Tesla’s Rollercoaster Ride: Stock and Earnings Outlook

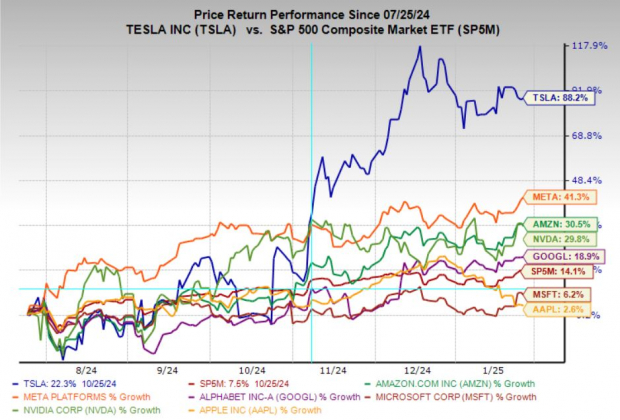

Looking back, Tesla (TSLA) frequently follows a volatile path upward—but upward is where it continues to go. In the past six months, Tesla stock has outpaced other members of the Magnificent Seven, despite being the weakest performer in the first half of 2024.

Elon Musk’s close ties with now-President Trump may have provided Tesla with a strategic advantage. As the first major tech CEO to align with the new administration, Musk set a precedent, prompting many of his contemporaries to follow suit.

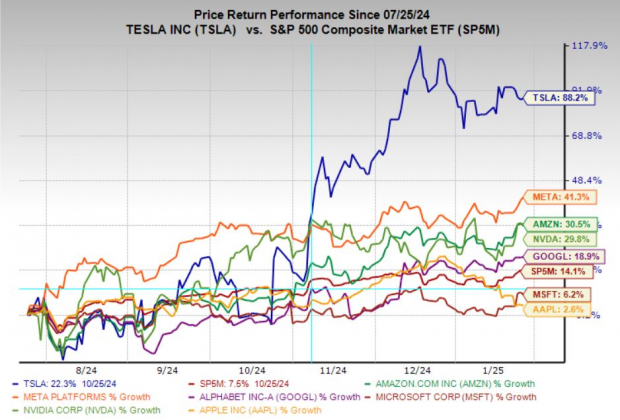

Tesla holds the strongest one-year earnings growth forecast among its peers—excluding Nvidia—and is the only company, along with Amazon, with a positive Zacks Earnings ESP. However, Tesla is currently rated Zacks Rank #3 (Hold), indicating mixed earnings updates. Over the past month, TSLA stock has stagnated while Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOGL) have been reaching new highs.

Image Source: Zacks Investment Research

Tesla: Fluctuations in Earnings Performance

Just as Tesla stock fluctuates between highs and lows, so too do its earnings results. In the past four quarters, Tesla exceeded estimates once by 24.14%, but fell short on three other occasions by as much as -16.13%. This inconsistency highlights struggles that include a decline in vehicle delivery growth last year, pricing changes, and margin strains.

Image Source: Zacks Investment Research

Key Drivers and Challenges for Tesla

The Energy Generation and Storage segment has become Tesla’s most profitable area, with deployments increasing at an impressive 180% compound annual growth rate (CAGR) over three years. The charging division also looks promising as major car manufacturers like Ford, GM, and Mercedes adopt Tesla’s North American Charging Standard across a network of over 60,000 connectors.

Despite these strengths, significant challenges persist. Margin pressure arises amid economic instability, and competition is heating up. Tesla’s U.S. electric vehicle market share has decreased to 50% from 63% in 2022, while rivals like BYD and NIO from China are growing stronger. Additionally, in the competitive autonomous vehicle sector, Tesla’s Full Self-Driving system remains at Level 2, requiring human oversight, while competitors like Alphabet’s Waymo have successfully operated regulated robotaxi pilots for several years.

Analyzing Tesla’s Stock Price Dynamics

Tesla stocks often experience notable boom-and-bust cycles, characterized by sharp rallies followed by steep corrections. Leading up to the presidential election, Tesla gained traction, and post-election, its price jumped. Historical data indicates that the stock has undergone three significant increases since last summer, more than doubling in value.

Such rapid price increases are noteworthy. Currently, the stock is in a consolidation phase resembling a bull flag. Nevertheless, there is a rise in price volatility, which sometimes suggests an impending end to a sustained rally.

Nevertheless, Tesla could stay in this consolidation phase for a while longer before possibly breaking out again. However, investors should note that the stock’s current valuation is high, trading at 125 times forward earnings. A breakout could happen in either direction, leading to significant market movements.

Image Source: TradingView

Tesla’s rising stock price, mixed business developments, historic earnings fluctuations, and premium valuation create a challenging environment for potential investors. The company has promising growth drivers, particularly in its Energy Generation and Storage sectors and its leadership in electric vehicle charging. Still, multiple obstacles loom ahead, including margin pressures, a declining market share in the U.S., and intensifying competition.

Considering Tesla’s tendency to experience boom-and-bust price cycles and the possibility of a significant price adjustment after earnings, investors should proceed with caution. The stock’s high valuation of 125 times forward earnings and recent consolidation trends imply that much of the positive sentiment might already be reflected in the price. Furthermore, Tesla’s Zacks Rank #3 (Hold) rating, which indicates mixed earnings revisions, tempers excitement as well.

For those thinking about investing in Tesla, waiting for clearer indicators of improved fundamentals or a more favorable technical situation post-earnings might be the wiser decision.

Zacks Highlights #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our new top chip stock has substantial potential for growth.

This company is well-positioned to capitalize on the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to soar from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.