Tesla’s Future: Beyond Just a Car Company?

Tesla Inc. TSLA is increasingly seen as more than just an automobile manufacturer, according to The Future Fund Managing Partner Gary Black. His comments on Tuesday emphasized the company’s remarkable price-earnings ratio.

Key Insights: “With future expected EPS growth of 25-30%, TSLA trades at 84x FY’25 Adj EPS compared to 5-6x for traditional auto firms,” Black stated in a post on the social platform X.

He highlighted that a company’s price-earnings (P/E) ratio considers anticipated growth rather than current operations. Tesla is heavily invested in electric vehicles (EVs) and autonomous driving, sectors recognized for robust growth potential.

Black noted that when Tesla’s profits from vehicles drop below 50% of total profit, it won’t be compared to other car manufacturers. Currently, the auto business profits account for 80% of Tesla’s overall earnings.

On Monday, Black also raised his 6-12 month price target for Tesla from $270 to $300, citing better earnings projections. His revised estimates for adjusted earnings per share (EPS) are now $2.40 for FY’24 and $3.60 for FY’25, which is slightly ahead of Wall Street’s consensus.

Related Interest: Cathie Wood’s Ark Invest Sees Tesla Unlocking $11 Trillion Revenue Potential With Robotaxi Fleet, Surpassing Uber And Lyft

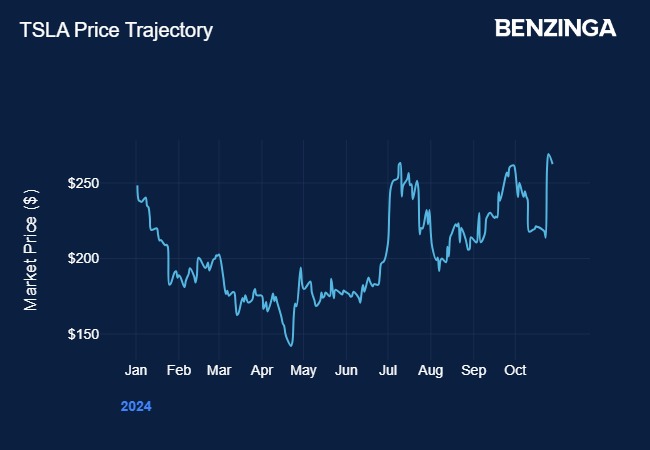

Significance of Earnings: Tesla’s stock had been on a downward trend this year until the company reported third-quarter earnings on October 23, which exceeded expectations and included positive future guidance.

The company posted earnings per share of 72 cents, outperforming Street estimates of 58 cents. Elon Musk also projected a 20% to 30% increase in vehicle sales for next year, easing fears over potential declines in EV demand. Additionally, Tesla aims to surpass its previous year’s delivery figures in 2024.

Stock Performance: Tesla shares declined by 2.5% to close at $262.51 on Monday. Still, the stock has gained 5.7% year-to-date and nearly 21% over the past week, according to Benzinga Pro data.

Stay updated on Benzinga’s Future Of Mobility coverage with this link.

Next Steps:

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs