Trump’s Return Boosts Tesla: Stock Surges Amid New Policy Directions

Since Donald Trump’s victory in the 2024 U.S. presidential election, Tesla TSLA has been making waves in the stock market. Yesterday, shares of TSLA rose 5.6%, driven by reports that the incoming Trump administration plans to advocate for a federal framework supporting self-driving vehicles. Given CEO Elon Musk’s close relationship with Trump, Tesla’s goals in both autonomous and electric vehicle (EV) sectors appear to be on the brink of rapid advancement.

Musk and Trump: A Strategic Alliance

Musk played a crucial role in Trump’s return to the White House, and this rapport is already yielding positive results. Last week, Trump appointed Musk to co-lead the newly created Department of Government Efficiency (DOGE), focusing on deregulation and cost reduction. For Tesla, this is more than just political favor; collaborating with the President provides a significant advantage in navigating regulatory challenges. As co-leader of DOGE, Musk has an opportunity to propel Tesla’s innovative aspirations forward without facing excessive bureaucratic obstacles. Additionally, Trump’s administration gains insight from a leading tech visionary.

Trump’s initiative to create a streamlined federal framework for autonomous vehicles (AVs) stands to remove significant barriers that have previously slowed Tesla’s deployment of Full Self-Driving (FSD) technology. Musk’s long-wanted vision of a fleet of robotaxis could soon become realized, following the “Cybercab” concept previously announced.

Propelling Tesla’s Ambitions in Robotaxis

Tesla’s goals in the robotaxi sector are bold. With a Trump-led initiative aimed at simplifying AV regulations, the company could more easily launch its autonomous fleet. Currently, Tesla’s FSD system is available only in a supervised capacity, but it aims to shift towards unsupervised operation in select states like Texas and California by next year.

Musk has assured that robotaxi services will roll out in Texas, California, and other states within a year, dependent on regulatory approvals. The anticipated Cybercab, priced at approximately $30,000 and designed without steering wheels or pedals, is set to make its debut in 2026, underscoring Tesla’s commitment to entering the autonomous vehicle market.

This regulatory shift could enhance Tesla’s competitive edge against Alphabet‘s GOOGL Waymo, which currently leads in the robotaxi sector.

Additionally, shares of Uber UBER and Lyft LYFT declined yesterday, dropping nearly 5%, on fears that Tesla’s robotaxi network could challenge their dominance in the ride-hailing sector.

TSLA Less Affected by EV Tax Credit Changes

In the EV arena, Tesla stands out compared to traditional automakers like Ford and General Motors, which still heavily depend on EV tax credits. Trump’s proposal to eliminate the $7,500 EV tax credit coincides with Musk’s belief that such credits distort competition. Tesla’s early investments in EV technology give it a considerable lead over rivals who are still reliant on federal incentives. With strong brand loyalty, a head start in production, and an extensive Supercharger network, Tesla has largely moved beyond the need for such assistance.

Positive Developments for TSLA

Robust Energy Generation & Storage Sector: The revenues from Tesla’s energy generation and storage division have surged, exhibiting a triple-digit compound annual growth rate (CAGR) over the last three years. Although small compared to its overall business, this segment’s strong growth and high profit margins offer promising catalysts for long-term success.

Cybertruck Sales Surge: According to Elon Musk, the Cybertruck ranked as the third best-selling EV in the U.S. during the third quarter, trailing only the Tesla Model Y and Model 3. As Tesla improves its production efficiency, delivery rates for Cybertrucks are expected to rise significantly.

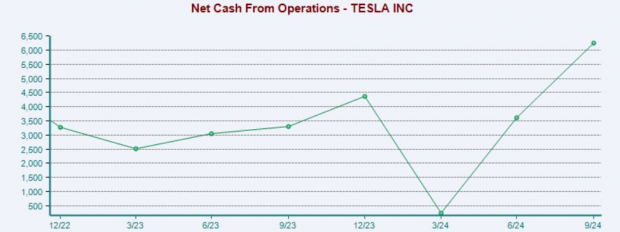

Solid Financial Position: Tesla boasts a high level of liquidity and low leverage, providing the financial flexibility to pursue growth opportunities. At the close of the third quarter of 2024, the company reported more than $33 billion in cash, cash equivalents, and investments. Its long-term debt-to-capitalization ratio stands around 7%, a strong contrast to the industry average of 40%. Moreover, Tesla’s operating cash flow peaked at $6.3 billion last quarter.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Improving Earnings Estimates for TSLA

Over the past month, the Zacks Consensus Estimate for Tesla’s earnings per share (EPS) for 2024 and 2025 has increased. Projections suggest that Tesla’s earnings could climb by a robust 29.5% in 2025.

Image Source: Zacks Investment Research

TSLA’s Impressive Stock Performance

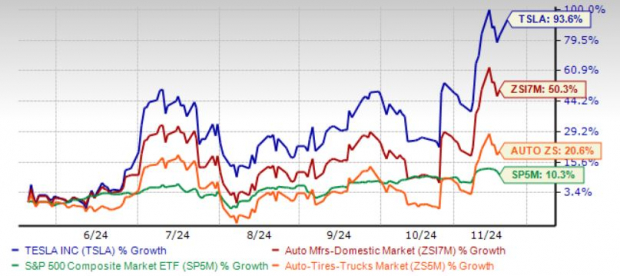

Over the past six months, TSLA stock has surged more than 90%, outpacing the overall industry, sector, and the S&P 500. As earnings estimates continue to improve alongside Musk’s hopeful outlook for fiscal year 2025 (projected vehicle deliveries expected to increase by 20-30% next year), the rally in TSLA shares seems set to persist.

6-Month Price Performance Analysis

Image Source: Zacks Investment Research

Final Thoughts

Musk played a vital role in Trump’s election, and it appears that Tesla stock is reflecting this connection. The Musk-Trump relationship could serve as a key driver for Tesla’s growth. As the company adapts to the new political landscape, it stands in a prime position to take advantage of favorable regulations and an innovative atmosphere in pursuit of its electric and autonomous goals.

Currently, TSLA holds a Zacks Rank #1 (Strong Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

7 Stocks to Watch in the Coming Month

Recently released: Analysts have identified 7 top stocks among the current list of 220 Zacks Rank #1 Strong Buys. These stocks are anticipated to have “Early Price Pops.”

Since 1988, the complete list has outperformed the market by more than 2X, typically achieving an average gain of +23.7% per year. These selected 7 stocks deserve your immediate attention.

Want the latest stock recommendations from Zacks Investment Research? Today, you can download the report titled 5 Stocks Set to Double. Click to access this free report.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.