Upcoming $300 Million Stock Sale by Tesla Insiders Raises Eyebrows

Recent regulatory filings reveal that Tesla (TSLA), the electric vehicle maker, is bracing for significant stock sales worth $300 million in the near future. Three board members—chairwoman Robyn Denholm, Kimbal Musk (Elon Musk’s brother), and Kathleen Wilson-Thompson—have initiated applications for Rule 10b5-1 trading arrangements to sell shares that will remain valid through the first half of 2025. These transactions stem from the expiration of stock options and follow particular conditions.

Details of the Upcoming Stock Sales

Tesla disclosed these planned share sales in its recent 10-Q filing. Robyn Denholm is preparing to sell up to 674,345 TSLA shares by June 18, 2025. Meanwhile, Kimbal Musk plans to sell 152,088 shares, targeting an expiration date of May 30, 2025. Additionally, Kathleen Wilson-Thompson aims to sell up to 300,000 shares by February 28, 2025.

In total, these three board members intend to divest 1,126,433 shares of the well-known electric vehicle company. Based on Tesla’s current share price of $262.51, this sale would net approximately $295.70 million.

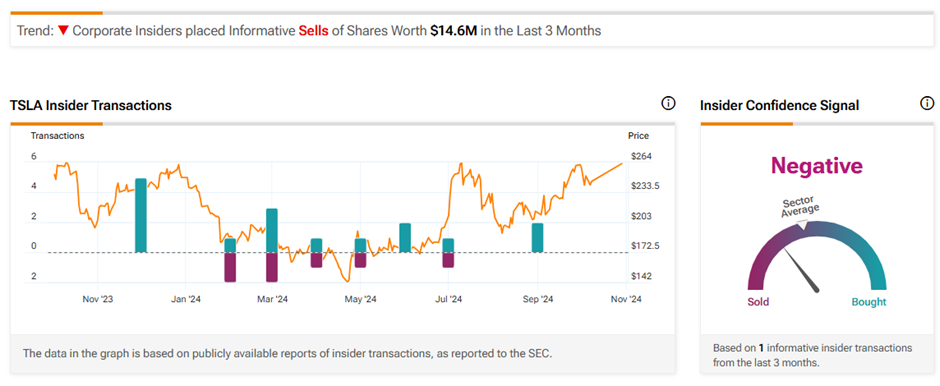

Examining Insider Transaction Trends

Currently, TSLA stock is showing a negative insider confidence signal on TipRanks, attributed to informative sell transactions totaling $14.6 million over the past three months.

Monitoring insider trades can be crucial, as these individuals often possess valuable insight into a company’s future prospects. TipRanks provides updates on daily insider transactions and highlights notable corporate insiders, alongside trending stocks that exhibit strong insider confidence signals.

What Analysts Are Saying About Tesla Stock

Despite a robust earnings report for Q3 FY24, Wall Street remains cautious about Tesla stock. Currently, TSLA maintains a consensus rating of “Hold” on TipRanks, with 11 Buy ratings, 16 Holds, and eight Sell ratings. Additionally, the average price target for Tesla is set at $207.83, indicating a potential downside of 20.8% from its current valuation. This year, TSLA shares have risen 5.6%.

See more TSLA analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.