Uncovering Tesla’s Long-Term Potential

Tesla (NASDAQ:TSLA) has experienced a stagnant stock price over the past six months. After several fluctuations, the current price resembles that of August levels.

However, in the last month, Tesla has declined by over 7%, as the market incorporates more negative news into its valuation.

Although Tesla is no longer the top electric vehicle (“EV”) seller over the last quarter, and encounters mixed reviews and recalls, the market’s myopic view is missing some crucial long-term potential the company still holds.

Contrary to the prevailing sentiment, Tesla’s stock is arguably undervalued by historical standards. Surprisingly, this low valuation comes at a time when Tesla has made substantial progress in its Energy, full self-driving (“FSD”), and charging segments, which are poised to be more financially impactful than car sales in the future.

Diving into the potential profitability of these segments over the next 7 years lends more support to a compelling investment case.

Simply put, this apparent pullback in Tesla’s stock presents an opportunity worth seizing for discerning investors.

Sizing Up Recent Developments

Although I have previously maintained a neutral stance on Tesla, recent events warrant a pivotal reevaluation.

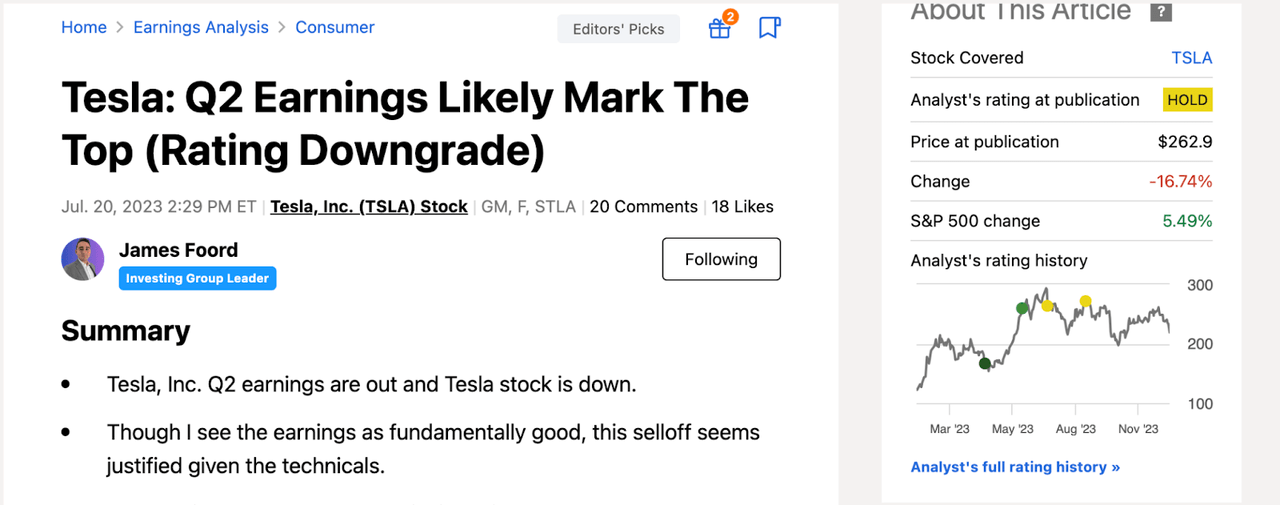

During the 2023 Q2 earnings, despite significant upward momentum, I offered a neutral rating based mostly on Technical Analysis.

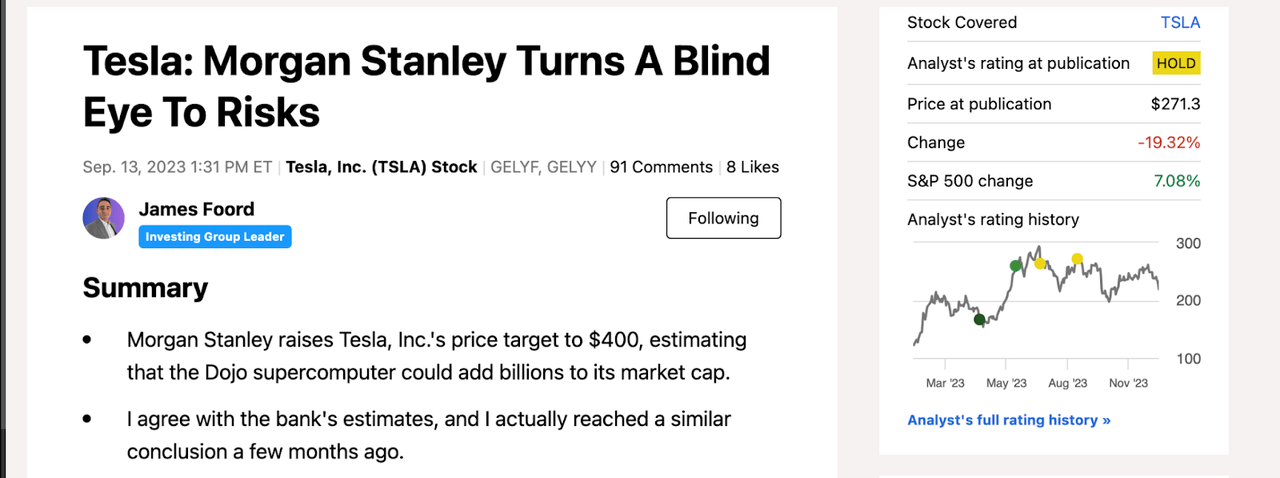

Similarly, on another occasion, despite my bullish long-term conviction, I adopted a neutral outlook following Morgan Stanley’s (MS) price target upgrade to $400. This was underpinned by concerns that the short-term optimism ignored the risks associated with China.

Yet, it seems that many of the negative factors have already been factored into the market sentiment. Out of the last 10 SA articles on Tesla, opinions are evenly divided, suggesting a shift in sentiment among investors.

The Bearish Case

Admittedly, there are ample reasons to adopt a bearish outlook on Tesla, especially in light of recent developments.

Supply Constraints

The temporary shutdown of Tesla’s largest factory in Europe, the Berlin Gigafactory, due to delayed key components, presents a troubling supply chain challenge. With the potential pause in output for an extended period, this exacerbates the strain caused by the underwhelming response to the Cybertruck release.

The Cybertruck Conundrum and Other Challenges

Following the commencement of Cybertruck deliveries, early videos depicting the vehicle’s struggles in adverse conditions and an unofficial test revealing deviations in advertised range raise questions about its immediate success in the market.

These tribulations with the Cybertruck are not unexpected, given its complex production, as emphasized by Elon Musk himself. Despite Musk’s estimates of substantial sales, the impact on the company’s bottom line remains uncertain.

Moreover, the recent recall of 2 million vehicles due to inadequate monitoring of drivers using self-driving capabilities adds another layer of complexity and concern.

Decline in Demand

Compounding these challenges, the loss of Tesla’s top EV seller status and dwindling sales add to the mounting headwinds faced by the company.