Tesla Sales Plummet Across Europe Amid Increased Competition

Tesla (TSLA) experienced a significant decline in car sales across multiple European countries in May, marking the fifth consecutive month of decreases. This downturn is linked to CEO Elon Musk’s political controversies and an aging vehicle lineup.

In Sweden and Portugal, sales dropped 53.7% and 68% year-over-year, respectively. Despite Tesla’s struggles, total electric vehicle (EV) sales in these countries rose by approximately 25%. Recent data shows a 30.5% decline in Denmark, 36% in the Netherlands, 19% in Spain, and 67% in France.

Notably, Norway saw a 213% increase in Tesla sales in May, primarily due to the updated Model Y SUVs. Units sold of both new and previous Model Y versions rose to 2,346 from 690 in May 2024.

While the latest Model Y is available for order in many European markets, deliveries of its most affordable variant won’t start until this month in countries such as Germany, the UK, France, and Italy. Consequently, May order numbers have not yet reflected in sales data.

To boost demand, Tesla has implemented various financial incentives in Sweden, Germany, Britain, and France. In Norway, it is offering interest-free loans for the new Model Y. Tesla faces stiff competition from both local and Chinese automakers in Europe, currently holding a Zacks Rank #5 (Strong Sell).

BYD and Volkswagen Gain Ground in the EV Market

In April, BYD Company Limited (BYDDY), a Chinese EV maker, saw its sales surge by 359% year-over-year in Europe. BYD surpassed Tesla in monthly EV sales for the first time in April, registering 7,231 new battery-electric vehicles, a 169% increase compared to last year. Tesla’s sales declined by 49%, placing it lower in the rankings.

Meanwhile, Volkswagen AG (VWAGY) captured a 1.1% market share in Europe, leading the EV segment in April. Volkswagen’s subsidiaries, Skoda and Audi, also reported significant growth in the battery-electric vehicle market. The Skoda Elroq topped sales charts among all-electric models in April, followed by Volkswagen’s ID3, ID7, and ID4 models.

Tesla’s Financial Performance and Valuation

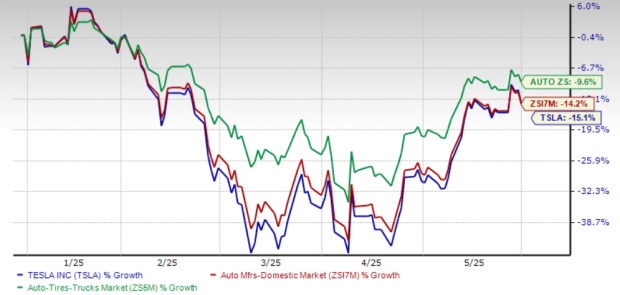

Tesla’s performance has lagged behind the Zacks Automotive – Domestic industry and the broader Auto, Tires and Truck sector for the year. Tesla shares have fallen 15.1%, compared to declines of 14.2% for the industry and 9.6% for the sector.

YTD Price Performance

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Tesla’s earnings per share for 2025 and 2026 has decreased by 13 cents and 16 cents, respectively, over the last 30 days.

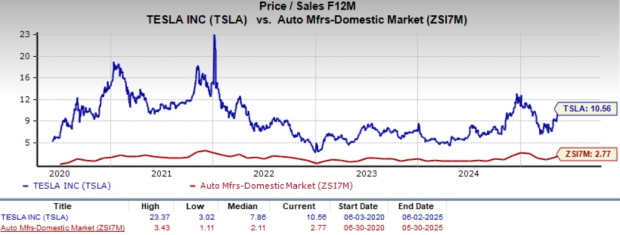

Image Source: Zacks Investment Research

From a valuation standpoint, Tesla appears overvalued with a forward sales multiple of 10.56, exceeding the industry average of 2.77.

Image Source: Zacks Investment Research

Tesla, Inc. (TSLA) : Free Stock Analysis report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis report

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.