Tesla Reports Mixed Q4 Results Amid Rising Energy Storage Demand

Electric vehicle (EV) leader Tesla TSLA revealed its fourth-quarter 2024 earnings, coming in at 73 cents per share. This result fell short of the Zacks Consensus Estimate of 75 cents, though it was an increase from 71 cents in the same quarter last year. The company reported total revenues of $25.71 billion, missing the consensus forecast of $27.5 billion but showing an uptick from $25.17 billion recorded in Q4 2023.

Stay up-to-date with quarterly releases: See Zacks Earnings Calendar.

Despite this mixed performance, Tesla’s stock climbed over 4% in after-hours trading. The company remains focused on launching affordable vehicles within the first half of this year and reiterated plans for Cybercab’s volume production to begin in 2026. Furthermore, Tesla anticipates energy storage deployments will expand by at least 50% this year.

Tesla’s Q4 Performance in Numbers

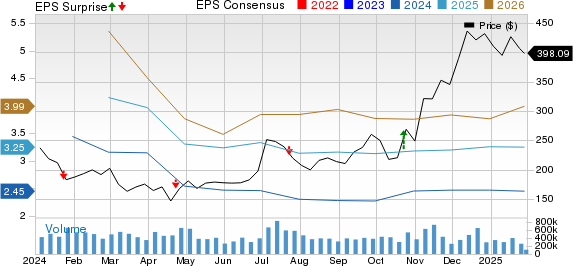

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Key Insights from the Earnings Report

In the fourth quarter, Tesla produced 459,445 units, which comprised 436,718 Model 3/Y and 22,727 from other models. This figure reflects a 7% decline year over year, falling short of an estimated 540,826 units. Deliveries reached 495,570 vehicles, marking a 2% increase compared to the previous year, but lagging behind an anticipated 517,043 units. Notably, Model 3/Y deliveries totaled 471,930, showcasing a 2% year-over-year climb but missing expectations by 19,221 units.

Automotive revenues totaled $19.78 billion, an 8% decrease year over year, which also missed the estimated $22.56 billion. This revenue figure included $692 million from the sale of regulatory credits for electric vehicles, a notable 60% increase from the previous year. When excluding revenue from leasing and regulatory credits, automotive sales surged to $18.66 billion, yet fell short of projections of $21.56 million due to lower than expected deliveries.

Gross profit from automotive sales, including regulatory credits, came in at $3.08 billion, resulting in an automotive gross margin of 15.9%. This is a decline from 18.3% reported in Q4 2023, and it did not meet expectations of 18.4%. The operating margin fell by 204 basis points year over year to 6.2%, also lower than the projected 8.4%.

Revenues from Energy Generation and Storage soared to $3.06 billion for Q4 2024, marking a remarkable 113% increase year over year, and surpassing estimates of $2.6 billion. Energy storage deployments reached 11 GWh, exceeding the 9.2 GWh forecast.

In the Services and Other category, revenues totaled $2.84 billion, reflecting a 31.5% increase year over year but not meeting the expected $2.99 billion. Tesla ended the fourth quarter with 65,495 Supercharger connectors.

Financial Health and Outlook

As of December 31, 2024, Tesla reported cash, cash equivalents, and investments of $36.56 billion, up from $29 billion the previous year. Long-term debt and finance leases, net of current portions, increased to $5.7 billion from $2.8 billion at the end of 2023.

The net cash generated from operating activities for Q4 2024 was $4.8 billion, up from $4.37 billion in the same period last year. Capital expenditures were recorded at $2.78 billion, while free cash flow for the quarter was $2.03 billion, slightly below the $2.06 billion reported in Q4 2023.

Currently, Tesla holds a Zacks Rank of #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Earnings News from the Automotive Sector

General Motors (GM) and PACCAR (PCAR), two major players in the U.S. automotive industry, also announced their fourth-quarter 2024 results recently.

General Motors reported adjusted earnings of $1.92 per share, surpassing expectations of $1.85 and increasing from $1.24 in the prior year. Their revenues reached $47.71 billion, exceeding the anticipated $44 billion and up from $42.98 billion a year prior.

For 2025, GM forecasts adjusted EBIT between $13.7 billion and $15.7 billion, compared to $14.9 billion in 2024. Expected adjusted EPS for 2025 is estimated to be between $11 and $12, compared to $10.60 last year.

Meanwhile, PACCAR recorded earnings of $1.68 per share for Q4 2024, slightly above the Zacks Consensus Estimate of $1.66, but down from $2.70 in the previous year. Total consolidated revenues were $7.9 billion, a decrease from $9 billion a year ago.

The company’s sales from Trucks, Parts, and Others amounted to $7.36 billion. For 2025, PACCAR expects capital expenditure and R&D expenses to be in the range of $700-$800 million and $460-$500 million, respectively.

Stocks With Potential for Growth

Five carefully chosen stocks could double in value over the next year, according to Zacks experts. Although past recommendations have been notably successful, remember that investments carry risks and not every pick is guaranteed to succeed.

Most of these promising stocks remain under the radar, offering a timely opportunity for early investment.

Today, see these 5 potential home runs >>

Looking for the latest recommendations from Zacks Investment Research? Download the report on 7 Best Stocks for the Next 30 Days for free.

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.