has decreased by 9.4%, contrasting with the SPX’s gain of 3.1%.

When comparing Teradyne’s performance to the Technology Select Sector SPDR Fund (XLK), which saw returns of 13.7% over the same period, the company’s struggles are more apparent, particularly as XLK gained 1.6% year-to-date.

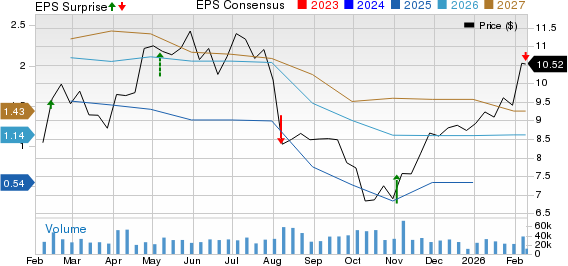

Teradyne’s fourth quarter results released on January 29 showed a different story. The company reported adjusted earnings of $0.95 per share and revenues of $752.9 million, both exceeding expectations. This represented a 20.3% growth in earnings and a 12.2% rise in revenues compared to the same quarter last year, primarily driven by robust demand in artificial intelligence.

Despite these strong results, the stock fell by 5.7% in the following trading day. Investor confidence appears to have been affected by uncertainties in the broader market and ongoing weakness in the industrial automation sector, which has impacted Teradyne’s robotics segment. Additionally, challenges in wireless testing due to a slow ramp-up of Wi-Fi 7 might have contributed to the decline.

Looking ahead to fiscal 2025, which concludes in December, analysts project an earnings per share (EPS) growth of 21.4%, reaching $3.91. Teradyne has a solid history of exceeding earnings expectations, achieving this in every quarter of fiscal 2024.

Among the 16 analysts covering Teradyne, the consensus rating stands at “Moderate Buy,” reflecting 12 “Strong Buy” ratings, two “Hold” ratings, one “Moderate Sell,” and one “Strong Sell.”

Three months ago, this sentiment was slightly more positive, with ten analysts suggesting a “Strong Buy” rating.

On January 31, UBS (UBS) analyst Timothy Arcuri maintained a “Buy” rating on Teradyne, but adjusted the price target to $155. This target indicates a potential upside of 35.9% from current levels. The average price target of $136.38 suggests a 19.6% upside, while the highest price target of $165 implies a significant upside potential of 44.7%.

On the date of publication, Neharika Jain did not hold positions in any of the securities mentioned in this article. All information and data in this article is provided solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.