Tesla’s Stock Soars Post-Election: Analysts Point to Potential for Future Growth

Overview of Recent Performance: Following the announcement of the 2024 election results, Elon Musk‘s Tesla Inc TSLA has experienced a remarkable surge of over 60%. Currently, its stock price is almost five times higher than the industry average, and technical signals indicate it may be overbought.

Despite this surge, Dan Ives of Wedbush has raised his price target for Tesla to $515 per share, expressing an optimistic outlook regarding potential changes under a possible Trump administration.

Current Stock Valuation: Tesla shares are currently valued at roughly 126 times their 2025 earnings, as reported by Benzinga Pro. In contrast, the average forward price-to-earnings (P/E) ratio for its industry peers is approximately 25.75, highlighting that Tesla is significantly more expensive than its competition.

When analyzing Tesla alongside other major tech companies, it stands out as the most expensive stock within the “Magnificent Seven” group, which includes notable firms like Apple and Amazon.

| Stocks | Forward P/E | Industry Average |

| Tesla | 126.582 | 25.75 |

| Apple | 33.333 | 20.23 |

| Alphabet | 21.552 | 125.77 |

| Meta | 24.450 | 125.77 |

| Amazon | 36.630 | 32.14 |

| Nvidia | 31.546 | 37.03 |

| Broadcom | 36.765 | 37.03 |

| Microsoft | 34.014 | 81.74 |

Market Trends: Since November 6, Tesla’s shares have risen by over 60%, significantly outperforming the Nasdaq 100 index, which only increased by 7% during the same time frame.

Year-to-date, TSLA has shown an approximate increase of 84%, transforming a previously modest performance year into a significantly rewarding one for investors.

| Performance | Nasdaq 100 | Tesla Stock |

| Since Nov. 6 | 7% | 60% |

| Year To Date | 33% | 84% |

| Five Year | 153% | 1597% |

Technical Analysis: Analyzing Tesla’s performance through moving averages reveals significant overvaluation. The stock closed at $436.23, resting above the eight and 20-day simple moving averages of $408.55 and $370.43, respectively. Further, it stands considerably higher than the 50 and 200-day averages at $303.86 and $225.59.

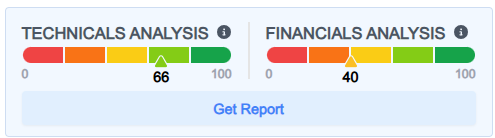

The relative strength index currently reads 79.17, indicating that Tesla may be overbought. Together, these indicators suggest the possibility of a future price correction.

According to Benzinga’s technical analysis scorecard, Tesla receives a score of 66 out of 100.

Analysts’ Insights: Dan Ives has adjusted his price target for Tesla to $515, explaining that a Trump administration may dominate Tesla’s advantages, particularly in artificial intelligence and autonomous driving. His report anticipates a market cap of $2 trillion by 2025, excluding the potential contributions from Tesla’s Optimus robot. These expectations coincide with emerging news regarding regulatory relaxations for autonomous vehicles, which Tesla has supported.

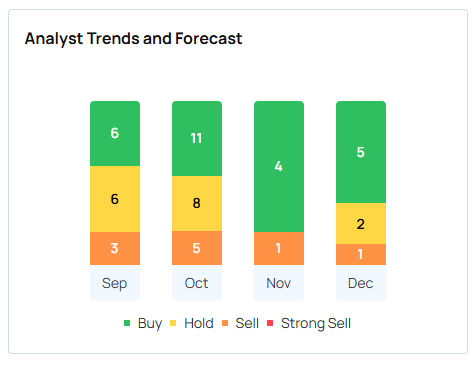

Ives has a long-standing positive view on Tesla, stating, “Tesla is the most undervalued AI name in the market in our view.” The consensus recommendation among 33 analysts tracked by Benzinga remains a “buy” for Tesla.

Recent Stock Movement: At the time of publication, Tesla shares were trading up 5.4% at $459.81, while the Invesco QQQ Trust, Series 1 QQQ rose 1.1% to $536.78.

Next Steps: As analysts and investors watch Tesla’s performance, the company’s future in the rapidly evolving electric vehicle market remains a key focus.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs